The Isle of Man is still facilitating the super-rich owners of private jets to fly below European taxes almost three years after Paradise Papers first revealed the practice, a new report finds.

Based on documents obtained in late 2019 from a bank branch of Cayman National Corporation (CNC), operating in the British-owned territory, justice advocacy group Global Witness reports that the self-governing island remains a paradise for luxury aircraft owners intent on avoiding European tax.

Global Witness says it has seen emails and records suggesting CNC routinely created complex, opaque structures that enabled its clients to avail of the zero-tax regime on the registration of luxury aircraft.

The advocacy group backs this up with Freedom of Information data that shows the island had received almost 300 applications for tax exemptions on private airplane imports since October 2011.

“All of them have been given the green light, potentially saving the owners almost £1 billion [$1.31 billion] — equivalent to the Isle of Man government’s entire budget for 2020,” Global Witness concludes.

Since its inception in 2007, the Isle of Man Aircraft Registry has attracted more than 1,000 private jets, making this Crown dependency between the U.K. and Ireland the second-biggest private jet register in Europe and the sixth-largest in the world.

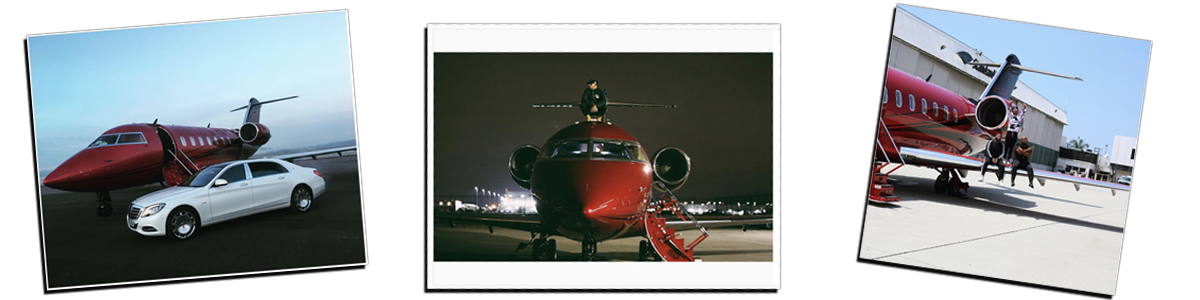

Private jets purchased outside the European Union are subject to a 20% sales tax should their owners wish to fly freely within the bloc without incurring additional customs charges. However, registration on the island allows such imports tax-free, based on a tax exemption for intended business use.

Paradise Papers, a trove of 13.4 million documents leaked to the German newspaper Süddeutsche Zeitung and shared with the International Consortium of Investigative Journalists, shone a light on the ways a privileged few maximize their wealth.

The documents detailed how Formula One motor racing’s star performer Lewis Hamilton managed to avoid European tax by using the Isle of Man to register his new $27 million jet.

The elite Bermuda-based Appleby legal firm teamed up with Big Four accountancy firm Ernst & Young to help Hamilton to avoid the tax by planning a touchdown on the Isle of Man.

“This will involve a short stay, normally less than two hours,” Appleby advised.

The documents showed that Hamilton had picked up a $5.2 million tax refund on his new jet. His advisors denied any subterfuge or improper levels of secrecy and there is no suggestion of illegality.

Paradise Papers also revealed how Ernst & Young had advised Appleby on the Isle of Man tax arrangements for private jets purchased by the flamboyant Russian billionaire Oleg Tinkov.

The businessman bankrolled the Tinkoff cycling team and rents out a number of exclusive properties around the world, including an icebreaker superyacht. He is currently being detained in London, where he is fighting a U.S. extradition warrant for allegedly filing false tax returns while resident in California.

In the wake of Paradise Papers, the U.K. investigated the Isle of Man tax treatment of private aircraft and luxury yachts, another area of concern. In 2019, the official UK report found no evidence of avoidance.

However, despite these findings, the European Commission said its own investigation initiated after Paradise Papers remained ongoing.

A Commission spokesman told ICIJ partner, the BBC, that its inquiry would continue until “we are satisfied that all necessary measures to stop fraud have been taken.”

An earlier version of this story wrongly stated that the Isle of Man is part of the European Union.