King Charles’ godson had extensive business ties with a US defense contractor now accused of a massive tax evasion scheme, records show

Lord Charles Tryon, who is not accused of wrongdoing, held key positions in several firms prosecutors allege were part of the contractor’s efforts to conceal more than $350 million in profits.

A godson of King Charles worked closely with an American financier accused by the U.S. government of evading taxes on more than $350 million in military contract profits, according to corporate documents.

Lord Charles Tryon held positions at a number of companies tied to Douglas Edelman, a former defense contractor who was charged in May on 30 counts of tax evasion, conspiracy, and providing false information to U.S. authorities. Tryon denied any involvement in Edelman’s alleged tax evasion, and prosecutors have not alleged wrongdoing on his part.

The Tryon family has been close to King Charles since the 1970s. The king once described Lord Tryon’s mother, Australian-born Lady Dale “Kanga” Tryon, who died in 1997, as “the only woman who ever understood me.”

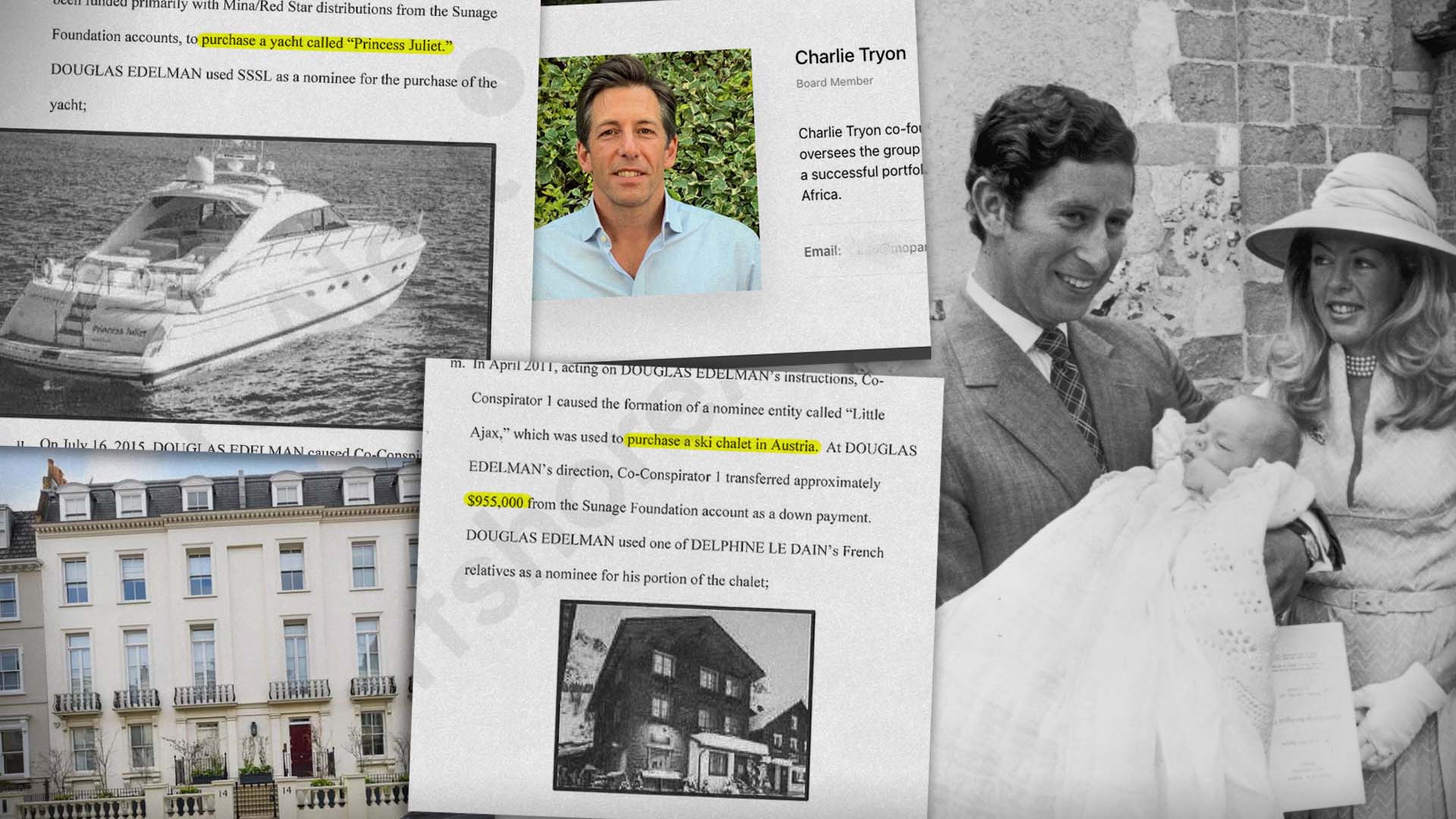

As an infant, Charles Tryon, now a 48-year-old financier, appeared in a famous photo of the king holding him at his christening. He became the 4th Lord Tryon in 2018.

