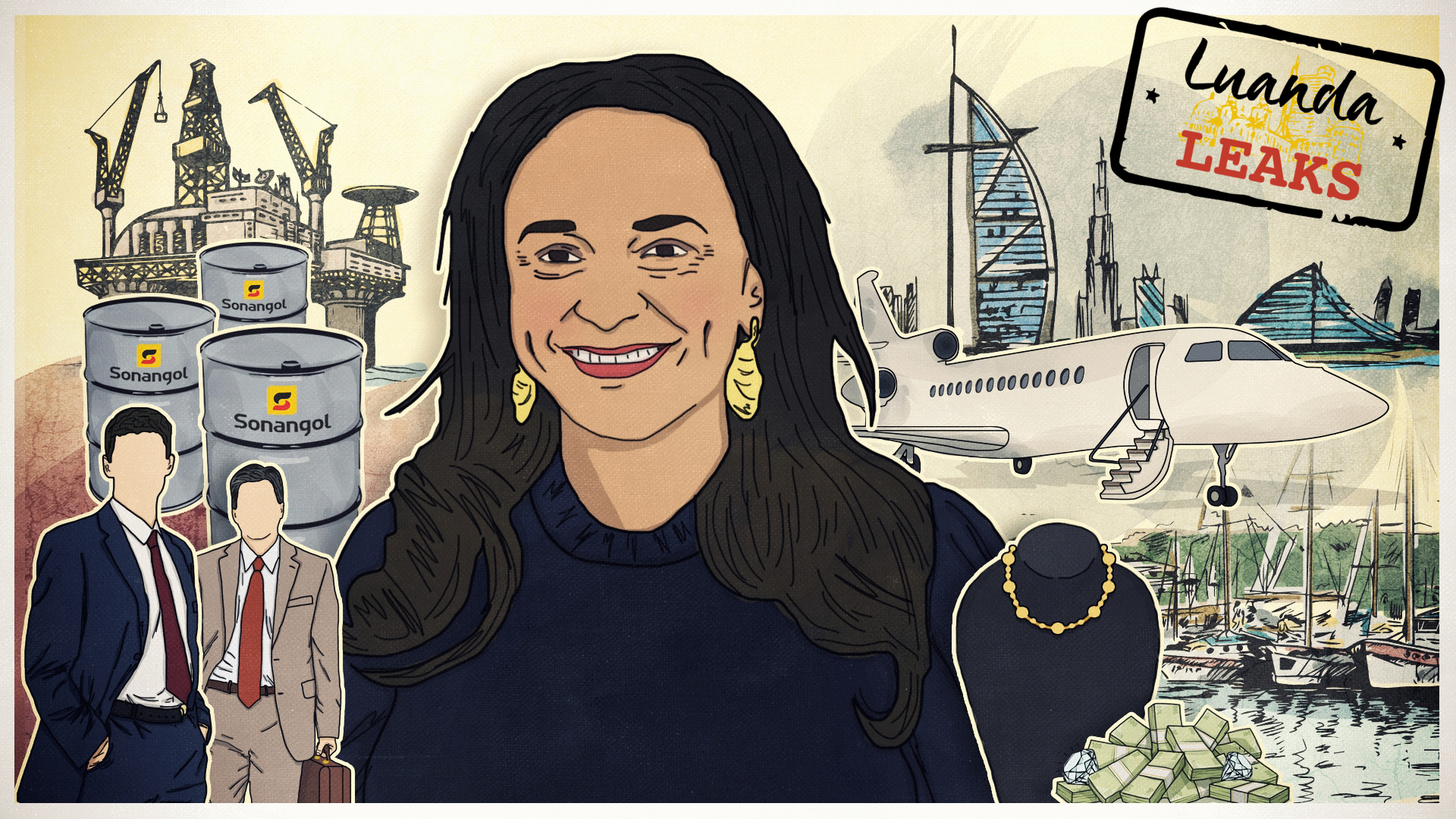

LUANDA LEAKS

Banking documents reveal consulting giants’ cash windfall under Angolan billionaire Isabel dos Santos

Boston Consulting Group, PwC, and McKinsey made tens of millions from a project to modernize state-owned oil company Sonangol, despite red flags indicating corruption.

Three of the world’s largest consulting firms received tens of millions of dollars in payments from an obscure firm in Dubai to help restructure Angola’s corruption-ridden oil sector, according to documents that reveal new details about suspicious money flows described in the globe-spanning Luanda Leaks investigation.

The Dubai firm, Matter Business Solutions, forwarded $31.2 million to Boston Consulting Group, $21.4 to PwC and $15.4 million to McKinsey as part of a 2017 project to modernize Sonangol, Angola’s state-owned oil company, according to bank statements and other documents seen by the Portuguese news outlets Expresso and SIC.

Billionaire Isabel dos Santos, the daughter of Angola’s long-time autocratic ruler, was Sonangol’s chief executive at the time of the payments. Last year, as part of Luanda Leaks, journalists revealed that the Dubai company was owned by a personal friend of dos Santos. The new documents provide a fuller picture of how Western advisors profited from the transfers, which are now under investigation in Angola.

Expresso and SIC were central members of Luanda Leaks, which revealed how secretive deals turned dos Santos into a billionaire and globetrotting bigwig under the presidency of her authoritarian father.

PwC and Boston Consulting were deeply enmeshed in dos Santos’ business affairs, the reporting showed. They retained those relationships long after many Western banks had cut her off amid questions about the source of her wealth. Boston Consulting helped run a failing jewelry business acquired with Angolan money; PwC suggested ways to avoid Angolan taxes and its accountants disregarded red flags about money movements between dos Santos entities that experts say should have raised alarms.

