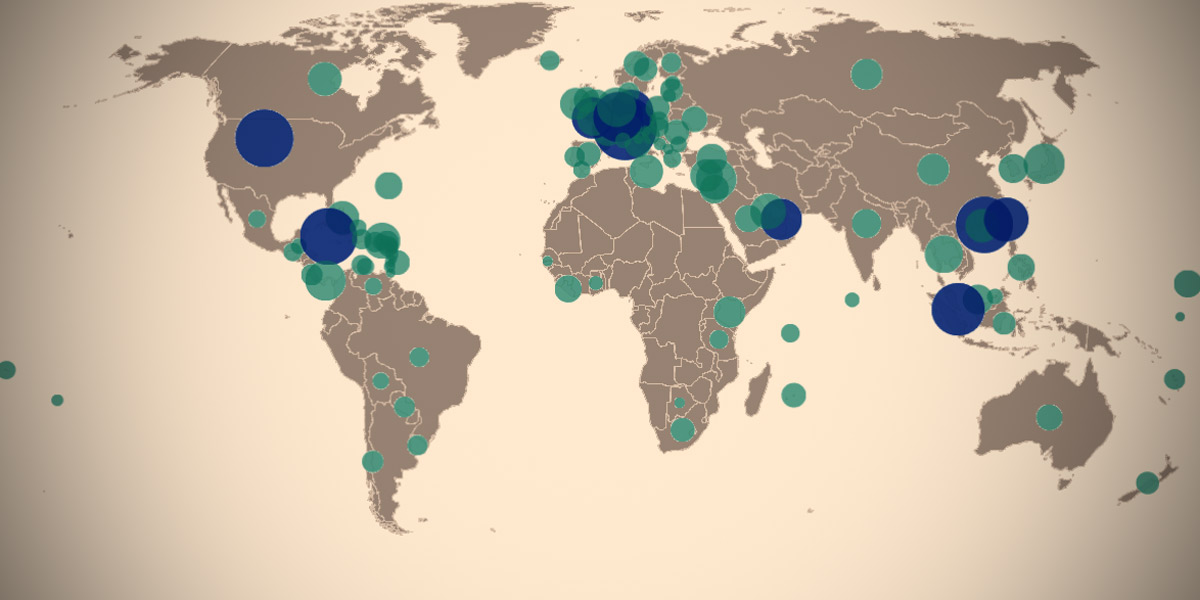

Switzerland and the United States are the biggest promoters of financial secrecy according to an index published today by the Tax Justice Network (TJN). The index ranks countries based on their level of secrecy and the percentage of financial services provided to non-residents.

Top 10 jurisdictions:

|

Switzerland, a well-known tax haven, whose practices were uncovered by ICIJ’s 2015 Swiss Leaks investigation, is still the worst offender as far as financial secrecy is concerned, according to TJN’s analysis. “Switzerland has delayed the implementation of automatic information exchange, and in 2017 lawmakers attempted to stop it altogether with countries they deemed ‘corrupt’,” the report noted.

As for the United States, it has refused to take part in international efforts to curb financial secrecy and instead set up a parallel system that seeks information on U.S. citizens abroad but does not provide data to foreign countries. Several U.S. states are also considered tax havens including Delaware, which doesn’t tax intangible assets such as intellectual property, patents or trademarks. “More than 66 percent of the Fortune 500 have chosen Delaware as their legal home,” claims the state’s Division of Corporations website.

The 2018 release confirms the long-term picture, that the richest and most powerful countries have continued to pose the greatest global risks.

This is not new. The U.S. ranked third in TJN’s 2015 secrecy index. Back in 2016, Mark Hays, senior adviser with Global Witness, told the Washington Post, “we often say that the U.S. is one of the easiest places to set up so-called anonymous shell companies.” Last month, a Bloomberg article referred to America as “one of the world’s best places to hide money from the tax collector.”

“The 2018 release confirms the long-term picture, that the richest and most powerful countries have continued to pose the greatest global risks – with Switzerland and the U.S. established as the key facilitators of illicit financial flows,” said TJN chief executive Alex Cobham.

Some of the criteria used to build the index include the absence of a public register, harmful tax residency rules and whether the system allows for bearer shares, which obscure ownership.

TJN noted some improvements since the 2008 financial crisis, most notably the automatic exchange of information that will be implemented in 2018 for many countries, including the Bahamas, Samoa and St. Kitts and Nevis. The report also underlines increased public pressure in favor of public registers of companies’ owners.

