IMPACT

Cyprus and U.S. to form partnership to combat financial crime

The two countries are finalizing an agreement under which the U.S. Justice Department and FBI will assist Cyprus authorities in identifying and prosecuting sanctions evasion and other illicit finance operations “with a nexus to Cyprus.”

The United States and Cyprus are codifying a partnership aimed at countering money laundering, sanctions evasion and other financial crimes emanating from the island nation’s financial and professional services sectors.

Cypriot law enforcement agencies plan to sign a memorandum of agreement to work with the U.S. Justice Department and Federal Bureau of Investigation and to identify and prosecute illicit financial activities, according to a joint statement released on Tuesday.

“DOJ in 2024 will share its experience with Cypriot counterparts to proactively detect, investigate, and prosecute cases involving financial crimes with a nexus to Cyprus, and will provide expert prosecutorial assistance,” the announcement says.

The effort will also involve the U.S. State Department’s Bureau of International Narcotics and Law Enforcement Affairs, along with the Cyprus Law Office of the Republic and the country’s Finance Intelligence Unit known as MOKAS.

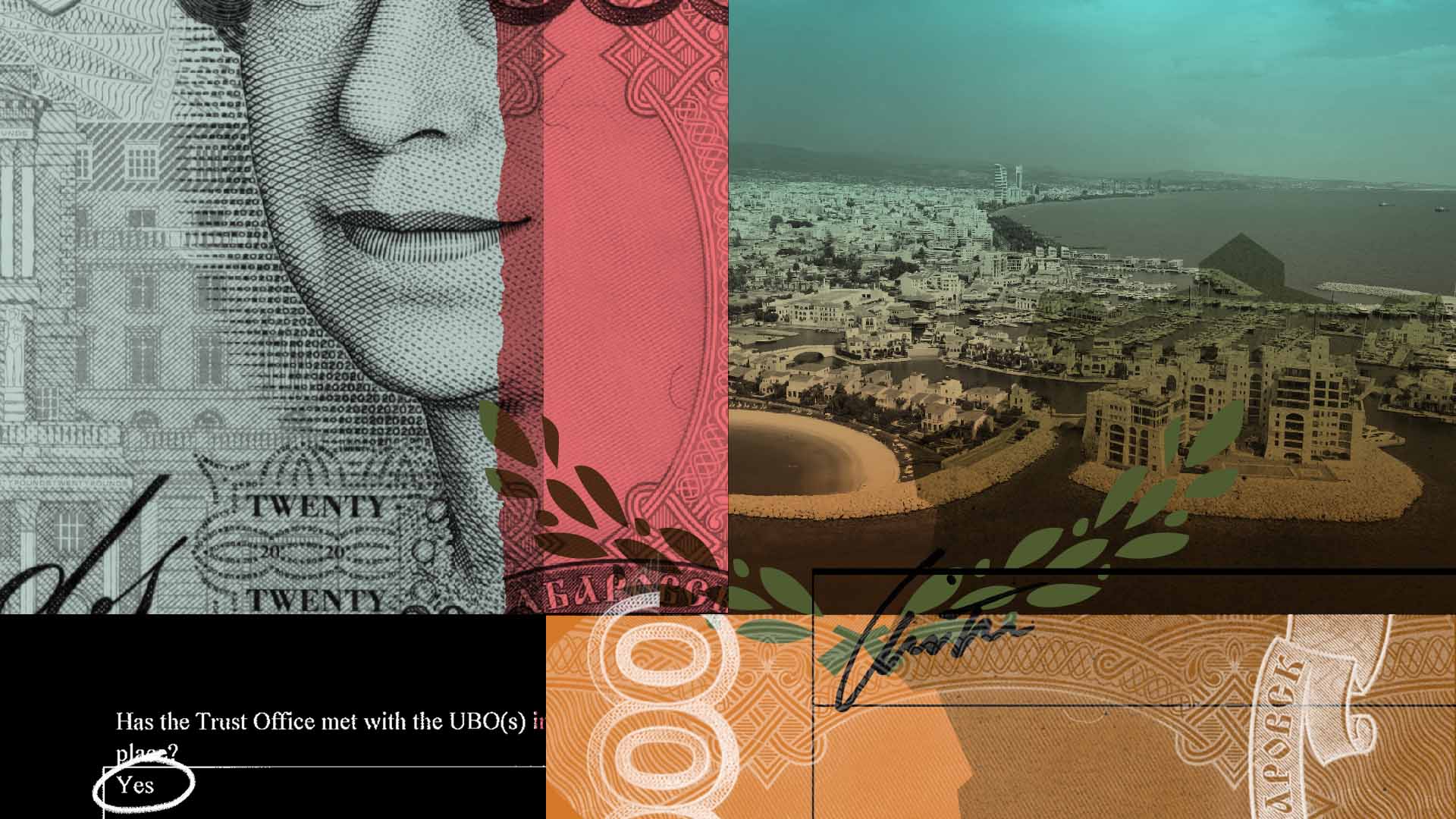

Cypriot President Nikos Christodoulides requested American assistance in the wake of Cyprus Confidential, a cross-border journalism collaboration led by the International Consortium of Investigative Journalists, Paper Trail Media and 67 media partners. The project revealed how Cyprus, at the east end of the Mediterranean nearest Turkey, Syria and Lebanon, plays an even bigger role than was commonly known in moving dirty money for Russian President Vladimir Putin’s autocratic regime and other brutal dictators and anti-democratic actors.

ICIJ’s analysis of more than 3.6 million leaked documents found nearly 800 companies and trusts registered in secrecy jurisdictions that were owned or controlled by Russians who have been sanctioned since Russia’s invasion of Crimea in 2014. Those include more than 650 Cyprus companies and trusts. Among them are mother companies of Russian holdings; subsidiaries of Russian conglomerates; and opaque entities used to conceal investments in properties, yachts and world-famous artwork.

Hours after the investigation launched in November, Christodoulides held a press conference and vowed to investigate all allegations of wrongdoing “within a specified timeframe.”

The next month, ICIJ reported that a team of two dozen FBI agents and officials from the U.S. Treasury Department’s Financial Crimes Enforcement Network deployed to Cyprus to assist Cypriot authorities; in February, the Cyprus government approved the creation of a professional-services sector oversight body to review cases that may run afoul of international sanctions.

Led by the Cyprus Securities and Exchange Commission, the oversight authority is intended to conduct its reviews with the Cyprus Bar and Accountants Associations.

The plan has drawn some criticism in its formation. The Cyprus Bar Association told ICIJ that it had not been appropriately consulted prior to the government’s approval of the oversight body. After outlining the history of its involvement in the plan, the Association expressed concerns that the plan may pose risks to attorney-client privilege among other problems.

The FBI and Department of Justice declined ICIJ’s request for comment.