The Sonangol payments, by way of the Dubai shell company, highlight ongoing concerns about lax due diligence standards by consulting giants and light-touch regulations that allow foreign advisors to amass huge profits — no matter the money’s origin.

“Consulting firms, like other private sector players, should identify who owns the entities they work with,” said Alexandra Gillies, an expert on corruption in the oil sector with the Natural Resources Governance Institute. “In this case, the owner was not only a close associate of a senior public official, but that official had a clear ability to influence the business in question, creating a conflict of interest. Those are some pretty major red flags for firms of this caliber to ignore.”

Responding to the new documents, PwC’s Lisbon office told Expresso that the company ended its relationship with companies linked to dos Santos in January 2020. Two Lisbon-based employees were dismissed following a “comprehensive internal investigation,” it said.

McKinsey told Expresso that it made “internal inquiries” after the Luanda Leaks investigation but “did not detect any irregularity on the part of the team involved.” McKinsey said that it provided services to institutions, not individuals. Its relationship with Sonangol predated dos Santos’ time as chair, the company said.

BCG said it was “not appropriate” to comment given ongoing “investigations regarding allegations against Isabel dos Santos.”

Millions go to friends’ consulting firms

The new financial records reveal that Sonangol first transferred funds to Matter Business Solutions’ bank account at NBD Emirates in Dubai. Funds were then sent to banks in Portugal and Spain for PwC, Boston Consulting Group and McKinsey, Expresso reported. Matter’s shareholder was Paula Cristina Fidalgo Carvalho das Neves Oliveira, a close ally of dos Santos.

Other lucrative wires from Sonangol to Matter landed in the bank accounts of a law firm and lesser-known consultancy companies, including one partly owned by the wife of dos Santos’ personal financial advisor, the news organizations reported. The payments were for services provided by the firms as part of a dos Santos-led restructuring of Sonangol, though it isn’t clear what services the firms provided in exchange.

Another $31.5 million in Sonangol funds remain unaccounted for after leaving Dubai, according to Expresso.

Following dos Santos’ dismissal in 2017, Sonangol’s new chairman, Carlos Saturnino publicly announced that dos Santos had mismanaged the company and approved more than $135 million in consulting fees, with most going first to her friend’s consulting company. Saturnino recently told ICIJ that he was unable to comment further.

Last January, shortly after publication of the Luanda Leaks investigation, Angola’s attorney general charged dos Santos with embezzlement and money laundering related to her time at the oil company.

Dos Santos and Oliveira deny wrongdoing. The billionaire previously said that payments to Matter Business Solutions were for legitimate services that consultants had delivered. She had no connection to the firm, dos Santos said.

Oliveira denied being “anyone’s frontwoman” and told Expresso and SIC that Matter Business Solutions provided legitimate business services. “The insinuation that the services that were invoiced by Matter to Sonangol were not rendered is not only insulting” but “deeply false,” Oliveira told Expresso.

As part of the Luanda Leaks investigation, ICIJ revealed that Boston Consulting received more than $3.5 million from a Maltese firm co-owned by dos Santos as part of a contract to restructure Sonangol just before the daughter of the then-president of the country was appointed head of the oil state company in 2016. PwC was paid $273,000 by the same dos Santos Maltese firm for services to the oil giant, according to documents provided to ICIJ by the Platform to Protect Whistleblowers in Africa, or PPLAAF, a Paris-based advocacy group. It’s unclear if the newly discovered payments are in addition to ICIJ’s previous reporting.

Beyond their work for Sonangol, ICIJ also revealed that PwC and Boston Consulting Group made millions from 2010 to 2017 working for other companies owned or partly owned by dos Santos and her husband Sindika Dokolo, who died in 2020. PwC played the biggest role in the dos Santos empire, providing accounting and auditing services to companies linked to dos Santos and her husband in Malta, Switzerland and the Netherlands.

“It is very worrying that those that are supposed to be the gatekeepers of the financial sector seem to be – in the best case scenario – asleep on the job,” said Maíra Martini, an anti-money laundering expert with Transparency International. “In this particular case, from the banks involved to the lawyers and accountants – they all seem to have missed important red flags,” Martini said.

From the $131 million paid first to Matter Business Solutions and then routed onwards, Expresso reported that two companies owned by dos Santos received $1.9 million combined. Another $3.4 million went to Youcall, a human resources firm whose shareholders include dos Santos and her friend, Oliveira, Expresso reported. Other firms in which Oliveira was the only shareholder received almost $3 million, according to the newspaper.

Odka, a consulting firm in the tax haven island of Madeira, received $11.5 million to provide Sonangol with management software, according to Expresso. Almost half of that company is owned by the wife of Mário Leite da Silva, dos Santos’ primary business advisor. In late 2019, the Angolan government named da Silva in a freezing order that alleged dos Santos, her late husband and da Silva caused Angola to lose $1 billion in poorly managed business deals. Last year, following the Luanda Leaks investigation, a court in the Netherlands removed da Silva from the board of Dutch holding company pending the outcome of an investigation into an energy deal between Sonangol and Dokolo, dos Santos’ late husband.

Da Silva told Expresso and SIC that there was nothing improper with Sonangol hiring Matter Business Solutions and that Angola’s oil company “gained a lot” from the relationship.

Odka’s director, Carlos Russo, told Expresso that the company “has a team, a history of successful projects and a set of skills that positively differentiated it and, we believe, made us the right entity for the job.”