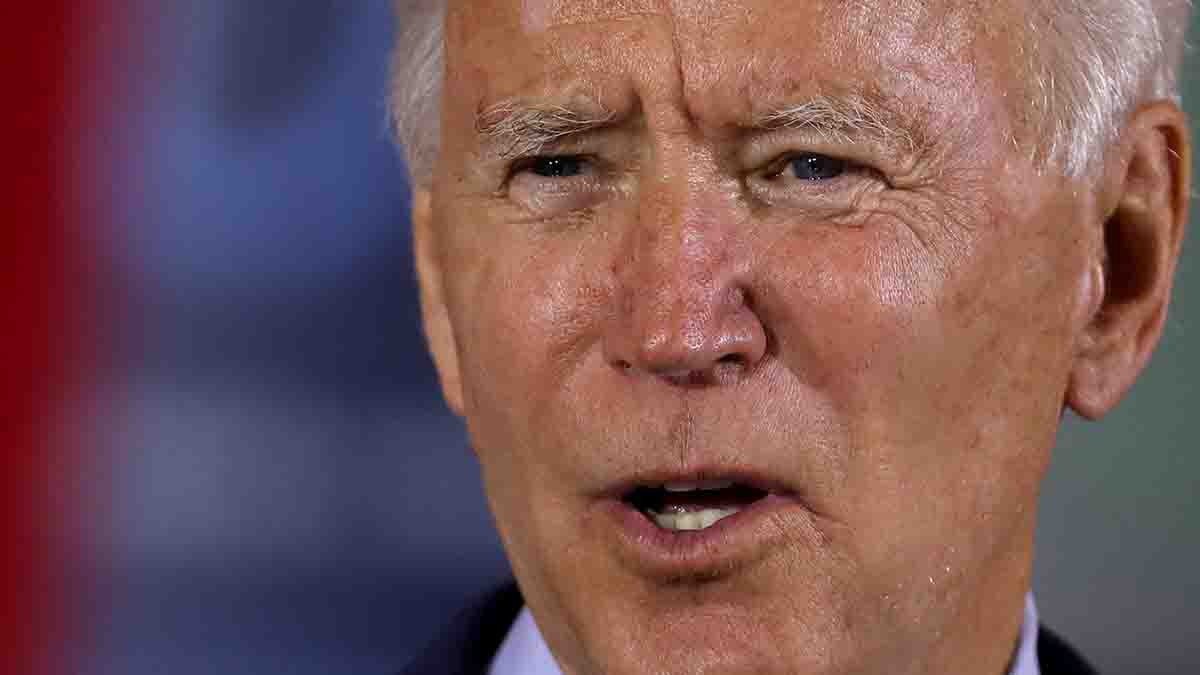

U.S. President Joe Biden has introduced sweeping new strategies to fight financial corruption, pledging a government-wide campaign to identify and punish bad actors who move illicit wealth in the United States and around the world.

Calling the effort a core national security interest, the administration said it would work with Congress to bring more scrutiny to trust companies, lawyers and other financial gatekeepers, seek to identify owners “hiding behind opaque” corporations and target those involved in real estate transactions used to hide or launder money.

The administration has also promised to ramp up anti-corruption investigations at the Treasury Department and other federal agencies and elevate U.S. efforts to partner with anti-money laundering regimes in other countries. The plan includes a call for greater diplomatic efforts to defend investigative journalists who expose corruption.

The so-called United States Strategy on Countering Corruption, announced by the White House Monday, represents the “most sweeping anti-corruption reform drive in American history,” said Josh Rudolph, a member of the National Security Council staff in the Obama and Trump administrations.

“Spanning dirty money, diplomacy, foreign aid, accountability, and more … the only historic comparison is all the legislation enacted after Watergate, but with that not possible in today’s Senate and the threat now transnational, Biden is combating corruption even more sweepingly through executive action as a national security imperative,” he said.

The plan, if properly backed by money and other resources, would bring badly needed reforms to industries open to exploitation, including the growing U.S. trust industry, said Ian Gary, executive director of the nonpartisan Financial Accountability and Corporate Transparency Coalition.

“The U.S. has become the largest destination for parking wealth funded by corruption and criminal activity because current law encourages the U.S. trust industry to compete on the basis of providing anonymity and shirking public accountability,” he said. “This effectively weaponizes our otherwise strong rule-of-law financial systems against us, undermining our national security and our democratic institutions domestically and internationally.”

The announcement from the White House came ahead of a scheduled congressional hearing to probe the rise of the United States as a global tax haven. The House Ways and Means Subcommittee on Oversight, citing the Pandora Papers, plans on Wednesday to focus on why South Dakota and other states enacted customer-friendly laws that have allowed the wealthy to move and hide assets in the United States.

The revelations were part of a global investigation by the International Consortium of Investigative Journalists and The Washington Post, which described South Dakota trusts that held assets connected to people and companies accused of fraud, bribery or human rights abuses in some of the world’s most vulnerable communities.

“Millions of Americans are right to feel the system is rigged when they see the powerful and big business tycoons hide their money,” subcommittee chair, Bill Pascrell Jr. (D-NJ), said. “The sunlight of the Pandora Papers investigation exposed yet more ways those at the top avoid paying their fair share in taxes that ultimately cheats us all, especially working-class Americans.”

Based on more than 11.9 million secret documents, the Pandora Papers also uncovered the financial secrets of 35 current and former world leaders and hundreds of politicians and public officials, including the King of Jordan, the presidents of Ukraine, Kenya and Ecuador.

More than a dozen countries have announced probes into activities revealed by the Pandora Papers, including an investigation of Ecuador’s president, Guillermo Lasso. In the U.S. a bipartisan group of lawmakers have proposed the most significant overhaul to anti-money laundering rules since 9/11.

The hearing Wednesday will address “blind spots” in U.S. laws that allow affluent people to take advantage of the growing trust industry, according to a copy of the subcommittee’s memo on the hearing.

“We will focus on investments in the U.S. and try to understand why South Dakota and other states have enacted laws that are friendly or advantageous for those hiding wealth and/or avoiding taxes,” according to the memo.

South Dakota Governor Kirsti Noem declined an invitation by the committee to participate, saying she had prior commitments. The committee is scheduled to hear from several witnesses, including Vanderbilt University Law School professor and taxation expert Beverly Moran.

“The Pandora Papers were a huge shock to most Americans who realized that the United States is a tax haven and that all sorts of bad actors are pouring money into the U.S.,” she said. “At the very least, we should be applying the same rules to this industry as we apply to organized crime so that the lawyers, accountants and bankers who help the tax haven industry have some limits on what they do and promote.”

The Financial Crimes Enforcement Network, the U.S. Treasury’s dirty money watchdog agency, alo announced Monday that it is seeking public comment on its plan to boost anti-money laundering oversight of the U.S. real estate industry, with specific attention on all-cash transactions. Last year, ICIJ’s FinCEN Files investigation highlighted how American real estate has become a means for global figures to hide illicit money. An exposé on now-sanctioned Ukrainian oligarch Ihor Kolomoisky, accused of orchestrating one of the biggest bank heists in history, revealed how the billionaire amassed a ruinous Midwest property empire.