THE AUDITORS

How auditing giant KPMG became a global sustainability leader while serving companies accused of forest destruction

The firm vouched for an Indonesian company with a supply chain beset by deforestation allegations and a project in Canada that led to an Indigenous forest’s “death by a thousand cuts”.

Just past mile 73 on the highway that connects Canada to Alaska, north of the small city of Fort St. John in British Columbia, a dense line of spruce and pine abruptly ends. It is replaced by a vast expanse of brush and stumps scarring the clear-cut forestland.

Sherry Dominic and her family once fished, hunted moose and picked berries here, following traditions of the native Blueberry River First Nations that stretch back hundreds of years in Canada’s westernmost province.

The land was once covered in boreal forest and laced with clear streams.

Then the loggers came.

In 2015, after more than a decade of intensive logging, Dominic and the Blueberry River First Nations sued the provincial government alleging that it had approved a “sustainable forest management” plan that failed to protect the forest. Instead, the project allowed companies including forestry giant Canfor Corp., to overharvest timber, damage native people’s territory and threaten their way of life.

First Nations members sent letters to the logging companies and the government, but their concerns “always fell on deaf ears,” said Dominic, a council member from the Blueberry River community. “They just kept going and going.”

In 2021, a provincial court suspended the approval of new logging permits, finding that the provincial government had promoted “intensive use” by forestry companies and other industries that left the Blueberry River First Nations’ territory and wildlife “drastically altered.”

Project audit reports point to another, less examined, point of failure that may have contributed to what the court calls “irreparable harm.”

KPMG, the global accounting firm, has served as both environmental auditor for the project and financial auditor for Canfor, a forestry conglomerate with $6 billion in annual revenue. Even as Canfor and other giant logging concerns cleared acres of forestland in the project area, KPMG was issuing reports that downplayed evidence that loggers were not complying with the project’s regulations, a review of the documents by the International Consortium of Investigative Journalists (ICIJ) has found.

The examination of KPMG’s environmental auditing practices is part of Deforestation Inc., an investigation led by ICIJ in collaboration with 39 media partners. The cross-border investigation exposes the flaws of the environmental auditing and certification industries designed to combat deforestation, illegal logging and other abuses.

Year after year, KPMG signed “assurance reports” for the project that described as “minor non-compliances” instances of logging in protected areas, destruction of wildlife habitat and degraded water quality.

Records describing the “sustainable forest management plan” also show that members of the Blueberry River First Nations complained that KPMG never visited the community during the audits.

The “cumulative effects” of industrial logging – along with the government’s failure to check an unrelated proliferation of oil and gas wells in the area – led to a “death by a thousand cuts,” the court concluded. Today the proportion of Blueberry River First Nations’ territory considered “intact forest landscape” amounts to less than 14%.

Canfor did not address specific questions from ICIJ. Through a spokesperson, the company said the sustainable forest management plan implemented in Blueberry River First Nations’ forestland had been reviewed, approved and monitored by the British Columbia government and supported by the Sustainable Forestry Initiative, or SFI, a voluntary certification organization that promotes responsible forestry practices.

In an email to ICIJ, SFI’s senior vice-president for customer affairs, Jason Metnick, declined to address questions about why SFI standards used to develop the plan led to such negative environmental impact for the community, according to the court. Metnick said that as a “third-party forest certification standard that explicitly requires respect for treaties, agreements, and other constructive arrangements, we feel that the SFI standard will continue serving as a valuable tool for ensuring that Indigenous Peoples’ rights and self-determined priorities are respected and direct the practice of sustainable forest management within their territories.”

KPMG did not respond to ICIJ’s detailed questions about the court ruling or other matters. In an emailed statement, a spokeswoman for KPMG Canada said the company is “committed to delivering high quality services in accordance with applicable regulated and international standards and independence requirements.”

She added that “this commitment applies to all of our practices, including our role in forestry certification.”

