Prosecutors are seeking a lengthy prison sentence for the first U.S. taxpayer charged with crimes as a result of the 2016 Panama Papers investigation.

Harald Joachim von der Goltz, an 82-year-old dual German-Guatemalan citizen who lived in the United States from the mid-1980s until 2017, pleaded guilty last week to a range of financial crimes, including fraud and conspiracy to commit tax evasion and money laundering.

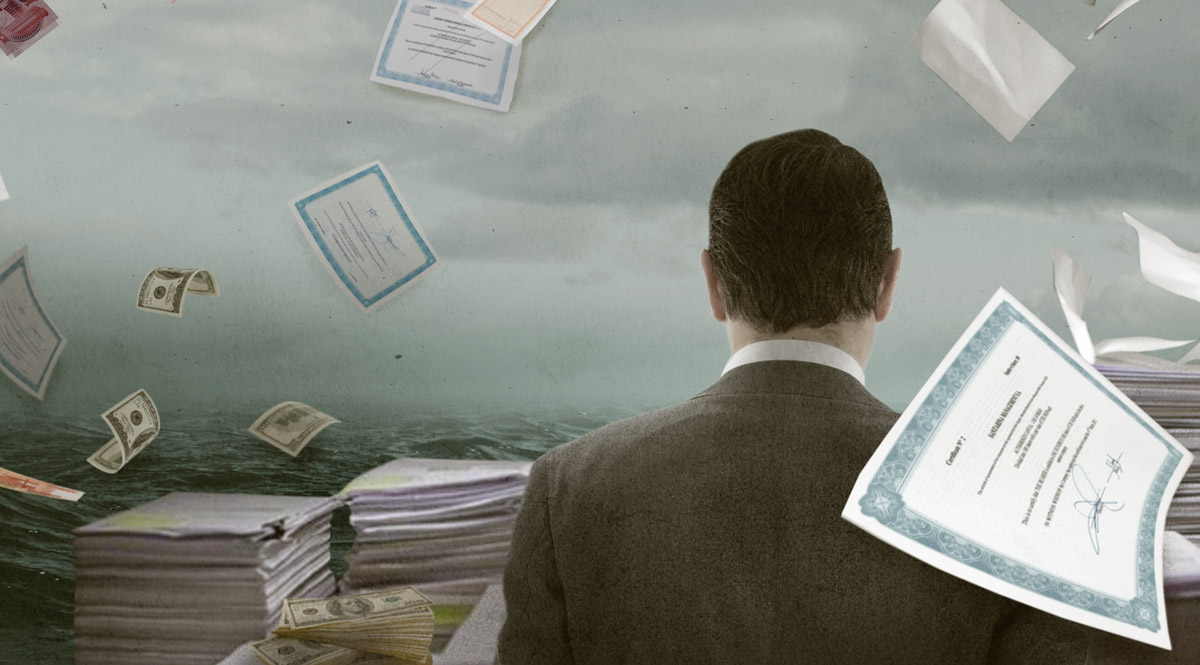

Von der Goltz was a long-time client of Mossack Fonseca, the law firm whose leaked files formed the basis of the Panama Papers.

In last week’s plea hearing, von der Goltz acknowledged having avoided taxes on investment income. Von der Goltz admitted that he falsely told investigators that his mother, who lived overseas and would not have to pay U.S. taxes, owned the investments.

“I’m profoundly sorry for my actions and for the harm I have caused not only to the United States but to the people I deceived, to my friends and most of all to my wife, my children, and other family members,” said von der Goltz.

“Harald Joachim von der Goltz went to extraordinary lengths to circumvent U.S. tax laws in order to maintain his wealth and hide it from the IRS,” said U.S. Attorney Geoffrey S. Berman of the Southern District of New York.

“Using the specialized criminal services of global law firm Mossack Fonseca, von der Goltz set up shell companies and off-shore accounts to conceal millions of dollars. Now, after years of concealment from the United States, von der Goltz has admitted guilt in a U.S. court and awaits sentencing that could result in a term in a U.S. prison.”

U.S. prosecutors said they will recommend von der Goltz spend up to 15 years in prison. Judge Richard M. Berman will sentence von der Goltz on 24 June.

ICIJ is following the case as it develops. For the major court filings, visit here. For rolling coverage, visit here.