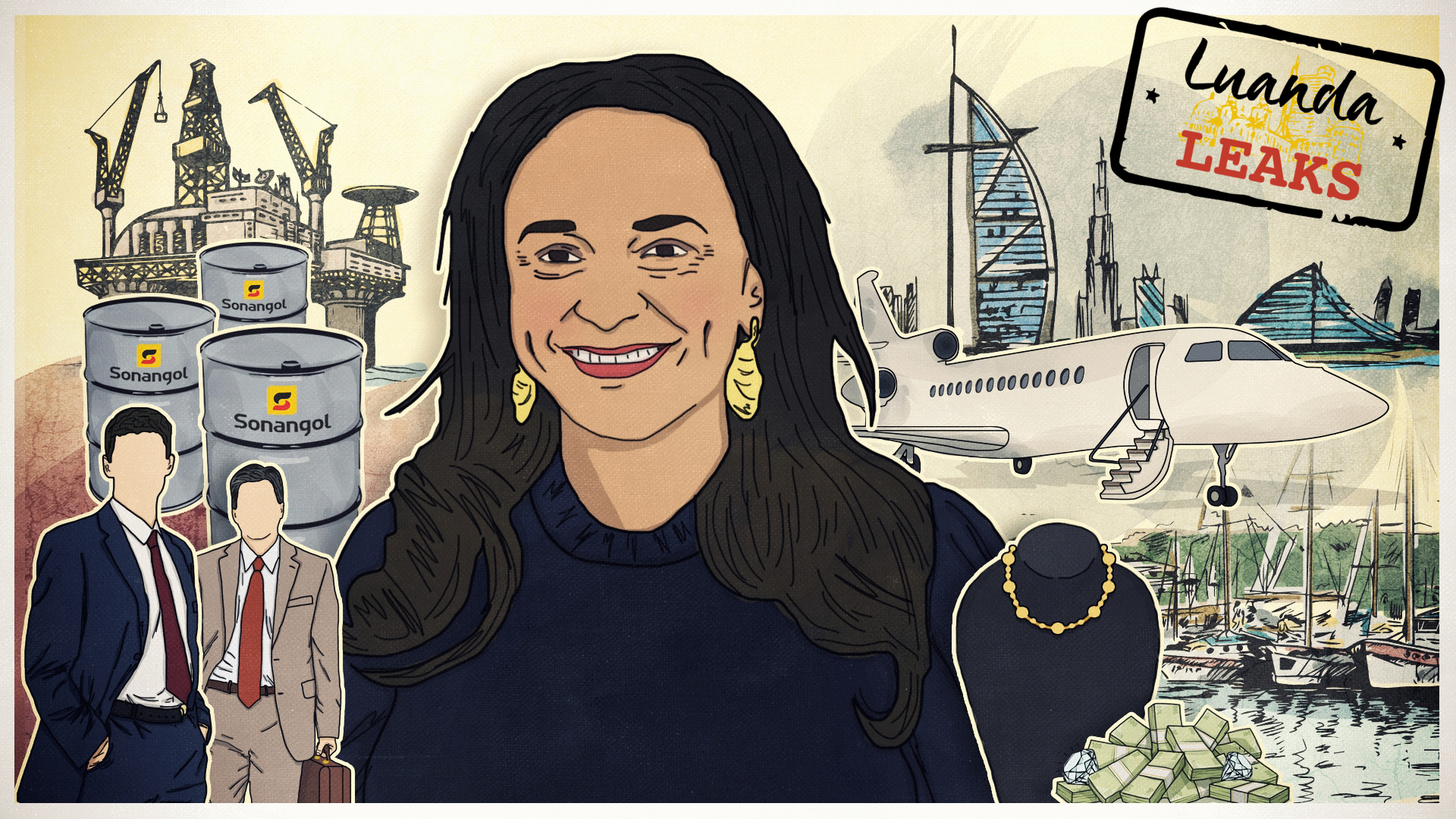

THE ENABLERS

Western advisers helped an autocrat’s daughter amass and shield a fortune

Isabel dos Santos created a shell empire to move tainted billions — lawyers, accountants and consultants made it possible.

