A German businessman charged with tax evasion and money laundering offenses following the publication of the Panama Papers investigation will plead guilty in New York, federal prosecutors said.

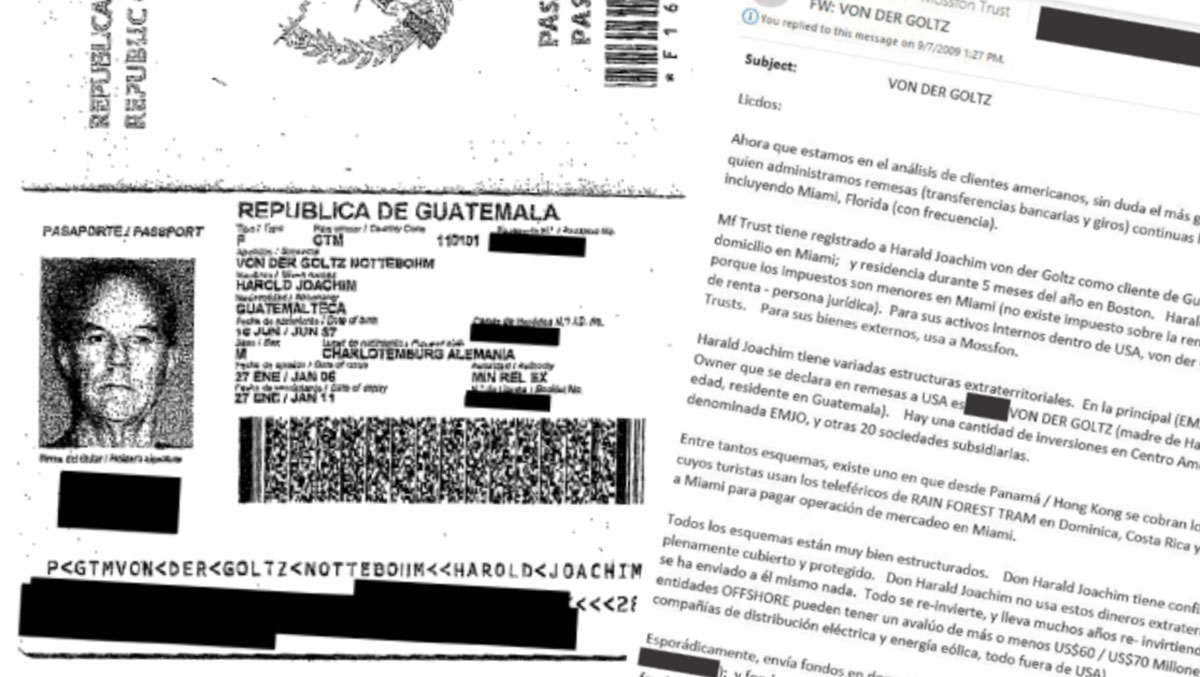

Harald Joachim von der Goltz, a former U.S. taxpayer, was indicted in December 2018 on charges that included wire fraud and making false statements as part of a “decades-long scheme to defraud the United States,” according to prosecutors.

Von der Goltz was a long-term client of the now-defunct Panama-founded law firm Mossack Fonseca. Prosecutors allege that von der Goltz, with the assistance of three other defendants, hid millions of dollars offshore, including through shell companies in Panama that he falsely claimed were owned by his centenarian mother in Guatemala.

As recently as December 2019, von der Goltz had denied wrongdoing. In filings made public last week, prosecutors did not specify the charge or charges to which von der Goltz will plead guilty. Von der Goltz’s lawyers will appear in court to change his plea on February 18.

“The simple failure of a U.S. taxpayer to disclose the existence of a foreign account is itself a serious violation of US law,” said Ross Delston, a Washington D.C.-based attorney and anti-money laundering specialist.

“Once the name of a potential violator surfaces, law enforcement can then fill in the details, thanks in large part to this treasure trove of intelligence called the Panama Papers.”

Prosecutors also charged von der Goltz’s former accountant, Richard Gaffey, and two former Mossack Fonseca employees, Dirk Brauer and Ramses Owens. Owens remains in Panama and U.S. prosecutors have labeled the offshore lawyer a “fugitive from justice.” The three men deny wrongdoing. The trial begins on March 9.

Von der Goltz is the first known U.S. taxpayer to plead guilty to criminal charges following the April 2016 publication of the Panama Papers investigation, coordinated and reported by the International Consortium of Investigative Journalists. The Panama Papers revealed how politicians, criminals and business titans hid assets, evaded taxes and facilitated bribes and arms deals through shadowy offshore companies.

Worldwide, countries from New Zealand to Argentina have recouped more than $1.2 billion in fines and unpaid taxes as a result of the disclosures. Prime ministers in Iceland and Pakistan were forced out of office and more than 6,500 people have been investigated as a result of the Panama Papers. The United States, like other governments, obtained documents from the Panama Papers through official channels, including from governments in Germany and Panama; ICIJ does not share information with authorities.

ICIJ is following the case as it develops. For the major court filings, visit here. For rolling coverage, visit here.