Yet, in the meantime the European Union, put together a blacklist of 17 secrecy jurisdictions last month, only to delist eight countries a few weeks later, including Panama (ranked 12 on the secrecy index) and Macao (ranked 22). In addition, members of the EU themselves rank high on the secrecy index: Luxembourg, the Netherlands, Malta and Germany are among the top 20 jurisdictions promoting financial secrecy. As for the United Kingdom, it continues to shelter financial secrecy through its crown dependencies, including tax havens Guernsey (ranked 10), Jersey (ranked 18) and the Isle of Man (ranked 42).

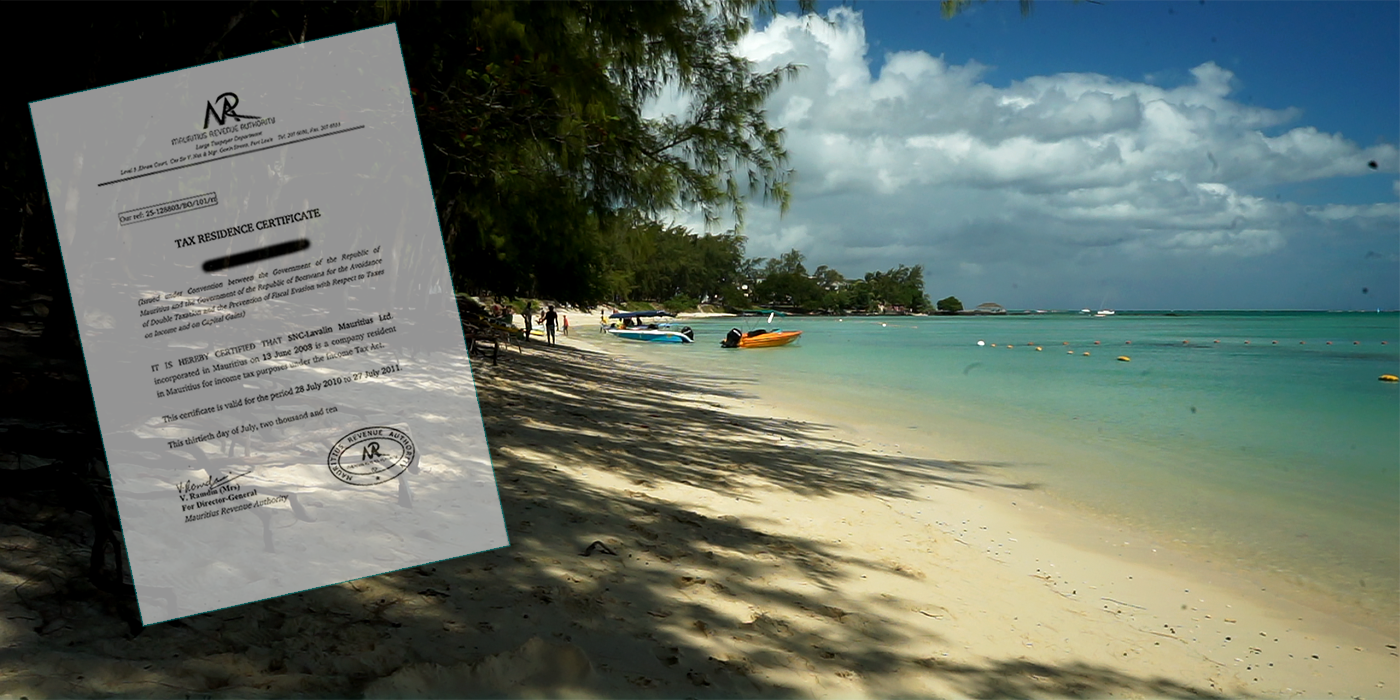

Among the countries that are new on the TJN list are Kenya, with a very high secrecy score of 80%, even higher than Mauritius (72%), which is one of Africa’s most high-profile tax havens. Although Kenya ranks high (9) on TJN’s secondary index based on secrecy only, it is much lower on the main index (27), given its rather small market share. This “is an example of how interests of western financial service lobbyists have successfully lured governments into a race to the bottom,” said the report.

“The damage being done to public services around the world is incalculable, and the violations in human rights are severe, whether this be through a lack of access to clean drinking water in sub-Saharan Africa or the pressures facing public health services in the UK and U.S.,” said Liz Nelson, TJN Director responsible for the Tax Justice and Human Rights program.