Pausing at the entrance to a star-studded bash at the Cannes Film Festival, ’90s icon Sharon Stone flashed her one-of-a-kind cuff bracelet. It was a wraparound hippo with rubies for eyes, sapphire nostrils and white diamond teeth. Its body was covered in brown, gray and white diamonds.

The dazzling ornament was a creation of de Grisogono, a Swiss luxury jeweler and the host of the exclusive event, held at the Hotel du Cap-Eden-Roc on the French Riviera.

De Grisogono had thrown Cannes parties before. But this one in May 2013 was especially sumptuous, with a fireworks show and a chamber orchestra to serenade guests as they took in the seaside views. Underwriting the festivities: the government of Angola, a country with one of the highest poverty rates in the world.

Angola’s diamond trading company, known as Sodiam, and a Congolese businessman married to Isabel dos Santos, daughter of the country’s then-president, had acquired a controlling stake in the struggling jeweler the year before. Its new managers, who included former employees of the management-consulting giant Boston Consulting Group, which had briefly helped run the jeweler, hoped the bash would help halt a long decline in sales. Stone was that year’s “ambassador,” a star still bright enough to entice the rich and famous to buy a de Grisogono bauble of their own.

The plan didn’t work. De Grisogono sold just $5.6 million of its wares through private sales in 2013, far short of its $33 million target, and took on more and more debt. Angola’s state diamond company now fears its investment of more than $120 million is gone for good.

The story of how Angolan public money came to be used to fete the 1% on the French Riviera goes beyond that of a dubious business strategy gone wrong. It offers a window into the lightly regulated professional services sector, which over the years has become a cornerstone of a thriving offshore industry that drives money laundering, tax avoidance and public corruption around the globe.

Dos Santos made her fortune by taking a cut of Angola’s wealth, often courtesy of government decrees signed by her father. She also benefited from insider deals, preferential loans and contracts fueled by public money, a review by the International Consortium of Investigative Journalists and 36 media partners found. Over the last two decades, she acquired valuable stakes in every important Angolan industry, including oil, diamonds, telecom and banking.

Dos Santos and her husband, Sindika Dokolo, amassed an empire of more than 400 companies and subsidiaries in 41 countries, including at least 94 in secrecy jurisdictions like Malta, Mauritius and Hong Kong. These companies bought up assets, such as high-priced real estate in London and Lisbon, and purchased stakes in other businesses, including the jewelry company de Grisogono.

Consultants, accountants and lawyers provided vital support at each step of the way, according to ICIJ’s examination of the Luanda Leaks, a trove of more than 715,000 emails, contracts and other documents.

From storefront offices in the tiny tax haven of Malta to conference rooms in Switzerland and Angola, Boston Consulting, PwC (formerly PricewaterhouseCoopers), KPMG and other major firms helped sustain the dos Santos empire for years. These enabling relationships continued long after many Western banks had cut off dos Santos amid questions about the source of her wealth, according to ICIJ’s examination of the Luanda Leaks.

Accountants disregarded red flags that experts say should have triggered alarms. Lawyers at prominent Portuguese law firms helped set up shell companies and move money for dos Santos and Dokolo. Consultants advised them on ways to run their businesses and avoid taxes.

Financial institutions are subject to stringent regulatory requirements, which, even if not always enforced, tend to make them pay close attention to their clientele. Professional firms have faced far less scrutiny. As such, they are often less likely to say no to a risky and wealthy client.

“The incentive structure makes it still too easy and too lucrative and not risky enough for them to engage in that dirty business,” said Markus Meinzer, director of financial secrecy at the Tax Justice Network, a think tank that studies tax evasion and financial regulation.

The Angolan government’s unlikely investment in a jewelry company can be traced to a series of transactions in 2012 that quietly routed millions of dollars through shell companies in Malta and the British Virgin Islands.