The Certifier

The KPMG environmental auditing unit that monitored the Fort St. John project is part of a $10 billion industry that, among other things, helps manufacturers, retailers and other companies trading or using wood, palm oil or other commodities associated with deforestation obtain sustainability certifications. Auditors perform risk assessments, inspect mills and interview company foresters and other employees about their practices, the auditing firms say.

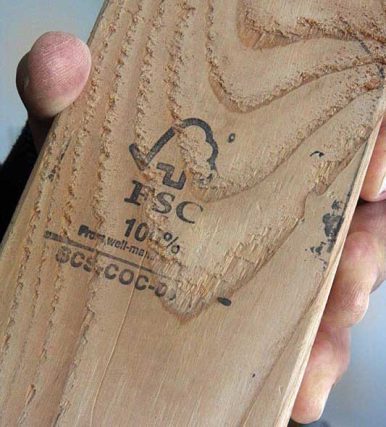

These certifications – often exhibited in companies’ marketing reports and stamped on products – are intended to assure investors, customers and regulators that the companies are complying with voluntary environmental standards in sourcing their products.

In countries where illegal logging is rampant and forestry governance lax, experts consider these voluntary schemes better than no oversight at all. But critics counter that the rules for vetting and documenting client compliance with environmental standards are weak and that companies can use the process to claim their operations to be sustainable when they are not.

“For many organizations as well as individuals, all they’re looking for right now is an FSC label or an SFI label, and it’s all good as far as they’re concerned,” said Herb Hammond, a registered professional forester and ecologist in Canada, referring to the SFI and a competing certification organization, the Forest Stewardship Council.

“As time has gone by, people in the know realized that these are largely ‘greenwashing’ kinds of schemes,” Hammond said.

SFI’s Metnik disputed the characterization of the certification industry and his organization, saying SFI “has a proven track record of advancing sustainability through forest-focused collaborations.”

A spokesperson for FSC defended the organization’s role in promoting responsible forestry. “FSC is an effective tool for implementing strict practices which are proven to be a solution against deforestation and degradation,” they said in a statement to ICIJ. The organization says it relies on firms such as KPMG to audit and issue certificates on companies’ products and forest management practices.

In the auditing industry, KPMG stands out for its international reach – and for its overlapping roles. The firm acts as a traditional financial auditor for forest-product companies. It also has a forestry auditing unit, which monitors environmental compliance for the same industry. A third unit offers general advice on “sustainability” and climate policies to businesses and other organizations.

In 2021, KPMG announced that it would invest more than $1.5 billion to expand consulting services designed to help clients reduce risks associated with climate change.

The firm has so far offered advice on sustainability to clients including the World Wide Fund for Nature, the United Nations Environment Program and a Dutch pension fund. KPMG is also a founding partner of a corporate initiative led by Britain’s King Charles III, which requires member companies to commit to biodiversity preservation and “acknowledge the need” to achieve net zero emissions by 2050.

Even so, ICIJ found that KPMG’s financial auditing clients include at least seven forestry and palm oil companies that have been accused of deforestation and illegal logging in Indonesia, Papua New Guinea, Malaysia, Cambodia, Guyana and other countries.

KPMG’s spokesperson said the firm does not comment on its clients.

An ICIJ review of audit reports, violation records and court filings on companies operating in at least 50 countries found the lapses of the environmental auditing industry extend far beyond KPMG. The Swiss giant SGS SA, the German TÜV and 45 other environmental auditing firms have at times also ignored or simply missed glaring environmental damage caused by their clients — who go on to contribute to the leveling of wide swaths of forest and to exacerbate global warming.

ICIJ found that, over the last 25 years, at least 340 companies in the forest products industry were cited by government agencies and environmental groups for a wide range of destructive practices after auditors had already certified their operations and products as sustainable. Those companies were later accused of overharvesting old growth forests and other illegal logging practices, bribing forestry officials, importing wood products in violation of trade restrictions, and performing sloppy checks on suppliers.

Fifty of those certified firms were later fined or convicted by a government authority or a court.

ICIJ’s findings of green-certified companies later cited for environmental wrongdoing span countries across Asia, Africa, the Americas and Europe and likely represent only a fraction of such cases because many government agencies don’t identify companies by name in environmental crime data.

