Formula One auto racing star Lewis Hamilton got a new luxury jet, a $27 million candy-apple-red Bombardier Challenger 605 with Armani curtains. He also got a refund on the value-added tax.

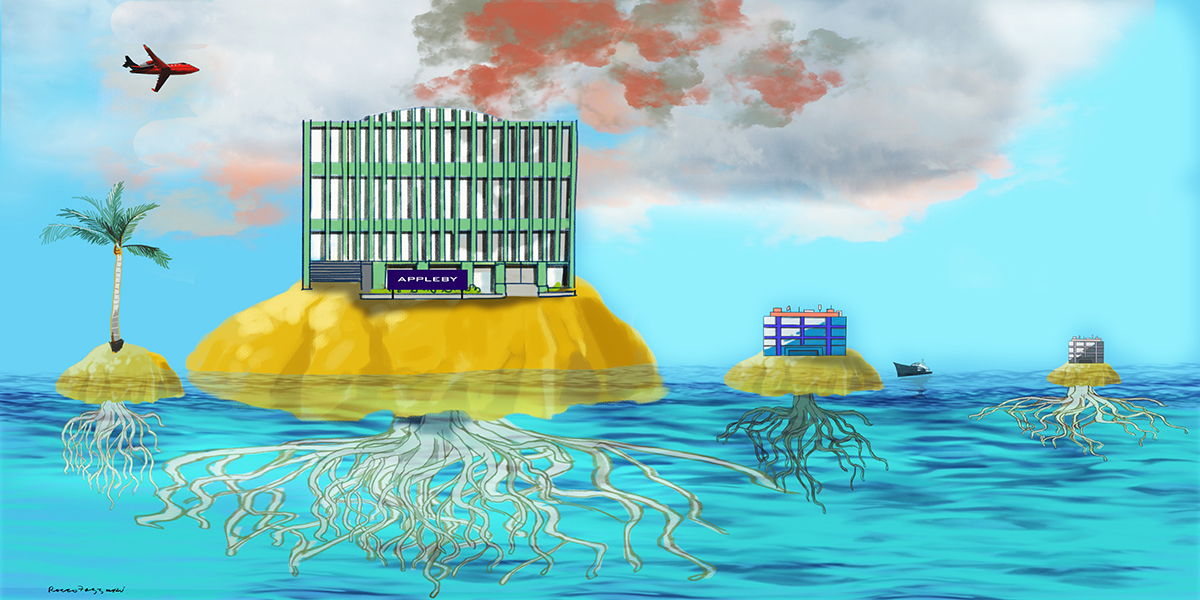

And the lawyers at Appleby, an elite law firm founded in Bermuda, were there to help.

They teamed with the London-based accounting giant Ernst & Young to craft an arcane plan to sidestep the VAT, a consumption tax charged in Europe on everything from socks to cars. One of the conditions: Hamilton’s inaugural flight would have to touch down on the Isle of Man, the British crown dependency in the Irish Sea known for its lenient tax treatment of the world’s super-rich.

“This will involve a short stay, normally less than 2 hours,” Appleby said in a written explanation of the tax-avoidance strategy.

The four-time Formula One world champion was up to the challenge. He and his girlfriend, Pussycat Dolls pop star Nicole Scherzinger, planned to make a layover on the Isle of Man on their first time out to Europe on his new jet in January 2013, according to an itinerary sent to Appleby.

Whether Hamilton actually made the trip could not be learned. But in the end, he did pick up a $5.2 million VAT refund, according to secret documents reviewed by the International Consortium of Investigative Journalists, the BBC, The Guardian, and more than 90 other media partners.

The documents come from the internal files of offshore law firm Appleby and corporate services provider Estera, two businesses that operated together under the Appleby name until Estera became independent in 2016. The files, which are now called the Paradise Papers, were originally leaked to the German newspaper Süddeutsche Zeitung and shared with the International Consortium of Investigative Journalists.

In a statement to The Guardian, Hamilton’s lawyers said that the race car driver has a set of professionals in place who run most aspects of his business operations on his behalf and that no subterfuge or improper levels of secrecy have been put in place.

Shielding offshore trillions

The episode opens a window onto a low-profile network of lawyers, bankers, accountants, financial advisers and other professionals who operate offshore in the gray international area between tax jurisdictions. This global system exists largely to shield assets from taxes, creditors and competitors and has been instrumental in luring trillions of dollars offshore, leaving other taxpayers to make up the difference.

An offshore subspecialty that handles private jets and mega-yachts has prospered even as concerns about the wealth and privileges of the global 1 percent have grown.

The yacht-and-jet offshoring business extends far beyond secretive tax havens and discreet law firms. It has involved U.S. banking giants such as Wells Fargo & Co., respected regional banks such as the Bank of Utah, and U.S. legal powerhouses such as Akin Gump Strauss Hauer & Feld. The banks have helped create trusts that have enabled otherwise ineligible foreigners to register jets in the United States, which can increase their resale value. Akin Gump helped an Arab monarchy qualify for a VAT refund on private jets it wanted to turn into spy planes. Ernst & Young worked with Appleby on a range of tax-related matters.

A spokeswoman for Wells Fargo said the bank is in the process of exiting the business of acting as trustee for foreign owners of non-commercial jets. “As a regular course of business, Wells Fargo evaluates its products and services to make sure we deliver the best experience for our customers while maintaining appropriate risk levels,” she said.

Alex Cobham, chief executive of Tax Justice Network, a U.K.-headquartered nonprofit that fights financial secrecy, said offshore ownership of luxury planes and boats is “a symptom of global inequalities.” These arrangements allow the rich to exploit the weaknesses of the international tax system through “hidden ownership and circular financing schemes,” he said.