The transactions, ICIJ has found, gave dos Santos’ husband, Dokolo, full management control of the Swiss jeweler despite a substantial investment by the Angolan agency.

The Luanda Leaks documents were shared with ICIJ by the Platform to Protect Whistleblowers in Africa, or PPLAAF, a Paris-based advocacy group.

They reveal a remarkable story of self-dealing and profiteering by a businesswoman whose vast fortune, and appealing narrative, bought access to such prestigious Western institutions as the World Economic Forum and the London Business School.

In late December, after ICIJ sent questions to the Angolan government, an Angolan court froze dos Santos’ and Dokolo’s assets in the country. The Angolan government told the court that the couple and a business associate were responsible for state losses of $1.1 billion.

Through their lawyers, dos Santos and Dokolo denied any allegations of wrongdoing. Dokolo said he was a successful entrepreneur and the target of a politically motivated campaign in Angola.

Dos Santos declined ICIJ’s requests for an interview. But in an interview with BBC Africa, which asked several questions on behalf of ICIJ, dos Santos called the inquiry a “political persecution.”

She accused the current Angolan government of targeting her family to distract attention from the country’s economic problems. “My holdings are commercial. There are no proceeds from contracts or public contracts, or money that has been deviated from public funds,” she said.

Dos Santos was scheduled to attend the 2020 World Economic Forum meeting in Davos, Switzerland, after Unitel, a mobile phone company she partly owns, was named an associate partner in 2019. Following the asset freezes, however, the World Economic Forum said dos Santos was no longer coming to the annual meeting.

Angola’s first daughter

Isabel dos Santos was born in Azerbaijan in 1973, the daughter of José Eduardo dos Santos, the future Angolan president, and Tatiana Kukanova, a Russian her father met and married while studying for a degree in petroleum engineering.

Dos Santos graduated from King’s College London in the 1990s with a degree in electrical engineering and business management, after which she worked for Coopers & Lybrand, an accounting firm that later became part of PwC, and as a project manager on a sanitation project in Luanda.

She went on to become the richest woman in Africa, with an estimated net worth of at least $2 billion and holdings in telecom, banks and a range of other industries.

In speeches and interviews, dos Santos promotes herself as a self-made billionaire and an inspirational figure whose great wealth is attributable to her shrewd business dealings. “I’m not financed by any state money or any public funds,” she told The Wall Street Journal.

But dos Santos’ pulled-up-by-her-bootstraps narrative never withstood much scrutiny.

Her father was president of Angola, a country wracked by poverty and civil war, for 38 years (1979 to 2017), and his administration was widely held to be corrupt. In 2013, Angola ranked near the bottom of a corruption index published by Transparency International. A stream of stories, including a Forbes magazine investigation, also published in 2013, have tied Isabel dos Santos’ fortune to handouts and preferential deals, including a founding stake in a major telecom company.

José Eduardo dos Santos did not respond to questions from ICIJ. In an open letter, he rejected allegations of wrongdoing, saying he never transferred government money to himself “or any other entity.”

‘Run like the devil from the cross’

Western banks were paying attention, ICIJ documents show. In the wake of the 2008 global financial crisis and a string of money-laundering scandals, regulators were breathing down lenders’ necks, and dos Santos and her husband fit the profile of clients that many institutions decided they could no longer afford.

A key U.S. banking regulator issued a cease-and-desist order to Citibank, a subsidiary of Citigroup, in 2012 after finding that the bank had failed to identify risky clients and stop illegal money transfers. High-profile cases against JPMorgan Chase and HSBC around the same time prompted the hiring of thousands of additional compliance officers to scrub client rolls of people tied to political corruption or criminal activity.

Later in 2012, another Citigroup subsidiary, Citigroup Global Markets Limited, walked away from a financing deal with Amorim Energia BV, a Dutch holding company. Barclays Bank did the same in 2013. Both were responding to concerns about the company’s shareholders, including Sonangol, which is the Angolan state oil company, and Exem Energy BV, a company owned by Dokolo, documents show. After Amorim Energia threatened legal action, Citigroup Global Markets agreed to pay $15 million as part of a confidential settlement. Citigroup and Barclays declined to comment for this article.

