Leaked records involving a company at the center of a Deutsche Bank money laundering probe expose a global cadre of money makers.

The records concerning former Deutsche Bank subsidiary Regula Ltd. shine a light, too, on how one of the world’s largest banks helped shield the identities and machinations of the world’s rich and powerful.

German police and tax inspectors have raided the homes and offices of German citizens, bankers, accountants and tax advisers as part of a criminal investigation. Authorities allege that Regula helped more than 900 wealthy Germans evade taxes and hide money from government coffers.

This month’s raids come on the back of a November 2018 search of Deutsche Bank’s headquarters in Frankfurt.

Regula is what is known as a “nominee” or “dummy” company.

For a few hundred dollars a year, dummy companies like Regula that are offered by banks, law firms and boutique offshore specialists worldwide can appear on the paperwork of an offshore company as a director or shareholder. A company’s real owner does not appear on public records.

Nominee services are legal and widespread. Clients can choose such services to avoid unwanted publicity, for example. Nominees are especially popular with the global elite and with criminals who seek to obscure money from tax authorities or hide evidence of graft.

The International Consortium of Investigative Journalists first wrote about Regula in the 2013 Secrecy for Sale investigation, also known as the Offshore Leaks probe. It included details on how Deutsche Bank helped clients maintain hundreds of offshore companies. The nominee company appeared again in ICIJ’s Swiss Leaks, Panama Papers and Paradise Papers investigations.

Since the raids related to the investigation in Germany, ICIJ has re-examined files about Regula. There is no suggestion in those files that the individuals named below have broken any laws or otherwise engaged in wrongdoing through their association with the nominee company.

Offshore Leaks

Henry Sy, the Philippines’ richest man until his death earlier this year, was worth an estimated $19 billion.

The “Father of Philippine Retailing,” Sy created his country’s largest shopping mall company, SM Supermalls, with more than 60 shop-’til-you-drop venues.

Sy purchased Starzen Holding Ltd. in the British Virgin Islands in May 2007, according to documents from Offshore Leaks.

Sy transferred ownership to Regula on Jan. 7, 2008, months after acquiring it, according to the documents. Regula became the company’s sole director at the same time. Sy listed his address within an upscale gated community in the Filipino capital, Manila.

Representatives of the Sy family did not respond to requests for comment.

Swiss Leaks

Indian billionaire Harshad Ramniklal Mehta is the former chairman of Rosy Blue Group, a major diamond trader and supplier.

In 2011, Indian authorities investigated Mehta and companies for allegedly failing to declare offshore bank accounts in Liechtenstein, according to the Indian Express. India’s tax office also searched Mehta’s family companies as part of a probe into an account worth about $44.5 million held at HSBC in Switzerland.

Regula was one of several offshore companies and trusts used by Mehta and his extended family as part of a structure with HSBC Private Bank in Switzerland, according to internal files obtained as part of Swiss Leaks. Together, the family held accounts worth $63.6 million as of 2006-2007, according to documents.

Responding previously in 2016 to the Indian Express’ Panama Papers investigation, Mehta said that he was a non-resident for tax purposes based in the United Arab Emirates. Companies were not established offshore to avoid taxes but to benefit from ease of incorporation, legal systems and succession planning, Mehta said.

A spokesman for Rosy Blue told ICIJ that Mehta was not connected “in any way” to the company. Neither Rosy Blue not its subsidiaries are connected to Regula, Deutsche Bank or previous investigations into offshore companies and accounts, the spokesman said.

