Australia’s top court has rejected a move by one of the world’s most profitable companies to stop government officials from using leaked documents to assess its tax bill.

Australia’s High Court ruled unanimously on Wednesday that commodity giant Glencore could not rely on “legal privilege” to prevent the Australian Tax Office from accessing emails, bank records, PowerPoint presentations and other files from the 2017 Paradise Papers investigation. Typically, documents marked “privileged” do not have to be disclosed in court.

The International Consortium of Investigative Journalists, in collaboration with 95 media partners, published the Paradise Papers investigation in November 2017.

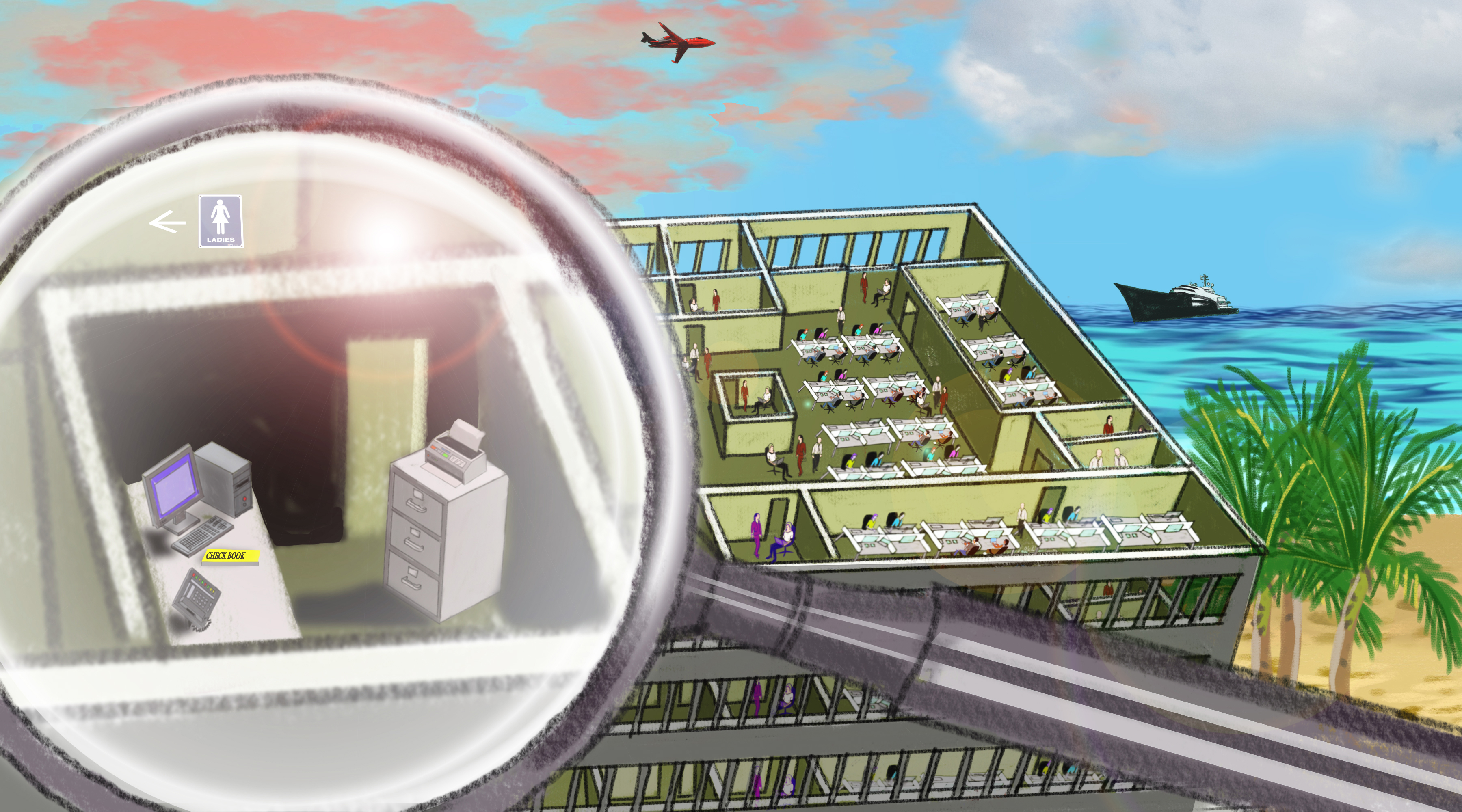

The investigation, based on 13.4 million leaked records, revealed the offshore activities of some of the world’s largest and most secretive companies and individuals, including Uber, Apple and Irish rock star Bono.

The investigation propelled Switzerland to open a criminal case against tax advisers KPMG and the former asset manager of Angola’s sovereign wealth fund and spurred Europe’s competition czar to conclude that footwear giant Nike underpaid billions of dollars in taxes in the Netherlands. Other countries, including Lithuania, recouped unpaid taxes as a result of the investigation.

In Australia, ICIJ’s media partners The Australian Financial Review, the Guardian and the Australian Broadcasting Corporation examined hundreds of leaked records that touched upon Glencore’s operations in Australia, which include cotton, grain and coal mining.

Documents from the Paradise Papers investigation showed that Glencore planned to move tens of billions of dollars “out of the Australian tax net” through an offshore web, according to the AFR. The Paradise Papers also showed that Glencore Australia participated in complex financial instruments known as “cross-currency interest rate swaps,” according to the Guardian. The ATO has previously targeted such swaps as possible tax avoidance tools.

Glencore told the AFR at the time that the offshore plans, known internally as Project Everest, were intended to simplify the company’s asset ownership and “did not improve Glencore’s tax position.”

The AFR reported that the ATO’s view of Project Everest, about which the tax office was made aware, changed after the Paradise Papers revealed that Glencore had backdated documents in other cases. Backdating documents could have saved the Swiss-based company billions, according to the AFR.

[Read some of the documents: Glencore integration planning | Glencore board resolution | Glencore Australian Group simplification plan]

In its 21-page decision, Australia’s High Court ruled that Glencore’s “argument cannot be accepted. Fundamentally it rests upon an incorrect premise.” Privilege shields companies from being forced to hand over information, but does not allow Glencore to stop the tax office using documents already in the public arena, the seven justices wrote.

The days of being able to hide money overseas are rapidly coming to an end … taxpayers are only one data leak away from their entire affairs being exposed – Jeremy Hirschhorn, Australian Taxation Office

Ignoring the Paradise Papers documents could force tax inspectors to determine Glencore’s tax bill based on information that bears “no real relationship to the true facts,” the court said.

Australia’s tax office welcomed the decision.

“The broader ramifications of this decision beyond Glencore are that the days of being able to hide money overseas are rapidly coming to an end – not only are foreign banks providing the ATO with details of Australians with offshore money, but taxpayers are only one data leak away from their entire affairs being exposed,” ATO’s Second Commissioner, Jeremy Hirschhorn, said in a statement.