An ICIJ Investigation

Secrecy for Sale

Inside the Global Offshore Money Maze

Millions of leaked files from two financial service providers, a private bank in Jersey and the Bahamas corporate registry reveal how tax havens around the world are used to hide riches.

Offshore clients

Leaked Records Reveal Offshore Holdings of China’s Elite

By Marina Walker Guevara

January 21, 2014

- Millions of leaked files from two financial service providers, a private bank in Jersey and the Bahamas corporate registry reveal how tax havens around the world are used to hide riches.

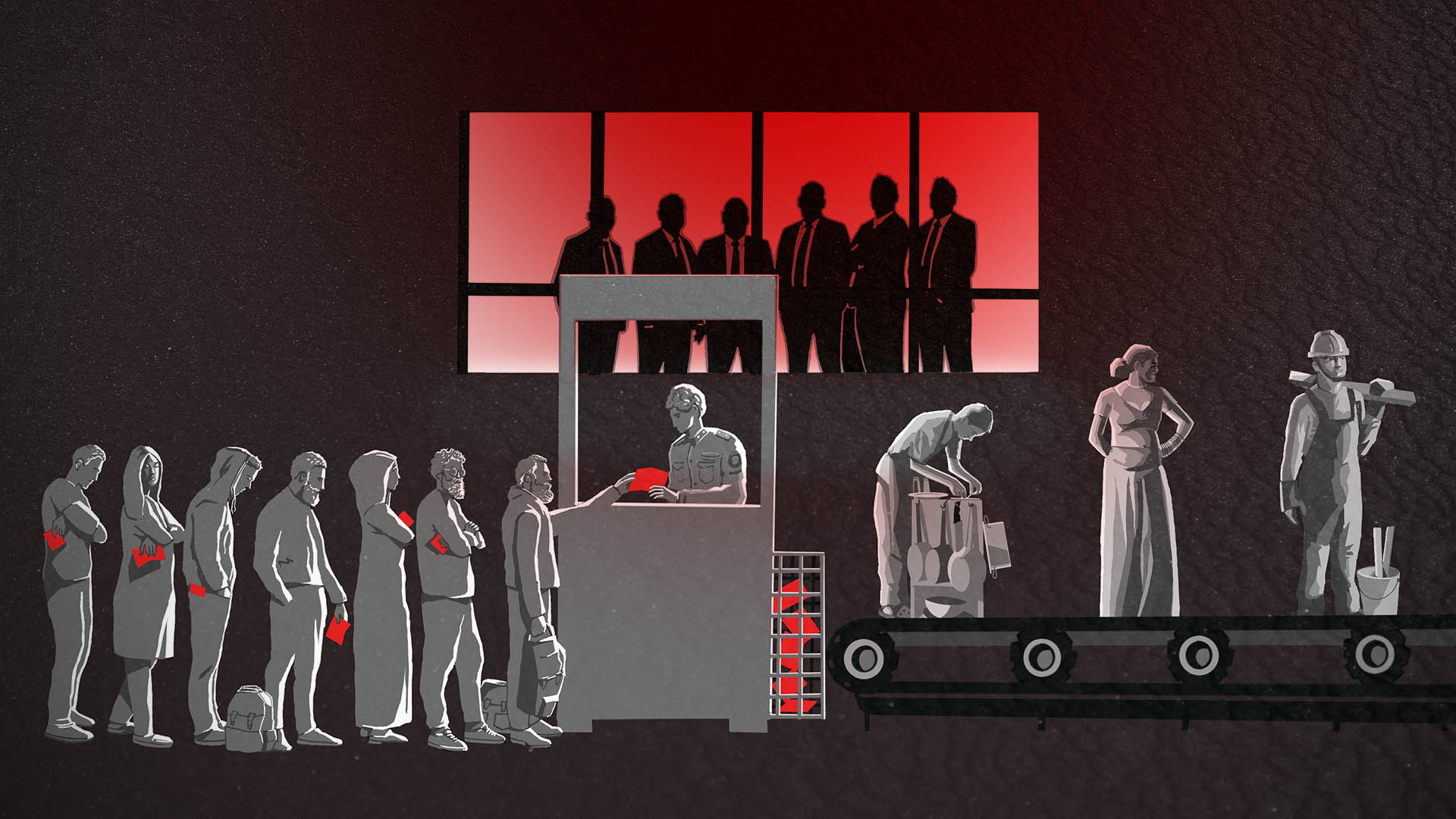

- Government officials and their families and associates in China, Azerbaijan, Russia, Canada, Pakistan, the Philippines, Thailand, Mongolia and other countries have embraced the use of covert companies and bank accounts.

- The mega-rich use complex offshore structures to own mansions, yachts, art masterpieces and other assets, gaining tax advantages and anonymity not available to average people.

- Many of the world’s top’s banks – including UBS, Credit Suisse and Deutsche Bank – have aggressively worked to provide their customers with secrecy-cloaked companies in the British Virgin Islands and other offshore hideaways.

- A well-paid industry of accountants, middlemen and other operatives has helped offshore patrons shroud their identities and business interests, providing shelter in many cases to money laundering or other misconduct.

- Ponzi schemers and other large-scale fraudsters routinely use offshore havens to pull off their shell games and move their ill-gotten gains.

ACCOUNTABILITY

Aug 30, 2024

Nordea to pay $35 million to end Panama Papers-linked money laundering probe

Accountability

Jul 08, 2024

Ten years after an ICIJ exposé, Danish authorities charge Nordea bank with money laundering violations

BEHIND THE SCENES

Apr 03, 2023

Ten years of exposing the financial secrets of some of the world’s most powerful people

Accountability