The first person arrested in the United States in relation to the Panama Papers has pleaded not guilty before a New York court, according to recently-released records that provide new details on the case and the long road ahead.

Richard Gaffey, a Massachusetts accountant, faced the District Court for the Southern District of New York on Dec. 17.

U.S. officials arrested Gaffey on Dec 4. He is one of four men charged with a range of offenses, including conspiracy to commit tax evasion and money laundering, wire fraud and failing to file tax returns.

Prosecutors allege that Gaffey helped former U.S. resident Joachim von der Goltz evade taxes.

“Not guilty, your Honor,” Gaffey told Judge Richard M. Berman in New York, according to court transcripts obtained by the International Consortium of Investigative Journalists.

The Department of Justice and Gaffey’s lawyers met with the judge to plan for the upcoming trial.

Things may take time, U.S. Attorney Sarah E. Paul told the court. In addition to classified materials, she said, “the volume of the unclassified discovery is substantial.”

“It’s probably between 500 gigabytes and one terabyte,” said Paul, including subpoenaed documents, documents obtained during a raid on Gaffey’s accounting firm and international material.

A team of U.S. attorneys is reviewing documents to exclude anything that would breach client-lawyer confidentiality, also known as privilege.

Buzzfeed reporter Jason Leopold previously tweeted that the Department of Justice established a similar “filter team” within the department to analyze the Panama Papers documents following the publication of the cross-border investigation in April 2016.

The DoJ has not publicly confirmed what documents from the Panama Papers it does or does not have.

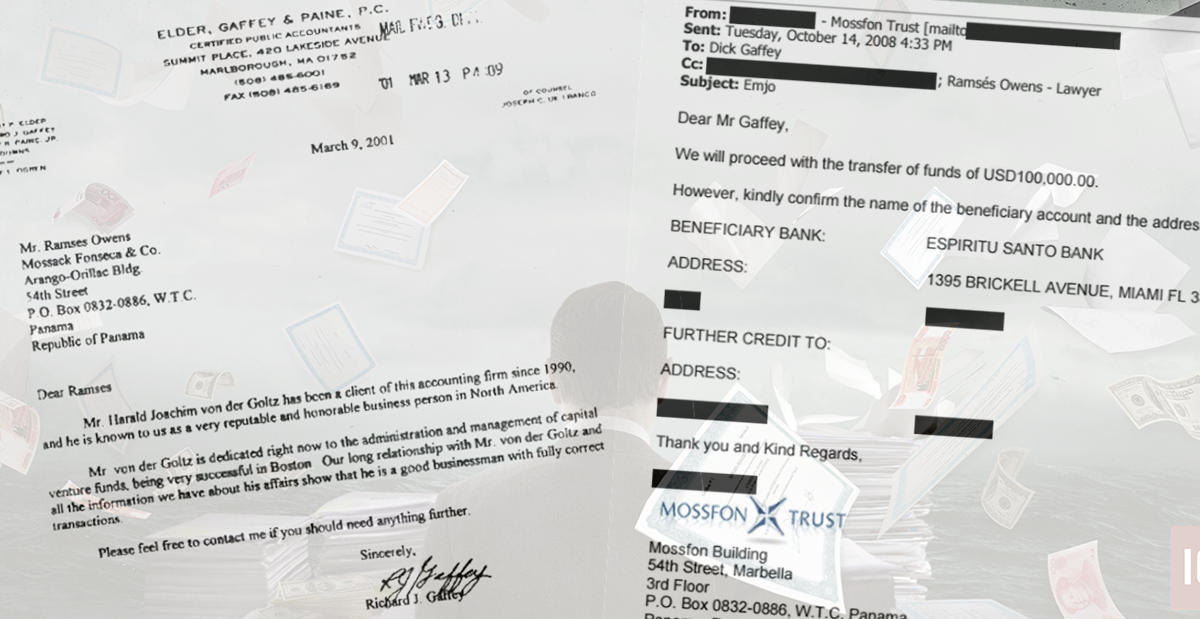

Documents analyzed by the International Consortium of Investigative Journalists from the Panama Papers include discussions about payments to Columbia University in New York City and other emails, letters, and invoices involving Gaffey, Von der Goltz, and others.

Von der Goltz “is known to us as a very reputable and honorable business person in North America,” Gaffey wrote to offshore lawyers, Mossack Fonseca, in 2001.

In another 2008 email, Gaffey tells a Mossack Fonseca lawyer that Erika von der Goltz, von der Goltz’s mother, wished to make a $100,000 gift into a Miami bank account.

“Ohh, yes, I know ERIKA wants it to be done quickly, we will proceed,” offshore lawyer Ramses Owens responded to Gaffey. Owens was also named in the recent charges laid by U.S. officials.

In a subsequent internal email to a colleague who wished to confirm the identity of ultimate beneficiary of the transfer, Owens wrote that “effectively, it means HARALD JOACHIM VON DER GOLTZ.” (Read the email chain)

U.S. prosecutors allege Gaffey, von der Goltz and others falsely claimed Erika von der Goltz, who is from Guatemala and now 102, owned offshore companies and bank accounts that belonged to her son.

Prosecutors allege Gaffey and von der Goltz made a series of money transfers described as gifts from Erika von der Goltz, which would be “a non-taxable gift from a foreign person.”

They also claim that the payments were “a transfer of von der Goltz’s own money to one of his personal domestic bank accounts.” Von der Goltz previously told ICIJ’s reporting partner, The New York Times, that the offshore companies complied with U.S. tax laws and never engaged in illegal activity.

U.S. Attorney Paul told the court that her office was waiting for further information from German authorities and from Rothschild Bank. Finally, Paul revealed that they were seeking the extradition of two of Gaffey’s co-defendants who were arrested in December.

Von der Goltz was arrested in London and Dirk Brauer, a former investment manager, was arrested in Paris.

Brauer previously worked for the offshore law firm Mossack Fonseca, whose 11.5 million leaked documents formed the basis of the 2016 Panama Papers investigation.

U.S. authorities charged Von der Goltz, Brauer and another former Mossack Fonseca employee, Ramses Owens, with conspiracy to commit tax evasion and money laundering.

Brauer helped U.S. clients evade taxes for years in what prosecutors called a “decades-long criminal scheme,” U.S. prosecutors alleged at the time.

“For decades, the defendants, employees and a client of global law firm Mossack Fonseca allegedly shuffled millions of dollars through offshore accounts and created shell companies to hide fortunes,” said U.S. Attorney Geoffrey S. Berman.