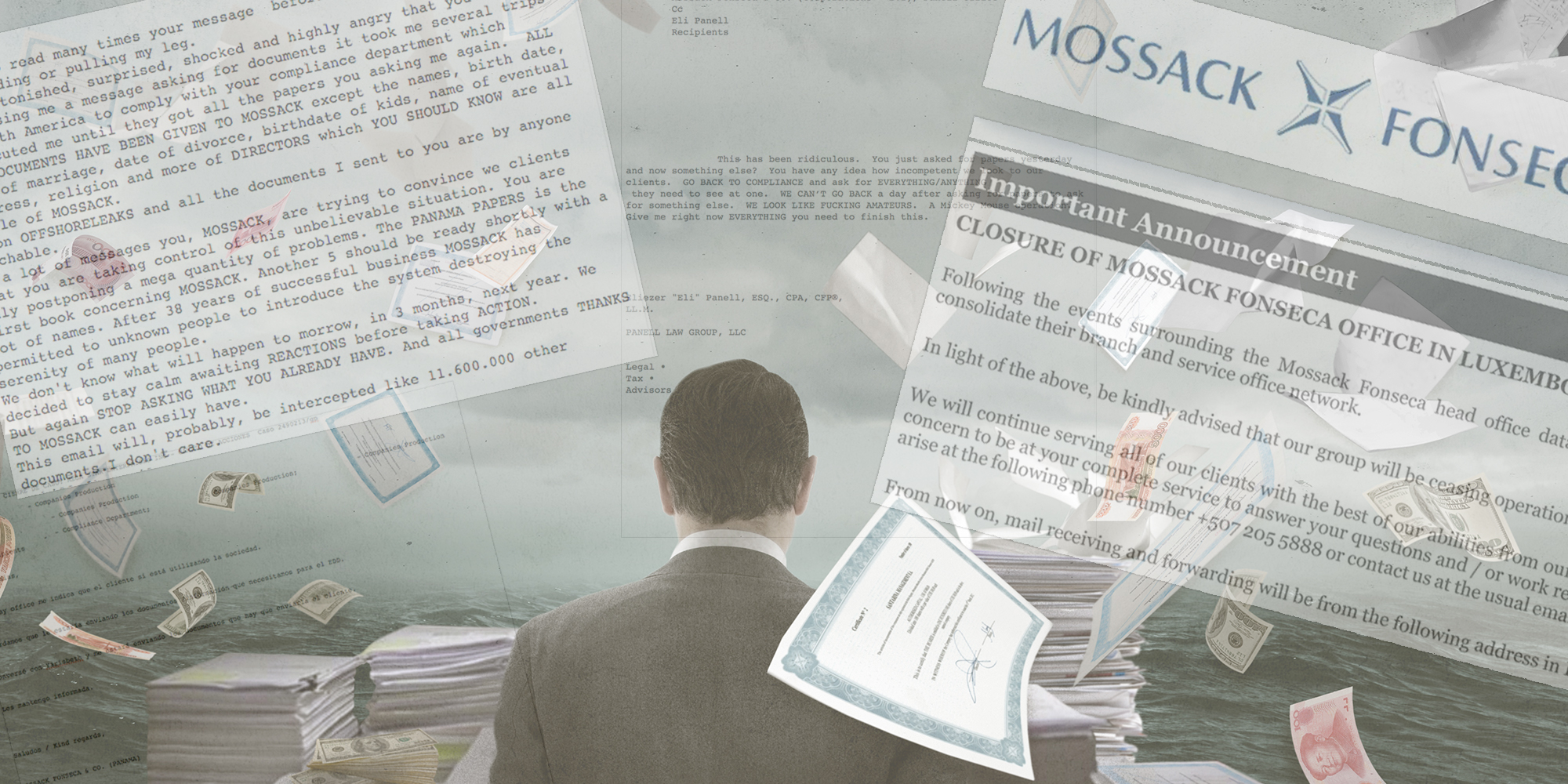

United States authorities have charged four men, including two former Mossack Fonseca employees, with money laundering and fraud, the Department of Justice announced today.

The charges are the first in the U.S. following the Panama Papers investigation, which was first published in 2016 by the International Consortium of Investigative Journalists, Süddeutsche Zeitung and more than 100 global media partners.

Ramses Owens and Dirk Brauer, two former senior employees of the Panama-headquartered law firm, were charged with a string of offenses “in connection with their alleged roles in a decades-long criminal scheme,” the DOJ said in a statement.

Authorities also charged Boston-based accountant Richard Gaffey, and former U.S. taxpayer Harald Joachim Von Der Goltz with tax evasion, wire fraud and money laundering.

A statement from the DOJ alleges that the four men “defrauded the U.S. government through a large scale, intercontinental money laundering and wire fraud scheme.”

“These defendants went to extraordinary lengths to circumvent U.S. tax laws in order to maintain their wealth and the wealth of their clients,” said U.S. Attorney Geoffrey S. Berman.

“For decades, the defendants, employees and a client of global law firm Mossack Fonseca, allegedly shuffled millions of dollars through offshore accounts and created shell companies to hide fortunes.”

U.S. authorities partnered with enforcement agencies around the world to arrest Brauer in Paris, France, and Von Der Goltz in London, United Kingdom. Gaffey was arrested in Boston on Tuesday. Panamanian citizen Owens remains at large.

“These efforts reflect the commitment of U.S. law enforcement to follow that trail and apprehend these criminals regardless of where they are in the world.”

The men are presumed innocent until proven guilty.

According to the DOJ, Mossack Fonseca employees deliberately created bank accounts in tax havens to hinder enforcement investigations and advised U.S. taxpayers to secretly repatriate money. The names of the real owners of shell companies “generally did not appear” on offshore company paperwork.

The Panama Papers investigation was based on a trove of 11.5 million files from inside Mossack Fonseca that were leaked to reporters Bastian Obermayer and Frederik Obermaier at German newspaper Süddeutsche Zeitung, and shared with ICIJ. The investigation, done in collaboration with more than 370 reporters working for 100 media outlets, exposed the offshore holdings of world political leaders, links to global scandals, and details of the hidden financial dealings of fraudsters, drug traffickers, billionaires, celebrities, sports stars and more.

German-born Von Der Goltz, who lived in the U.S. from 1984, allegedly evaded taxes through shell companies and offshore bank accounts.

The DOJ alleged that Von Der Goltz falsely claimed his mother, who lived in Guatemala and is now 102, owned companies and bank accounts. Von Der Goltz denied wrongdoing, according to a 2016 report from ICIJ media partner The New York Times.

Gaffey allegedly helped Von Der Goltz and another unnamed U.S. taxpayer evade taxes, the DOJ alleged.

“The charges announced today demonstrate our commitment to prosecute professionals who facilitate financial crime across international borders and the tax cheats who utilize their services,” said Assistant Attorney General Brian A. Benczkowski.