Banco Santander, a major Spanish bank, flagged dos Santos as a “politically exposed person” — a term that applies to public officials and their family members — and refused to work with her, the documents indicate. Politically exposed persons, known in finance as “PEPs”, are considered risky clients because they can abuse their positions to engage in bribery, money laundering and other forms of corruption.

“These guys hear about Isabel and they run like the devil from the cross,” a dos Santos business manager wrote about Banco Santander in a 2014 email to a colleague.

Even Deutsche Bank, which has been fined more than $600 million for failing to stop a Russian money-laundering scheme, blocked attempts by dos Santos’ husband to transfer money, emails show. (Deutsche Bank declined to comment. A spokesperson said the bank carefully monitors risks related to politically exposed persons).

But accountants, consultants and other professional advisers weren’t deterred.

Each of the Big Four accounting firms worked for dos Santos companies long after many banks had broken ties. Deloitte served as auditor for Finstar, an Angolan satellite TV company partly owned by dos Santos, and Ernst & Young did the same for ZOPT, the company dos Santos uses to hold her stake in NOS, a major Portuguese cable TV and internet provider. KPMG served as auditor for two companies in dos Santos’ retail network and consulted for Urbinveste, dos Santos’ project-management firm.

Among the Big Four, PwC played the biggest role in the dos Santos empire, providing accounting and auditing services to companies linked to dos Santos and her husband in Malta, Switzerland and the Netherlands. PwC also gave tax and financial advice to Angolan businesses owned or partly owned by the couple. Firms in PwC’s global network billed more than $1.28 million for this work between 2012 and 2017, an ICIJ analysis found, including more than $900,000 charged to companies incorporated in the offshore financial center of Malta.

PwC did not respond to detailed questions about its work for dos Santos-connected companies, citing confidentiality restrictions, but said it has “taken action to terminate any ongoing work” for entities controlled by members of the dos Santos family.

“We strive to maintain the highest professional standards at PwC and have set expectations for consistent ethical behaviour by all PwC firms across our global network,” the firm said in a statement. “In response to the very serious and concerning allegations that have been raised, we immediately initiated an investigation and are working to thoroughly evaluate the facts and conclude our inquiry.”

Deloitte, Ernst & Young and KPMG also cited confidentiality restrictions in declining to answer specific questions about their work. The firms said they have rigorous screening procedures for potential clients. Deloitte and KPMG said they review clients annually; EY Portugal (an Ernst & Young member firm) said it reviews its client-acceptance procedures every year to make sure that they comply with current laws.

KPMG said it conducts additional due diligence for audit clients in Angola, which includes scrutiny by the firm’s forensic team.

Watching the watchdogs

Accountants play a critical watchdog function intended to compel companies to be truthful about their finances. Done properly, audits give public pension funds and other investors crucial insight into how companies are managed and whether it’s safe to invest in them.

When accountants fail, the consequences can be catastrophic.

Like the credit-rating agencies that gave high ratings to defective mortgage bonds sold by their Wall Street clients, the Big Four have gotten in trouble for putting profits ahead of their professional obligations.

A fraud scandal at Enron in the early 2000s brought down both the energy giant and its auditor, Arthur Andersen. Each of the remaining Big Four has since had its own stumbles, including allegations of helping clients carry out or cover up wrongdoing.

But because of their subsidiary role in the financial system and a regulatory burden that is less stringent than those of banks and other players, the accountants, for the most part, have managed to escape public notice. A lawsuit by New York prosecutors, for instance, alleged that Ernst & Young had helped hide problems at Lehman Brothers that triggered the 2008 global financial crisis, and the House of Lords rebuked the entire U.K. accounting profession as “complacent.” Such stains, however, were lost in the turmoil of the Great Recession. (Ernst & Young agreed to a $10 million settlement, but did not admit wrongdoing.)