The auditing firms have defended their work and said they carry out their services in compliance with the “highest standards.”

Deforestation and other forms of forest degradation are important contributors to climate change. When cut, trees release carbon dioxide into the atmosphere, a phenomenon that is responsible for more than 10% of greenhouse gas emissions that cause global warming.

At the 2021 United Nations COP26 climate summit in Glasgow, U.S. President Joe Biden and more than 100 other world leaders vowed to halt and reverse forest loss and land degradation by 2030. Soon after that pledge, private certification firms stepped up to offer services they said would help fight the climate crisis. The American firm SCS Global Services said in a blog post: “Once the buzz of COP26 fades, what are the boots-on-the ground solutions that will ensure best practices are in place and deforestation is being proactively mitigated?”

“One part of the solution is sustainability certifications,” SCS said.

Forest management experts, and current and former forestry auditors, are skeptical.

“I would take that with a pinch of salt,” John Innes, a sustainable forest management professor at the University of British Columbia, told ICIJ. “They’re just jumping on the bandwagon. They’re looking for anything that may help boost their case.”

Certification was intended to improve forestry governance and hold forest- product companies accountable. But as more brands became willing to pay for green certification as a way to increase market share, the rules became more lax and the checks less effective, some forestry auditors told ICIJ.

Market-driven sustainability

KPMG’s foray into the certification business started in the late 1990s, when environmentalists (later joined by consumers) began to demand environmental regulation of forest products originating in areas exposed to deforestation.

In Canada, the powerful forestry industry launched a campaign against proposed environmental laws, portraying them as a stifling economic burden on the industry.

The government of British Columbia hired KPMG to study the issue. In 1997, the firm produced a report that asserted that the proposed laws would increase logging costs by 75% – a finding disputed by other experts.

The province sided with the industry and introduced a clause in the forestry code that allowed the industry to follow voluntary standards instead.

Subject to the approval of government authorities, logging companies were allowed to create their own forest-management plans, like the one Canfor and other operators deployed in the Blueberry River First Nations territory.

KPMG’s consultants were also part of the technical committee that helped create the new standards, according to records of the non-profit Canadian Standards Association.

“There is a general trend toward environmentalism, and some big-box stores look to certification as a way to get a leg up on their competition,” Michael Alexander, who was then a forestry specialist at KPMG, told a Canadian magazine in 2001. “It can help increase sales,” he said.

In Canada, the firm set up an environmental auditing unit that went to work certifying forest-product companies as “sustainable” – in some cases according to the same voluntary standards it helped make possible and helped to write.

The so-called sustainability industry got a boost in late 2009, when about 200 political leaders gathered in Copenhagen for the United Nations conference on climate change, marking one of the first real global attempts to discuss the climate crisis.

While some developed and emerging powers — including India, Brazil and China — resisted meaningful reforms, the participants did set significant emission-reduction goals and pledged $100 billion by 2020 to fund climate-mitigation and adaptation projects in developing countries.

KPMG and the rest of the “Big Four” auditing and accounting giants saw an opportunity.

After the Copenhagen summit, KPMG hired prominent climate policy experts to steer its environmental consultancy division, advising banks and other clients on how to shift their investment strategies toward businesses that do not harm the environment.

The firm positioned itself as an environmental leader.

In a 2012 report addressed to corporate clients, KPMG consultants wrote that “exploitation of natural resources, climate change and other factors are putting the world on a development trajectory that is not sustainable,” adding that “if we fail to alter our patterns of production and consumption, things will begin to go badly wrong.”

In the following years, KPMG consultants partnered with universities in the Netherlands and the United Kingdom to develop sustainability reporting practices, lobbied European government officials to promote sustainable food systems, joined “sustainable finance” initiatives in Switzerland and sponsored forestry industry events.

Before long the firm’s environmental auditing and advisory units became embroiled in controversy involving a Canadian government trust that provided seed funding for emission-reduction projects. One of those projects, at Canfor’s mill in Fort St. John, which processed lumber from Blueberry River First Nations territory, was cleared to receive government incentives worth about $300,000, trust documents show.

