Governments around the world have recouped more than $700 million in fines and back taxes as a result of the Panama Papers investigation, a new tally reveals.

An additional $182 million has been clawed back in Germany and Australia, adding to more than $500 million previously recouped globally because of the 2016 investigation.

ICIJ German partners Süddeutsche Zeitung reported in April that German authorities had collected 140 million euros ($171 million.) Research by ICIJ media partners NDR, WDR and Süddeutsche Zeitung found that more than 2,000 official investigations were underway and 71 criminal cases had been initiated.

“North Rhine-Westphalia alone received 100 million euros in fines from banks and financial institutions that had contributed to tax evasion,” Süddeutsche Zeitung wrote.“Through tax repayments, the country received another 17.5 million euros.”

In May, the Australian Tax Office (ATO) reported to parliament the completion so far of 315 reviews and audits sparked by the Panama Papers.

In 2018, the ATO recorded the recovery of $11 million more to add to $37 million already recouped since April 2016. “We’ve got three individuals who are under criminal investigations at the moment, resulting from the work we’ve done,” the tax office told ICIJ.

The overall amount collected worldwide is likely to keep growing as other countries continue audits on the basis of the Panama Papers information. Australia’s tax office has 81 ongoing probes, while Canada’s revenue agency has confirmed 123 audits and several criminal investigations.

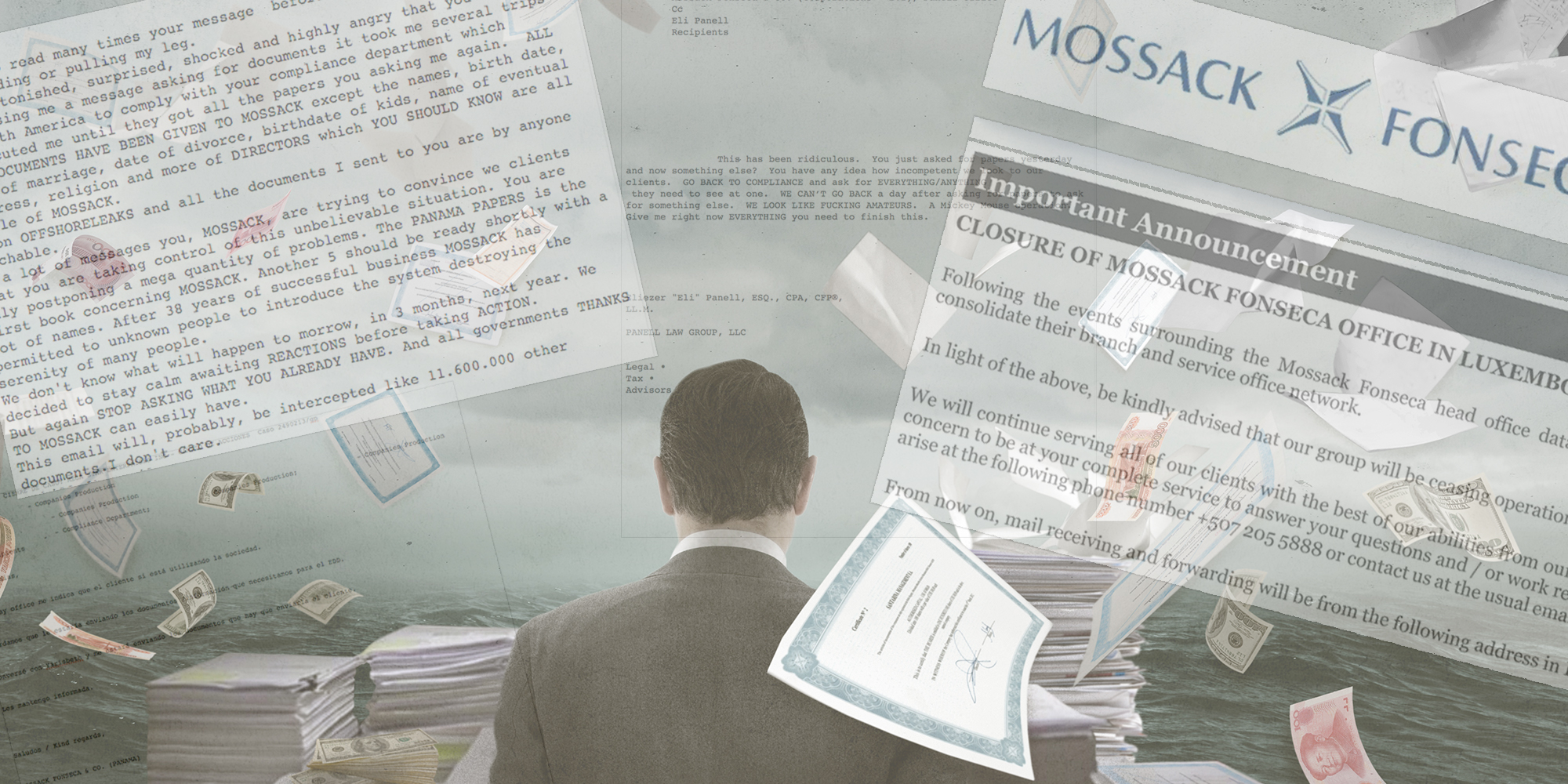

Earlier this year, Mossack Fonseca, the offshore law firm whose 11.5 million leaked files were at the heart of the Panama Papers investigation, closed.

Last week, ICIJ published a new series of articles based on Mossack Fonseca documents obtained after the publication of the 2016 investigation.

The new leak of information revealed tax and criminal inquiries to the law firm from authorities around the world, including India, France, Australia, Panama, the United Kingdom.

The new documents also showed the reactions to the leak of bankers, accountants and lawyers who, along with Mossack Fonseca, helped the rich and famous avoid or reduce taxes through offshore companies.

One unhappy lawyer who had used Mossack Fonseca’s services for years complained that the Panama Papers investigation resulted in exactly what secretive offshore companies were designed to avoid.

“Thanks to Mossack,” he wrote in January 2017, “customers have to pay income taxes.”