“Accountants tend to have gone under the radar,” said Nate Sibley, a research fellow who studies anti-corruption policies at the Washington-based Hudson Institute.

The United States, which has imposed some of the world’s toughest anti-money-laundering laws on banks, has no federal law requiring accountants to vet potential clients or report suspicious activity to law enforcement. The American Institute of Certified Public Accountants, the world’s largest association of CPAs, has issued guidelines directing members to vet clients, but there is no evidence that U.S. accountants on the whole “make any more enquiries about customers than is absolutely necessary,” according to the Financial Action Task Force (FATF), an anti-money-laundering organization of 37 member countries.

The top accounting regulator in the U.S., the Public Company Accounting Oversight Board, a nonprofit established by Congress in 2002, has authority to oversee audits of publicly traded U.S. companies. Critics say the oversight board hasn’t been aggressive enough in policing the Big Four. A recent investigation by the Project on Government Oversight, a nonpartisan watchdog group, found that in the past 16 years, the board identified 808 defective audits done by the Big Four, but brought only 18 enforcement cases.

The Big Four have shelled out a lot of money to influence rulemaking. Altogether, the firms spent nearly $90 million on lobbying over the past decade, according to data compiled by the Center for Responsive Politics. Most recently, they fought a bill that would make public the oversight board’s disciplinary proceedings against accounting firms. The board is currently required to keep disciplinary proceedings confidential until its decision is reviewed by the Securities and Exchange Commission or the review period has passed.

Europe’s uneven enforcement

On paper, European Union rules are far tighter. The EU requires accountants to vet clients and alert national authorities if they suspect a client’s funds “are the proceeds of criminal activity.” Like banks, accounting firms have to file a suspicious activity report if they believe a client is laundering money. The EU includes Malta, where many companies owned by dos Santos and her husband are incorporated.

Under EU rules, senior executives must approve decisions by accounting firms to sign up politically exposed persons, and the firms must take “adequate measures” to ensure that the source of a client’s money is legitimate. Vetting might include checking media reports, commercial databases and studies by the International Monetary Fund or World Bank. This level of scrutiny is supposed to continue throughout the business relationship.

But research shows that compliance is spotty. In at least 10 EU countries, accountants filed fewer than 10 suspicious transaction reports in 2015, a European Commission study found. Banks in many of those countries filed thousands of reports over the same period.

Meanwhile, other research found that accountants, either wittingly or unwittingly, often facilitate money laundering. A recent analysis of more than 400 corruption and money-laundering cases, conducted by the U.K. national chapter of Transparency International, documented the involvement of hundreds of professional advisers, including 62 accountancy firms in the United Kingdom.

“Without the assistance of these people, these corruption schemes and the money laundering that flows from that would be unable to happen,” Ben Cowdock, one of the researchers who worked on the report, told ICIJ.

Some EU countries have tried to crack down. Denmark is investigating Ernst & Young’s operations there after the firm allegedly failed to report red flags to authorities while auditing Danske Bank, which is involved in a money-laundering scandal. (EY Denmark told Bloomberg News that it “reported as required.”) In other EU countries, however, agencies and professional bodies tasked with regulating accountants appear to have done little to enforce compliance with anti-money-laundering laws.

What’s more, much of the Big Four’s work takes place beyond the reach of Western regulators. Though headquartered in major Western cities, the industry operates on a franchise model in which global networks of affiliated firms share the same brand but are typically independent legal entities bound only, in most cases, by local laws.

“Though they portray themselves as global firms, they only use the word global when they want to win business,” said Prem Sikka, an accounting professor at the University of Sheffield. “When it comes to liability, their claims on globalization vanish, and then they say they’re a loose network of national firms — even though they have a global website, a global board.”

Without the assistance of these people, these corruption schemes and the money laundering that flows from that would be unable to happen.

– Ben Cowdock, Transparency International U.K.