In 2013, a provincial auditor faulted the trust for seeding projects that were already underway. An investigation by the Vancouver Sun had revealed that KPMG had advised the trust and helped select many of the already-started projects, including one energy-saving system at a Canfor mill. KPMG told The Sun that it could not provide documentation supporting its validation of the projects because of confidentiality agreements.

The trust was later dissolved.

‘Just a statement’

In the summer of 2013, Indonesia and two neighbors, Singapore and Malaysia, were engulfed by record levels of hazardous smog. Schools closed; adults and children donned masks to avoid the toxic fumes.

The Indonesian government blamed pulp and paper producers for illegally burning carbon-rich peatlands to expand their plantations. One of the accused companies was Asia Pacific Resources International, known as APRIL.

For years environmentalists had raised concerns about the company’s allegedly destructive practices. Before the Forest Stewardship Council could void APRIL’s certification, the company withdrew its membership and gave up the right to use the FSC green label on its products.

As more brands became willing to pay for green certification as a way to increase market share, the rules became more lax and the checks less effective, some forestry auditors told ICIJ.

APRIL committed to improving its practices. A committee of independent experts established to help APRIL achieve that goal hired KPMG’s environmental auditing unit to monitor its progress toward one day regaining certification and customers.

Since then, KPMG has monitored APRIL operations and compiled “assurance reports” that describe the company’s sustainability achievements and shortcomings. Since 2016, KPMG has reported finding no major issues with APRIL’s forest management, citing only a lack of information about its suppliers and the inability to accurately monitor their operations.

But in 2020, a group of environmental watchdogs and forestry specialists in Indonesia analyzed satellite images and concluded that one of APRIL’s Indonesian timber suppliers had cleared protected forest in apparent violation of APRIL’s sustainability commitment. The environmentalists accused KPMG auditors of missing the evidence of deforestation.

APRIL disputed the researchers’ findings saying that the supplier’s harvesting activities preceded APRIL’s sustainability commitment and that the forested area was not designated as a “high conservation area” requiring special management and protection.

ICIJ found that APRIL continues to buy pulpwood from a supplier whose parent group has been accused by environmental groups of deforestation and wildlife habitat destruction, Korintiga Hutani.

Korintiga, a subsidiary of South Korean-Indonesian agribusiness conglomerate Korindo, used child labor in one of its concessions, according to a 2020 report by a third-party auditing firm. A later inspection found that the company had implemented a “monitoring system to ensure there is no violation of the minimum age regulation,” the report says. ICIJ found that KPMG did not mention the findings in the firm’s audits of APRIL, even though the pulp producer’s sustainability policy states that it does not tolerate child labor.

Korintiga Hutani did not respond to comment requests from ICIJ.

In response to questions from ICIJ, APRIL said that all of the company’s “suppliers remain subject to stringent and diligent compliance and monitoring processes,” and that it would look into “any cases of non-compliance that are brought to our knowledge regarding supply partners.”

KPMG’s spokesperson said that “as a certification, validation and verification body,” the firm’s “work is conducted under the rigorous oversight of independent accreditation bodies that act to ensure third party assurance requirements are implemented as intended.”

Phil Aikman, an analyst at the international environmental group Mighty Earth, said that for companies like APRIL, hiring environmental auditors is often just an exercise in “PR.”

Aikman said clients can control the scope of the audits, and auditors don’t have to provide evidence to support their conclusions. As a result, companies can “quite easily” get Big Four accounting firms to certify that they are meeting environmental standards and provide them with a “clean outcome,” Aikman said.

A final audit report remains “just a statement,” he said.

Power in the hands of the loggers

The Blueberry River First Nations’ 3,720-acre reserve lies in northern British Columbia, alongside the river whose name the Blueberry River community has adopted for its own. About 200 people live in houses by unpaved roads. Some residents have decorated storage sheds with moose antlers.