Panama Papers

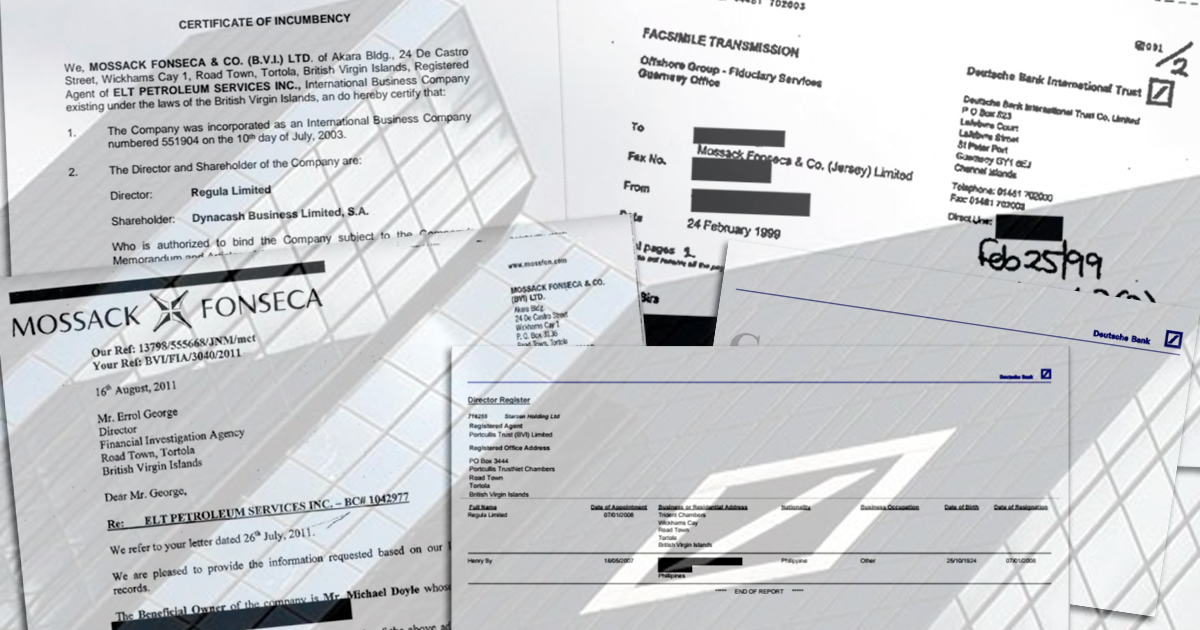

In July 2003, the Panamanian law firm Mossack Fonseca, whose leaked client files and other records became known in 2016 as the Panama Papers, helped establish the British Virgin Islands company Elt Petroleum Services Inc. and appointed Regula as the company’s nominee director. The company did business in Russia, according to a 2006 lawsuit.

In 2011, BVI government investigators specializing in financial crimes demanded documents on Elt Petroleum’s activities, according to a document from the Panama Papers.

Mossack Fonseca responded that its records showed the company’s owner and director was a man from Kent, England — not Regula. Today, that man’s address, as listed in the law firm’s files, puts him next to a pet shop.

Months later, however, an employee from a Moscow-based company told Mossack Fonseca that the British man was himself a nominee.

Paradise Papers

Count Federico Zichy-Thyssen, a German-born Argentine who died in 2014, was the nephew of minor European royalty and part of the family that founded steel giant Thyssen A.G.

On March 28, 2000, Zichy-Thyssen transferred his sole ownership of shares in the Cayman Islands company White Stallion Corp. to Regula, according to documents from the 2017 Paradise Papers investigation.

Years later, as an administrative query arose over the exact identity of White Stallion’s shareholder, an attorney from the law firm Appleby emailed that “Deutsche Bank (Cayman) Limited became [a] shareholder on 28 March 2000.” Regula had been used in the past “on behalf of Deutsche Bank,” wrote the attorney from Appleby, whose internal files formed the center of the Paradise Papers investigation.

The purpose of White Stallion Corp. is unclear, although Zichy-Thyssen was a prominent horseman. The count owned a horse-breeding farm in England in addition to a mansion in the Dominican Republic, a palace in Buenos Aires and a villa in Spain. His death sparked a messy and public family feud.

Zichy-Thyssen’s family could not be reached for comment.