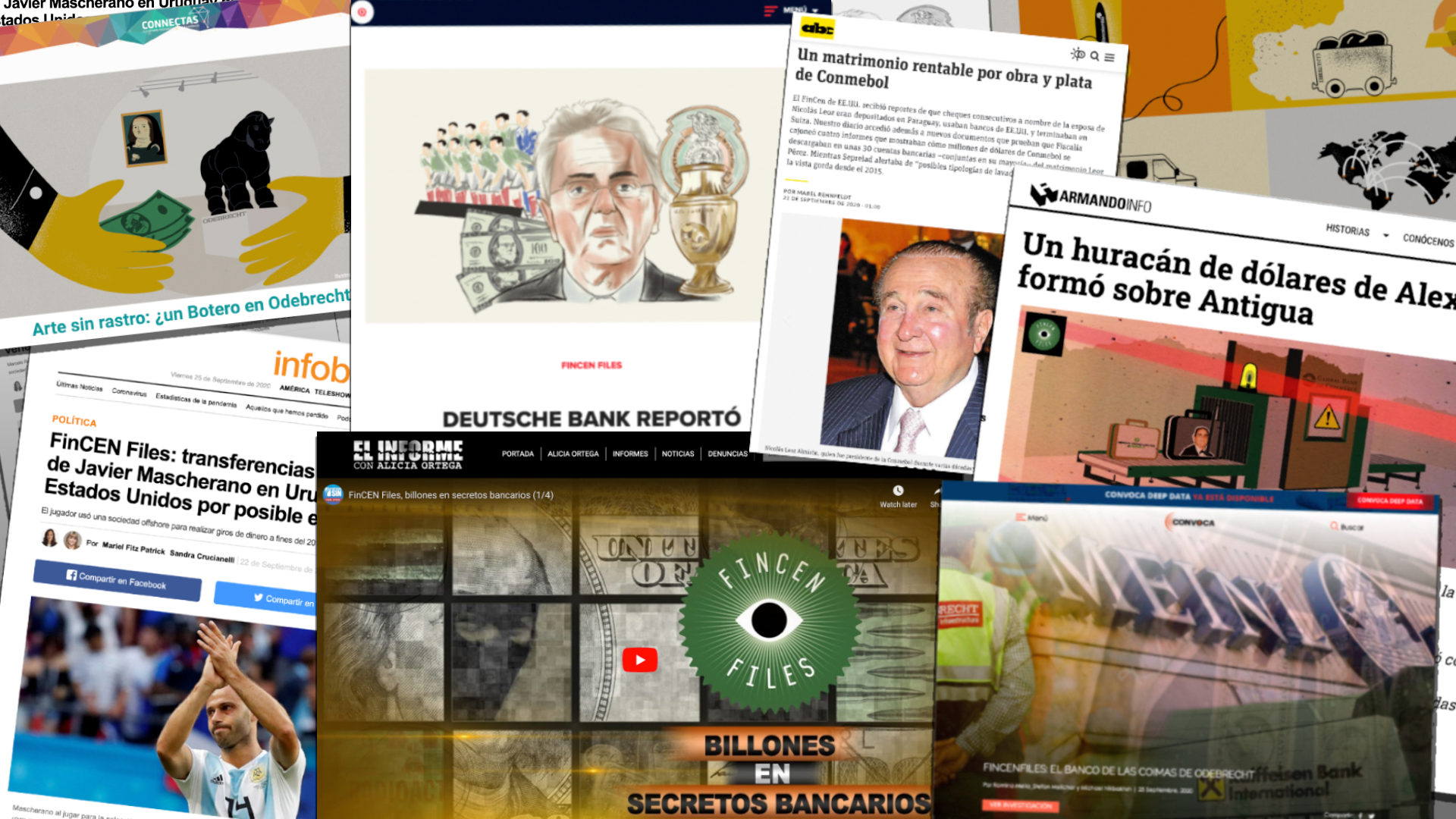

Soccer stars and FIFA officials, gold dealers with checkered pasts and politically connected tycoons suspected of ripping off food and housing programs for the poor were among the gallery of wealthy subjects whose banking secrets were exposed by the FinCEN Files.

The investigation landed with a bang in Latin America, revealing questionable payments that flowed freely for nearly two decades through banks across the region.

The global collaboration, led by the International Consortium of Investigative Journalists and based on a trove of secret bank reports obtained by BuzzFeed News, included 72 journalists in 13 countries in Latin America.

Below are some of the key findings from the ICIJ team’s work in the region.

Soccer and corruption

Soccer is king in the world of Latin American sports, and the FinCEN Files revealed the lucrative industry’s underside in countries across the region.