In 2018, the FATF took a close look at how criminals hide their assets to launder money and evade taxes. The analysts found that professional intermediaries, including accountants, played a key role in a majority of the 106 cases they studied.

“Professional service providers significantly enhance the capacity of criminals to engage in sophisticated money laundering schemes to conceal, accumulate and move volumes of illicit wealth,” the FATF report says.

Buying credibility

In interviews, dos Santos has pointed to her relationships with major consulting firms as validation that her wealth is legitimate. In October, she told the Portuguese news agency Lusa that she had received careful vetting to work with a number of entities, including “consultants who are in the top five worldwide.”

Consulting firms are subject to even fewer legal requirements to vet their clients than accountants. In the U.S. and the EU., they aren’t subject to any industry-specific anti-money-laundering regulations at all.

That leaves little more than the threat of reputational damage to guide their behavior.

McKinsey & Company, Boston Consulting and Booz Allen Hamilton continued their relationships with Crown Prince Mohammed bin Salman of Saudi Arabia after the murder of Saudi journalist Jamal Khashoggi, according to news reports, despite the crown prince’s alleged involvement. McKinsey has also worked for other authoritarian governments, including Turkish President Recep Tayyip Erdogan’s.

Luanda Leaks documents provide insights into the relationships between consultants and the dos Santos businesses they advised.

In 2016, McKinsey created a strategic plan for Efacec Power Solutions, a Portuguese maker of electric power equipment in which dos Santos controlled the majority stake.

PwC suggested creative ways to reduce taxes. In 2017, for example, PwC consultants told a dos Santos retail group called Grupo Condis that it could take advantage of “very competitive” tax rates, “potentially between 0% and 5%,” by incorporating a holding company in an offshore financial center such as Malta or Singapore. The firm also advised Ciminvest, a dos Santos company with a stake in an Angolan cement producer, on loan repayment and dividend distribution.

From 2010 to 2016, Boston Consulting sent invoices for at least $4.3 million to companies owned or partly owned by dos Santos and Dokolo, ICIJ found, including more than $3.5 million for a subcontract from Wise Intelligence Solutions Limited, a Maltese company owned by the couple. The Angolan government had awarded Wise a contract worth $9.3 million in 2015 to help it restructure Sonangol, the state oil company. Wise also subcontracted to PwC, which charged $273,000 for its work on the project.

Through her lawyers, dos Santos said the Angolan government sought her involvement in the project “because she is one of very few Angolans with substantial international business experience.” Dos Santos also denied receiving any tax advantages from operating through foreign or offshore companies.

A spokeswoman for Boston Consulting said that senior partners at the firm “regularly review the type of work we do — before it is taken on and during its delivery.”

“In Angola, we reviewed the payment structures and contracts, as we do for all projects, to ensure compliance with established policies and avoid corruption and other risks,” she said.

In response to questions from ICIJ, McKinsey said its relationship with Efacec started before dos Santos became a shareholder. “McKinsey typically serves the management of companies, not individuals or the shareholders,” a spokesman added in an email.

De Grisogono: anatomy of a self-deal

For more than two decades, the de Grisogono jewelry company sold watches, rings, bracelets and other luxury items to the world’s elite from boutiques in New York, Paris and more than a dozen other cities.

Its founder, Fawaz Gruosi, a silver-haired former salesman for other high-end jewelers, made a point of throwing parties that attracted the likes of Naomi Campbell, Heidi Klum and Ivana Trump. But his impressive Rolodex wasn’t enough to make de Grisogono thrive. Sales plunged after the 2008 financial crisis, and the company struggled under an increasing load of debt.

In 2012, a lifeline arrived from an unlikely pair. Sodiam, the trading arm of the Angolan state diamond company, and dos Santos’ husband, Dokolo, acquired a controlling stake in de Grisogono. Gruosi kept a minority stake.