Sherry Dominic, the council member who testified against the province, lives on the reserve with her family. She is a great-granddaughter of the Blueberry River First Nations’ last “dreamer,” the elder who, in his dreams, made contact with animal spirits to pay respect before the start of the annual hunting season.

At the 2019 trial against the province, Dominic and other members of her family testified that for generations, the community, known locally as a “band,” harvested moose and caribou to eat as dried meat in the winter. But the animals, like the trees, started to disappear. Intensive logging and gas development have destroyed the Blueberry River First Nations’ territory, they said, effectively ending the band’s ability to hunt, harvest and pass on traditions to their children.

“A long time ago growing up, you could actually just drive down the road, not even half an hour, and then you could see a moose, shoot a moose or whatever, or you could go to areas, pick berries,” Dominic recalled. “Now you go out there, and there’s no trees anywhere.”

Her teenage son shot his first moose at the age of 10. But “in 20, 30 years time, when he has kids, how are they going to be able to practice our cultural way of life?”

After years of natural-resource exploitation, living standards on the reserve remain poor, she said. Mold and a lack of running water are chronic problems. Intensive logging has forced families further and further afield for trapping and berry picking.

In a 2021 ruling, the Supreme Court of British Columbia found that the government, by allowing private companies to exploit the territory so intensively, had infringed on the Blueberry River First Nations’ rights to their land and to the preservation of their traditions.

The forestry companies and KPMG were not defendants in the case, which hinged on the provincial government’s responsibilities to the Blueberry River First Nations. Writing for the high court, however, Justice Emily Burke said the province had improperly delegated to the logging companies “much of the power regarding what cutblocks to harvest, how and when.” A cutblock is an area within which a license holder is authorized to harvest timber.

At the trial, Canfor’s forest planning manager, Peter Baird, testified that the company was following rules and regulations designed by the government. He added that if change was to be made, the province needed to provide that direction via legal regulation or legal effect, according to the ruling.

Two Canfor sawmills south of Fort St. John turn wood from Blueberry River First Nations’ territory and surrounding areas into pulp and wood chips. An ICIJ review of trade records found that the company sells some of what it produces to Chinese firms that make packaging boxes. Some of it ends up on Home Depot shelves in Canada and the U.S.

KPMG has certified the company’s forest management, sawmills and chip plants in the area as “sustainable.” Canfor cites the certification in its annual report as proof of its commitment “to the responsible stewardship of the environment throughout its operations.”

A separate KPMG unit audits Canfor’s financial statements. It was paid more than $3 million for that service in 2020 and 2021, according to corporate filings.

Both spokespeople for the FSC and SFI, the two certification standard organizations that include KPMG among their accredited certifiers, said that the firm’s financial auditing unit and the environmental auditing units are separate and independent from each other.

However, some experts interviewed by ICIJ said that KPMG’s dual role – as Canfor’s financial auditor and forestry auditor – raises questions about a possible conflict of interest.

The problem is that there are no legally binding rules on auditing companies’ sustainability claims, said David P. Weber, who teaches forensic accounting at Salisbury University in Maryland.

“This is the new frontier of accounting and where the money is,” said Weber, a former chief investigator for the U.S. Securities and Exchange Commission. “It’s the Wild West.”

Business as usual

In recent years, other major players in the financial sector – banks, insurers and private equity firms – have come under scrutiny for financing businesses accused of harming the environment. Activists from Jakarta to Belfast to Los Angeles have taken to the streets to protest banks’ financing of companies engaged in deforestation. Regulators in Europe, the U.S. and major financial centers like Singapore have proposed or issued rules requiring many publicly traded companies to disclose the extent to which their operations contribute to climate change.

Accounting and auditing firms, meanwhile, have escaped such oversight, even when clients flagrantly violate environmental laws.

While KPMG’s environmental advisory and auditing services expanded in the last decade, a large part of the firm’s revenue still comes from its traditional financial auditing — which generated about $12 billion in fiscal 2022.

ICIJ found that KPMG’s financial auditing unit has continued to provide services to companies accused of environmental abuses, including clearing unspoiled forests that are an essential resource in the race against global warming.