Edelman made a fortune from more than $7 billion worth of contracts with the U.S. military to supply forces in Afghanistan and the Middle East with jet fuel during the post-9/11 war on terror, according to the indictment.

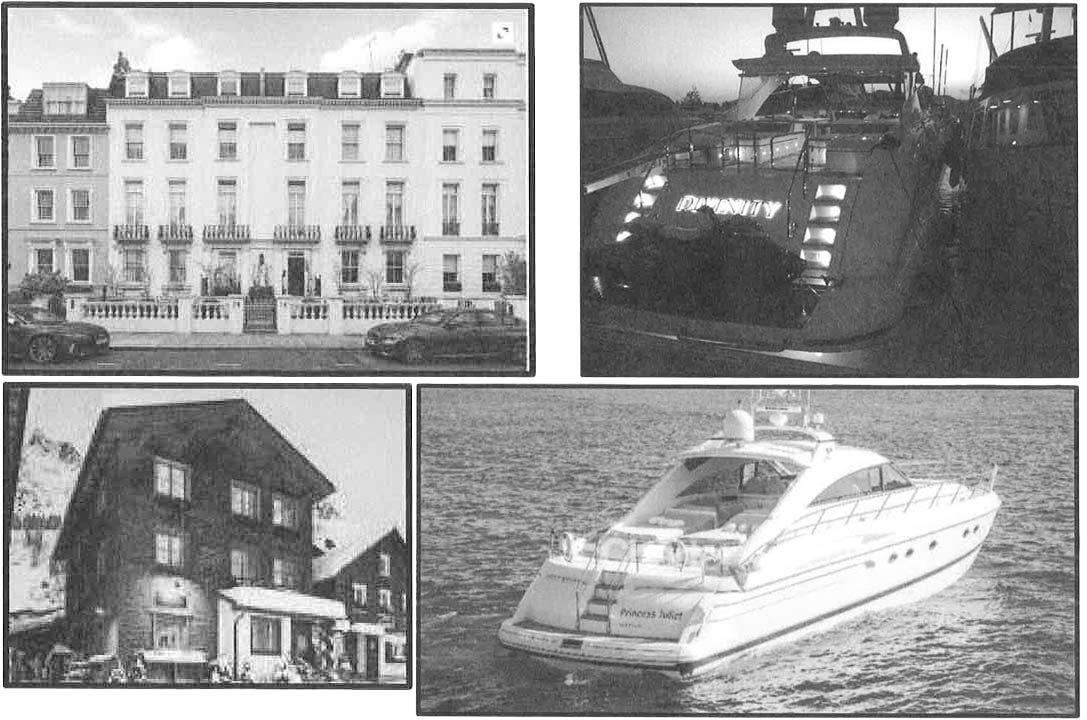

Prosecutors allege that Edelman used several offshore companies as part of an elaborate scheme to place assets in his French wife’s name and thus evade millions in U.S taxes. They claim that Edelman opened overseas bank accounts in the names of these companies, which he used to purchase a $43 million mansion in the upscale London neighborhood of Kensington, an Austrian ski chalet and multiple yachts. Edelman has pleaded not guilty to the charges.

Records obtained by the International Consortium of Investigative Journalists (ICIJ) from the Pandora Papers list Tryon as a director of one of those companies from 2009 to 2011 and as having power of attorney in connection with another entity in 2009. Another business that Tryon launched was, until 2014, registered to a London address linked to Edelman’s businesses; Tryon asserted that his firm took over the lease from Edelman’s companies. Edelman also invested in a business founded by Tryon in South Sudan until 2017.

In response to questions about his involvement with Edelman, Tryon wrote that he worked in businesses linked to the American financier from 2003 until mid-2008, and split from Edelman “on somewhat acrimonious terms” in early 2009. He strongly denied that he had any involvement in or knowledge of Edelman’s alleged tax evasion, which the indictment alleges took place from 2003 to 2020.