Documents and emails obtained by ICIJ reveal that the terms of the acquisition were enormously favorable to Dokolo. The deal gave him “full control of the management” of the jewelry company, according to a draft shareholder agreement. Dokolo also received a roughly $4 million “success fee,” drawn from the Angolan state money, for arranging the deal that left him in charge.

The transaction worked like this: Sodiam and a Dokolo-owned shell, Melbourne Investments BV, set up a third company, Victoria Holding, in Malta. Victoria Holding became the biggest investor in Victoria Limited — another Maltese shell company. Victoria Limited became the majority investor in de Grisogono.

Records indicate that Sodiam, then under the influence of dos Santos’ father, initially supplied $45 million to buy off de Grisogono’s debt and acquire shares in the struggling jewelry company. Part of the money was also used to pay the “success fee” to one of Dokolo’s offshore companies in the British Virgin Islands, called Almerk International Limited. Through his lawyers, Dokolo said he invested $115 million in the jeweler initially and that he subsequently invested significantly more. He said he had received the success fee, which he reinvested in the company, for “the successful complex negotiations and structuring of the acquisition.”

“The strategic vision for the acquisition of De Grisogono, envisaged by Mr. Dokolo, was to achieve a vertical integration of Angola’s diamond industry and to create a value-added business along the entire value chain from mining to polishing to retail sales,” lawyers for Dokolo said in response to ICIJ questions.

Sodiam continued to lend money to the jewelry company after the acquisition. All told, according to a 2016 letter Sodiam sent accountants, it pumped in more than $120 million — money the state company itself had borrowed. Records show Sodiam borrowed at least $98 million at a 9% interest rate from Banco BIC in Angola, which dos Santos partly owns.

Under new ownership, the jewelry company enlisted consultants from Boston Consulting for several months and later hired several of them for top leadership roles. De Grisogono named Boston Consulting project leader John Leitão CEO in 2013 and Elmar Wiederin, who had been Boston Consulting’s main liaison to the jewelry company, chairman in 2015.

In an interview with ICIJ partners at The New York Times, Leitão characterized Boston Consulting’s role at the jewelry company as “shadow management.” (Boston Consulting disputes this and said the firm worked only on three specific projects.)

All the while, de Grisogono hemorrhaged cash. The company racked up huge debts, including the loans from Sodiam, even as it continued to throw lavish parties at the Cannes Film Festival. Leitão was unapologetic about spending big on parties. “To grow the business, you make a lot of noise,” he said. “Everyone wants to come to your parties.”

By 2016, de Grisogono had laid off staff in Geneva, New York and London. It struggled to pay suppliers, virtually all of whom lost confidence in the jeweler, one senior manager at de Grisogono said.

“I am stunned our top management did not foresee these problems,” Gruosi, de Grisogono’s founder and minority owner, complained in a 2015 email. He left the company in early 2019.

In response to questions from ICIJ, Gruosi said he did not have information about the company’s corporate structure or finances because his role under the new ownership was restricted to creative director.

Leitão, the former de Grisogono CEO, told The New York Times that the company’s financial problems were exacerbated by sanctions against Russia and a fall in oil prices, which hit the pocketbooks of Russian and Middle Eastern clients. Had the jeweler been successful, he said, its shareholders would have made a fortune.

De Grisogono declined to comment. Wiederin said confidentiality rules prevented him from answering questions about the company’s finances.

A final accounting

Accountants for Victoria Holding and Victoria Limited, the Maltese companies with a majority stake in de Grisogono, appear to have missed red flags in their financial statements.

In 2013, PwC’s Malta office drafted financial statements for the companies covering the 2012 calendar year. E-mails show that PwC accountant Daniel Difesa asked dos Santos’ financial advisers at Fidequity, a management services firm, about Almerk, Dokolo’s British Virgin Islands shell company that had received a $4 million “success fee.” Fidequity played a central role in business operations, including coordinating with accountants and lawyers, for much of the dos Santos empire.

