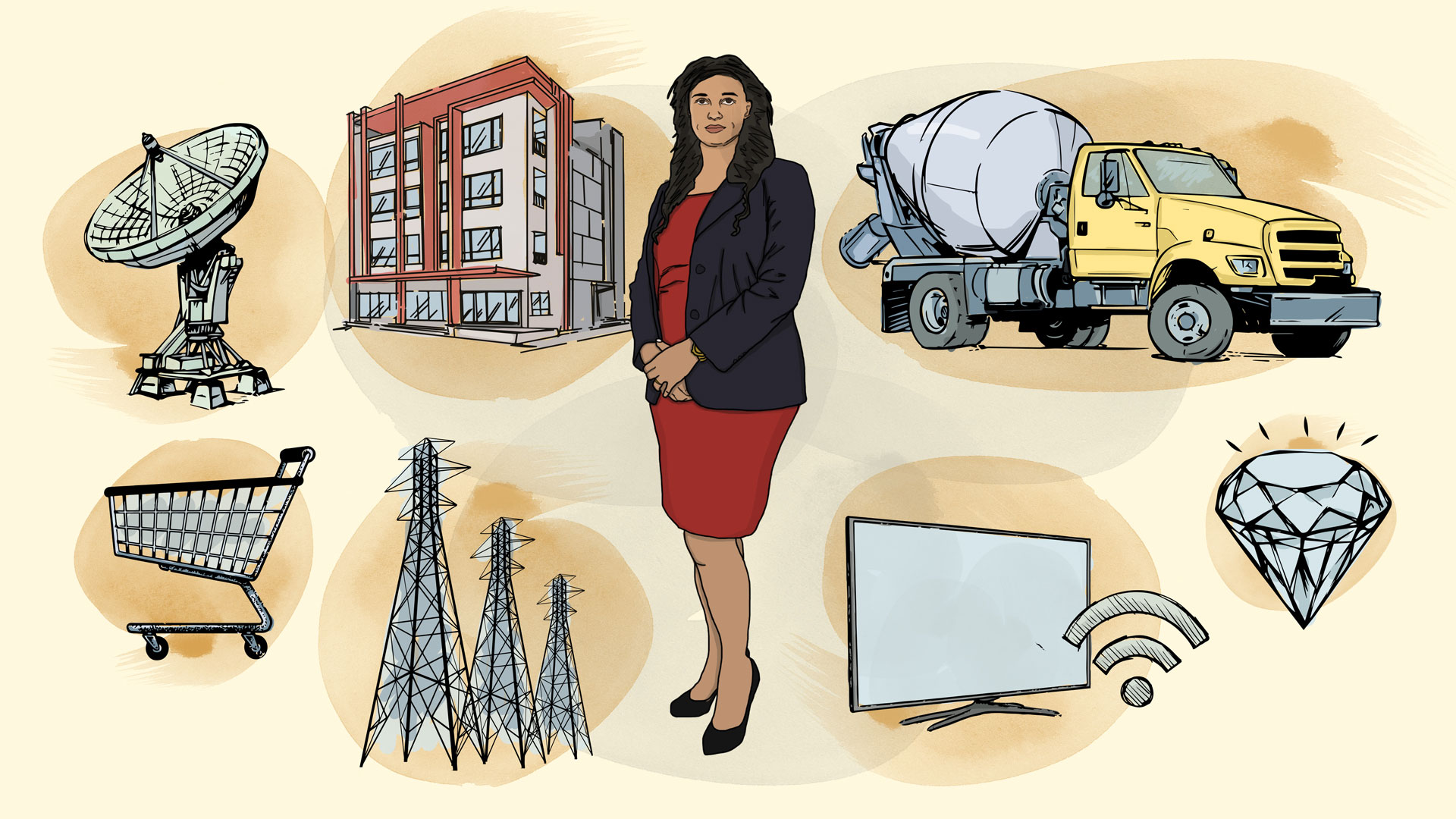

Embattled businesswoman Isabel dos Santos has lost joint control of NOS, Portugal’s $1.82 billion leader in the so-called ‘quad play’ market of internet, TV, fixed and mobile telephony.

In a flurry of statements to the Portuguese stock exchange last week, the Angolan billionaire’s business partner, Sonaecom, announced an agreement to dissolve ZOPT, their 50-50 joint venture, which owned 52% of NOS shares.

According to local media, minutes after Sonaecom announced the dissolution of ZOPT, it then informed the stock exchange that it had purchased a bloc of shares from Banco BPI, taking its ownership to 33.45%, making it the biggest shareholder.

Previously, Sonaecom and dos Santos had held a majority shareholding in NOS through ZOPT, with two equal stakes of 26% each. Dos Santos held her stake indirectly through two entities – Dutch shell company Unitel International Holdings BV and Malta-registered Kento Holding Limited.

“Once the referred sharing is completed, NOS will no longer be under the joint control of Sonaecom and Eng. Isabel dos Santos as controlling shareholder of Unitel International Holdings, BV and Kento Holding Limited,” Sonaecom confirmed to the stock exchange.

In April, Lisbon’s Central Criminal Investigation Court seized the 26% NOS share capital controlled by dos Santos. The order extended to future dividend payments and voting rights.

At the time, Sonaecom criticized the ruling on the basis of the collateral damage it said it would inflict on the company. The dos Santos entities also vowed to fight the order.

The court order was prompted by Angola’s attempts to recover an estimated $1 billion in public money it alleges dos Santos and her associates siphoned from the country during her father’s 38-year rule, which ended in 2017.

Angolan authorities also allege misappropriation of funds during her time as chair of the state-owned oil company Sonangol.

Dos Santos has consistently and repeatedly denied any wrongdoing.

Her sprawling business portfolio has contracted rapidly since the publication of Luanda Leaks, an investigation led by the International Consortium of Investigative Journalists (ICIJ), detailing decades of unscrupulous deals in one of the world’s poorest countries.

Key individuals close to dos Santos held NOS directorships. One of her lawyers, Jorge Brito Pereira, resigned as chairman in the wake of the publication of Luanda Leaks as did a key business associate, Mário Leite da Silva, and her friend, Paula Oliveira. Both were named in connection with several controversial offshore transactions.

The Lisbon court’s seizures also extend to her sizable shareholdings in Eurobic bank and an engineering conglomerate, Efacec.

In June, Spanish bank Abanca pulled out of its purchase of Eurobic at the last minute, citing differences in valuation after it had completed pre-sale due diligence. In July, Portugal announced it would nationalize and sell her majority stake in Efacec.

Dos Santos also holds an indirect stake in the Portuguese energy giant Galp Energia.

A London-based dos Santos spokesperson said she had “no further comment to the public (and regulatory) statements already made.”