The records reviewed by ICIJ show Tryon’s involvement in Edelman’s companies, but do not detail his activities on their behalf. Tryon is not mentioned in the indictment, and wrote that he has not been contacted by prosecutors in relation to the ongoing case.

Edelman was arrested in Spain in July and extradited to the United States in September to face trial. Sen. Ron Wyden (D-OR), the chair of the Senate Finance Committee, has written that the charges against him “represent one of the largest individual tax evasion schemes in American history.”

Edelman declined to comment for this story.

Tryon is currently CEO of the Mauritius-based Maris Limited, which he describes as an “Africa frontier market focused venture capital fund.”

Maris Limited’s website reports that the company holds assets of over $125 million, and that its investments include a machinery dealership in Angola, mining businesses in Zimbabwe and a forestry business in South Sudan.

Leaked documents reviewed by ICIJ show that, from 2009 to 2011, Tryon was a director of a British Virgin Islands-based company called Satellite Support Services Limited, which the U.S. indictment alleges was used to conceal Edelman’s profits. The indictment claims Edelman opened bank accounts in Singapore and the United Arab Emirates in the name of the company, and in 2014 and 2015 used it to purchase two yachts, “Divinity” and “Princess Juliet.”

Tryon initially wrote in an email that he did not serve as a director for Edelman’s businesses, and subsequently wrote that he was surprised to learn that he had been a director of Satellite Support Services. He wrote that he could not understand why he had been made a director in April 2009, after he said he split with Edelman, and served in that role until September 2011.

Documents also show Tryon as having been issued a power of attorney in October 2009 in connection with the Aspen Wind Corporation, another entity the U.S. indictment alleges was part of Edelman’s tax evasion scheme. Prosecutors claim that Edelman held a bank account at Credit Suisse in the name of the company, and that Edelman shifted its assets to Singapore after the Swiss bank told him in November 2008 that he would either have to disclose the account to U.S. authorities or close it. The assets were transferred before Tryon held power of attorney at the company.

Aspen Wind was described on news site EurasiaNet as an “umbrella” organization that held a wide range of Afghanistan-based businesses, including a company that sold Internet services in Afghanistan of which Tryon was CEO.

Tryon first wrote that he remembered being granted a power of attorney for Aspen Wind so that he could sign an agreement with the Internet services provider. He subsequently wrote that he did not know why he would have been granted a power of attorney several months after ending his business relationship with Edelman.

Satellite Support Services and Aspen Wind shared a London mailing address with a U.K.-registered company of which Tryon served as director, Maris Capital Advisors. Tryon wrote that Maris Capital Advisors took over the lease from Edelman’s businesses at 20 Conduit Street, but that it was completely unconnected to Edelman. Records reviewed by ICIJ show that Edelman’s businesses used the building as their mailing address until 2011, and U.K. corporate records show that Tryon’s Maris Capital Advisors listed 20 Conduit Street as its official address until 2014.

Records reviewed by ICIJ show that a Panamanian law firm which provided corporate services to Edelman listed a similarly named company, Maris Capital Limited, as part of Edelman’s offshore corporate network. Tryon said that this firm had been incorporated by one of his colleagues at his current venture, and that the formation agent accidentally associated it with Edelman’s businesses. He said the company did not conduct any business and was removed from the BVI corporate directory in 2021.

In a 2010 article he wrote for The Daily Telegraph, Tryon described working for a “small, highly specialized venture capital company” in Afghanistan.

He wrote: “Given our successes there and the worsening political and security situation, I was given a remit to look further afield to Africa, which presented a new universe of opportunities.”

After Tryon left Edelman’s employment to launch his own business, they co-invested in two ventures in South Sudan. Tryon and Edelman’s companies both held ownership stakes in a billboard advertising company, and a firm that managed mobile telephone infrastructure in the country.

Tryon wrote that these businesses were his own initiatives and that neither Edelman nor his representatives were involved in their day-to-day operations. He wrote that he decided to close the telecommunications firm in 2015 and that the billboard advertising company was sold in 2017.

The Edelman case is the result of a major international collaboration involving the British tax authority and the IRS’s Joint Chiefs of Global Tax Enforcement (J5), called Operation Jetsetter.

The London property purchased by Edelman, 14 Cottesmore Gardens, has a storied history. It was previously owned by both disgraced press baron Lord Conrad Black and the jailed Australian magnate Alan Bond.