An unprecedented international investigation into tax deals struck with Luxembourg has uncovered the multi-billion dollar tax secrets of some of the world’s largest multinational corporations, including British and Irish-headquartered firms like Shire, Dyson, and Glanbia, according to The Guardian and The Irish Times.

A cache of leaked documents have painted a damning picture of an EU state which is quietly rubber-stamping tax avoidance on an industrial scale, The Guardian reports.

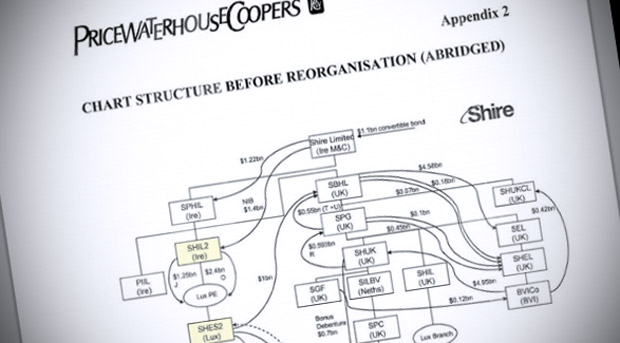

The documents show that major companies — including drugs group Shire, City trading firm Icap and vacuum cleaner firm Dyson, who are headquartered in the UK or Ireland — have used complex webs of internal loans and interest payments which have slashed the companies’ tax bills. These arrangements, signed off by the Grand Duchy, are perfectly legal.

The Guardian analysis has found:

- A Luxembourg unit of Shire, the FTSE-100 drug firm behind attention deficit pill Adderall, received more than $1.9 billion in interest income from other group companies in the last five years, paying corporation tax of less than $2m over four of the years despite minimal overheads.

- Vacuum and hand dryer firm Dyson set up companies in the Isle of Man and Luxembourg to pour £300 million of internal loans into its UK operations in 2011. Interest payments made on those loans slashed Dyson’s UK tax bill and were instead taxed at only around 1% in Luxembourg, saving Dyson companies millions in tax.

- Icap, the financial trading firm run by leading Conservative party donor Michael Spencer, lent $870 million from Luxembourg to its US business for seven years. Interest paid out from US companies on those loans was £247 million, which was taxed at a fraction of official corporation tax rates in the US and UK.

The leaked documents also revealed multi-million euro Luxembourg tax plans were also approved for Irish food multinational Glanbia and members of the Sisk business, according to The Irish Times.

The cache of tax documents also shed light on how foreign multinationals use Ireland as part of Luxembourg-based tax structures that reduce their corporation tax bills in Ireland and elsewhere.