Leaked confidential financial documents from ICIJ’s 2021 Pandora Papers investigation, as well as corporate financial filings and court records, show that KPMG’s financial auditing clients included three Malaysian forestry companies with sullied environmental histories. The companies have been accused repeatedly of deforestation, violation of indigenous rights and exploiting political connections to obtain logging licenses.

The allegations against two of the companies, Samling Corp. and Ta Ann Holdings Berhad, became so serious that, between 2010 and 2013, the Norwegian Government Pension Fund, one of the world’s largest funds, divested from the companies “based on an assessment of the risk of severe environmental damage.” The companies have denied wrongdoing.

Samling’s environmental record is controversial both at home and abroad. Sam Lawson, who heads the environmental investigation nonprofit group Earthsight, visited an area in southern Malaysia logged by Samling in 2009 and found a “post-apocalyptic” landscape. It was “a total wasteland of mud and destruction,” he said in an interview.

Samling’s subsidiary in Guyana was fined $474,000 in 2007 for bribing forestry officials and illegal logging. In Papua New Guinea, in 2011, a court ordered a company originally set up by one of Samling’s founders to pay nearly $100 million to four tribes that had sued it for destroying their forests. The company was dissolved and never paid the fine, according to a 2020 investigation by the news site Sarawak Report. Samling has denied having any links to the Papua New Guinea entity.

KPMG served as financial auditor for companies in the Samling group for more than a decade,even after the Norwegian fund blacklisted Samling for its environmental record, public filings show.

The firm continued to work as a tax consultant for Samling at least through 2021, according to Samling’s website, despite continuous allegations of deforestation and land grabbing, which Samling has denied.

The company did not respond to comment requests from ICIJ. But, in response to an earlier investigation by ICIJ’s media partner Malaysiakini, Samling’s Chief Operating Officer James Ho Yam Kuan said that both the governments of Guyana and the Malaysian province of Sarawak have disputed the deforestation allegations against Samling that led the Norwegian fund to divest from the company.

KPMG’s financial auditing unit also worked for Egger, an Austrian forestry company that allegedly bought timber from Romanian suppliers suspected of illegal logging. Egger said that, while authorities searched thousands of files belonging to its Romanian subsidiary, the firm itself is not a defendant in the pending legal case.

Experts wonder at what point should financial auditing firms be obliged to drop clients accused of environmental wrongdoing.

“What you can justifiably ask is the question: ‘Why are the Big Four still advising people who are doing things which are really helping to destroy the planet?’” said Yvo de Boer, a former executive secretary of the U.N. Framework Convention on Climate Change. De Boer worked as a special adviser for KPMG’s sustainability advisory services.

Other accounting giants have provided services to businesses embroiled in disputes over alleged environmental abuses. Ernst & Young (EY) is the auditing firm for a Chinese palm-oil trader that cut ties to an international body requiring members to submit deforestation reports. Deloitte represented a politically connected Malaysian forestry company blacklisted by the Norwegian pension fund over deforestation allegations.

These accounting firms advertise green advisory services and promise clients to help them create a “sustainable future.”

EY and Deloitte did not respond to comment requests from ICIJ.

‘There are no trees’

From the sky, the Blueberry River First Nations territory is now a patchwork of denuded cutblocks and gas wells. Aerial footage shot in late 2021 by ICIJ’s media partner in Canada, CBC, shows a vast expanse of what was once forestland and is now bare earth with only a few bushes standing. Dozens of logs lay on a barren hill, ready for transport to nearby mills.

Though the court suspended the approval of new permits, some previously approved logging continues on the band’s territory, said Maegen Giltrow, the lawyer who represented the Indigenous community.

Driving with her family to nearby Alberta province to a moose-hunting camp, Dominic, the Blueberry River council member, recalled many childhood excursions in the woods with her elders. She said those don’t make sense anymore.

“When my parents and my great grandparents grew up, they spent time” in the forest, Dominic said. “But now you go out there, and there are no trees, just cutblocks everywhere.”