In Argentina, soccer star Javier Mascherano, who was the captain of the national team from 2008 to 2011, was flagged by banks for more than $1 million in transactions by his British Virgin Islands-registered company, Alenda Investments Ltd. The payments raised suspicions of possible tax evasion, reported ICIJ’s partners at Infobae, La Nación and Perfil.

In Paraguay, a blockbuster story shed light on a scandal that embroiled soccer’s continental governing body Conmebol, the South American division of FIFA. A 2015 report by Deutsche Bank found suspicious payments by María Clemencia Pérez de Leoz, the wife of the late Conmebol president, Nicolás Leoz, revealed ICIJ’s partners at ABC Color.

Nicolás Leoz was indicted by the U.S. Justice Department and banned from FIFA in 2015 for his role in the massive ‘FIFAgate’ bribery scandal.

In Mexico, the money trail from the FIFAgate scandal also raised alarms at Deutsche Bank. The bank flagged more than $13 million in suspicious payments involving the Mexican soccer federation, Femexfut. The recipients of those payments included 11 people and two companies who were charged by the U.S. in connection with FIFAgate, ICIJ’s partners at Mexicanos Contra la Corrupción reported.

Odebrecht

In 2016, the U.S. Justice Department described the Brazilian construction giant Odebrecht’s cash-for-contracts corruption scheme as the “largest foreign bribery case in history.”

Payments linked to Odebrecht’s bribery operation, which paid off public officials to award Odebrecht with public works contracts, were reported in several countries in the FinCEN Files.

In Colombia, an offshore company that was used in Odebrecht’s scheme made a payment of $500,000 to the renowned artist Fernando Botero. Botero was not under any kind of investigation, but the payment appeared to indicate the purchase of a work of art, citing dimensions and a gallery in Colombia, ICIJ’s partners at Connectas and El Espectador reported.

In the Dominican Republic, payments to another offshore company linked to Odebrecht’s bribery scheme raised alarms at Standard Chartered Bank. The transfers came from construction firm Ingeniería Estrella, which partnered with Odebrecht in the construction of a massive coal-fired power plant, found ICIJ’s partners at El Informe.

Venezuela’s “boligarchs”

Venezuelan tycoons who made fortunes in business dealings with the governments of Hugo Chávez and Nicolás Maduro have become known as the “boligarchs” – an ironic reference to South American independence hero Simón Bolívar, who Chávez invoked as the inspiration for his political movement.

These magnates’ banking activities raised suspicions in countries across the Americas.

In Venezuela, the FinCEN Files revealed new details about Alex Saab, a close Maduro ally who the U.S. sanctioned in 2019 for “orchestrating a vast corruption network” that enriched himself and Maduro using overvalued contracts to import food aid for the poor. Banks reported Saab to U.S. authorities starting in 2016 for transactions from the Global Bank of Commerce in Antigua, revealed ICIJ’s partners at Armando.info.

In Argentina, a fugitive Argentine lawyer was employed by Venezuelan construction mogul Alejandro Ceballos Jiménez to serve as a frontman for an offshore company in London. Ceballos used the company, Sarleaf Limited, to send millions of dollars in public housing contracts to recipients including his family members, reported ICIJ’s partners at Infobae, La Nación and Perfil.

In the United States, Ceballos owns a multimillion dollar home and a horse-racing stable in South Florida, but has flown under the radar and avoided sanctions from U.S. authorities, ICIJ’s partners at the Miami Herald found.

Ceballos and the “boligarchs” were also the subject of an ICIJ FinCEN Files investigation.

Tarnished gold

The dark side of the gold industry, which has been linked to illegal mining and money laundering for drug cartels, was dragged into the light in the FinCEN Files.

In Peru, the Miami-based gold dealer Kaloti Metals & Logistics bought gold from Peruvian companies whose owners were investigated by Peruvian authorities for alleged money laundering and illegal mining. The payments raised red flags at banks including JPMorgan Chase, reported ICIJ’s partners at Convoca.

In Colombia, banks reported suspicious transactions involving two exporters for the gold dealer CIJ Gutierrez, one of the largest gold sellers in the country. Colombian prosecutors have alleged that individuals associated with CIJ Gutierrez were involved in money laundering and that the company had business dealings with shell companies linked to paramilitaries and family members of drug traffickers, ICIJ’s partners at El Espectador and Connectas found.

The gold industry was the subject of a global ICIJ FinCEN Files investigation, which revealed that the U.S. Treasury Department abandoned a major money laundering case against the Dubai gold company Kaloti Jewellery Group.