Difesa wanted to know whether Almerk was a “related party,” meaning connected to the shareholders of the Maltese shell companies. Fidequity administrator Antonio Rodrigues responded that he didn’t know — even though internal communications indicate that he was well aware that Dokolo owned Almerk.

Based on the records reviewed by ICIJ, it appears that PwC accepted the answer and didn’t dig further.

ICIJ shared documents and email exchanges related to PwC’s preparation of the 2012 financial statements, which the firm also audited, with four experts: an anti-money-laundering specialist, a forensic accountant, a former auditor and a former U.S. customs investigator. All cited the $4 million “success fee” paid to Almerk as suspicious.

“Paying huge and dubious consulting fees to anonymous companies in secrecy jurisdictions should sound all alarm bells,” said Christoph Trautvetter, a forensic accountant based in Berlin.

It’s unclear whether PwC reported the red flag to Maltese authorities. PwC did not respond to detailed questions about its work for Victoria Holding and Victoria Limited, citing confidentiality restrictions. Difesa, who no longer works for PwC, did not respond to repeated requests for comment. PwC’s code of conduct, which applies to its member firms across the globe, directs employees to know the identity of their clients and adhere to anti-money-laundering standards. “Where we suspect criminal behaviour, we take appropriate action,” the code reads.

Rodrigues and other Fidequity administrators did not respond to repeated requests for comment.

Robert Mazur, an expert on money laundering and a former U.S. federal agent, said that based on the documents he reviewed, PwC and Fidequity “should have seriously considered” filing a suspicious activity report.

Mazur, who went undercover to pose as a money launderer for Pablo Escobar’s Colombian drug cartel in the 1980s, identified the “success fee” paid to Almerk as a red flag because of the secrecy surrounding the company’s shareholders and because of the “intangible” nature of the services it allegedly provided.

“Over the past decades, these types of payments have often been arranged as a cover for payments related to corruption and/or illegal activity,” he said.

Records show that PwC has continued as auditor for Victoria Holding and Victoria Limited. PwC conducted Victoria Limited’s 2016 audit, which was filed with the Malta Business Registry in 2018. As of Jan.17, the firm was still listed as the auditor for both companies in Maltese business records.

In October, ICIJ media partners interviewed Sodiam Chairman Eugénio Pereira Bravo da Rosa in the capital city of Luanda.

Bravo da Rosa, who was appointed to the state diamond company in November 2017, said that Sodiam “has not profited one single dollar” from its investment in de Grisogono. He criticized the deal that put Dokolo in charge of the jewelry company and left Sodiam without a management role.

“It is strange,” Bravo da Rosa said. “I can’t believe a person would start a business and let its partner run the business with total power to make all the decisions.”

By the time Sodiam pays off loans it took out to participate in the deal, he said, it will have lost more than $200 million. Sodiam says it is repaying Banco BIC but hasn’t recouped its investment in de Grisogono. Banco BIC did not respond to questions.

Dokolo disputes that figure, and has told media outlets that he recently filed a case against Sodiam in a London arbitration court accusing the state diamond company of destroying the value of his investment in de Grisogono. He claims that Sodiam has stolen documents and violated confidentiality agreements.

Sodiam’s losses in the de Grisogono venture were cited as one of the justifications for the Angolan court order freezing Dokolo’s assets.

Sodiam, which in 2017 announced its intention to divest its interest in de Grisogono, is still trying to figure out what happened, Bravo da Rosa said.

“That is the question we are continually asking,” he said. “What has been done with the money?”

Editing by: Dean Starkman, Emilia Diaz-Struck, Richard H.P. Sia, Tom Stites, Joe Hillhouse, Fergus Shiel, Margot Williams, Hamish Boland-Rudder and Amy Wilson-Chapman.

Contributors: Sylvain Besson, Jacob Borg, Christian Broennimann, Rigoberto Carvajal, Antonio Cucho, Douglas Dalby, Will Fitzgibbon, Sydney Freedberg, James Oliver, Micael Pereira, Delphine Reuter, Sonia Rolley, Pauliina Sinauer and Mago Torres.