Leaked documents from Appleby and other sources reveal a long list of rich and super-rich individuals who rely on offshore operatives to handle the tax issues and other challenges involved in owning luxury planes and boats. Among them: celebrities like Hamilton; the crown prince of Saudi Arabia and other royalty; and politicians and figures connected to them, such as Russian President Vladimir Putin’s friends the billionaire brothers Arkady and Boris Rotenberg.

U.S. President Donald Trump, too, has taken advantage of offshore arrangements to organize ownership of private aircraft.

Leaked documents from the Bermuda corporate registry, not related to Appleby, list Trump as the owner of a Bermuda shell company that in turn owned a Boeing 727 jet used by Trump, who put it up for sale in 2009. Trump disclosed the company, D.J. Aerospace (Bermuda) Ltd., in his election disclosure filings. Trump’s offshore ownership of the jet has been previously reported. The jet is now owned by Weststar Aviation, a Malaysian company.

The Wall Street Journal reported in December that another Trump aircraft – a Boeing 757-200 he used during his presidential campaign – is controlled through a complex ownership and leasing setup involving limited liability companies; the arrangement could have enabled Trump to avoid paying $3.1 million in New York sales tax upfront and to instead pay it in installments spread over many years.

Trump and Rotenberg did not respond to requests for comment from ICIJ and partners.

Isle of riches

A craggy, rain-swept island otherwise known for its tailless Manx cats, the Isle of Man has long been a key outpost in the offshore industry, thanks in large part to its close but ambiguous relationship with the United Kingdom.

It has a “partnership” with the U.K., but it controls its own domestic policy — and has turned itself into a hub in the global financial system by offering low tax rates and tolerating high levels of corporate secrecy. It didn’t have an aircraft registry until 2007 but now maintains the largest offshore plane registry in the world, with roughly 1,000 private airplanes, each generating fees for the island’s financial services industry, the Isle of Man’s biggest employer.

The registry’s growth is in part due to the Isle of Man’s lenient VAT policy and tolerance for arrangements that exploit it. Appleby alone has been responsible for creating companies that owned at least 48 private jets with an average price of $33.9 million, according to an analysis of the law firm’s internal documents by the BBC and ICIJ.

Appleby also has a big business in registering yachts, particularly in the Cayman Islands, where it has set up offshore companies that claim ownership of dozens of yachts and ships. The owners of these vessels include the royal families of the United Arab Emirates and Saudi Arabia, Russian fertilizer billionaire Andrey Guryev and Microsoft co-founder Paul Allen. Guryev did not respond to request for comment. An Allen representative declined to comment.

On the Isle of Man, Appleby has drawn big-name customers by creating offshore arrangements that push the boundaries of EU tax rules, according to international tax experts contacted by ICIJ and its partners the BBC and The Guardian.

For instance, the Isle of Man grants, on a case-by-case basis, pre-approved exemptions that are not subject to public scrutiny. EU member states could choose to offer similar exemptions to the super-rich, but political pressures constrain them from doing so.

In 2011, under pressure from the European Union, the United Kingdom tightened a rule that had allowed owners to avoid the VAT if the aircraft weighed more than 8,000 kilograms.

That created an opening for firms on the the Isle of Man, which has access to the giant EU market through its relationship with the U.K., to attract even more offshore business.

Some of the complex Isle of Man arrangements don’t appear to meet the criteria set out in the EU’s VAT-exemption language, tax experts said. EU language, for instance, requires companies to be real operating businesses and not “letterbox” companies. “It doesn’t pass the smell test,” said Maria Martinez, a former international tax attorney now with the antipoverty nonprofit Oxfam America, referring to the Isle of Man’s handling of many tax arrangements.

After ICIJ partners sent questions about the arrangements to the Isle of Man’s government, its chief minister, Howard Quayle, called an October 23 press conference and declared: “We have found no evidence of wrongdoing or reason to believe that our customs and excise division has been involved in a mistaken refunding of VAT.” He added, “The Isle of Man is not a place that welcomes those seeking to evade or abusively avoid taxes.”

At the same time, however, Quayle announced that he had invited the U.K. treasury to conduct an assessment of the Isle’s jet-registration business.

And in response to The Guardian and ICIJ questions, the government disclosed that VAT refunds for 231 jets registered on the island had totaled more than $1 billion. Without the Isle of Man structures, much of that revenue would have gone to EU countries where the planes would have been registered.

How Lewis Hamilton’s jet deal flew

The exemption that Appleby helped secure for Formula One champ Hamilton’s jet, for instance, shows how expansively the Isle of Man interprets EU aircraft rules.

Appleby began with a pitch to Hamilton and his representatives: “By working with Ernst & Young LLC as a VAT specialist and through the use of their dedicated VAT Deferment Account together with appropriate structuring, the need to fund the VAT would not be required.”

Officials from Ernst & Young and Appleby, and other advisers, exchanged emails and held conference calls to puzzle over how to deal with EU rules, which allow VAT refunds for private planes only when they’re used for business purposes by real companies that operate in the EU.

Appleby set up an Isle of Man company called Stealth (IOM) Ltd. to lease the jet from Hamilton’s British Virgin Islands holding company, Stealth Aviation Ltd., and import the plane to the Isle of Man and, thus, thanks to the island’s relationship with the U.K., into the EU. The letterbox company then subleased the plane to TAG Aviation Ltd., a third-party jet operator in England.

But EU rules require that the company that imports the plane be a real – not a shell – company that actually operates in the EU. Only “fixed establishments” are eligible, and a fixed establishment is defined as having a “sufficient degree of permanence and a suitable structure in terms of human and technical resources to enable it to provide the services which it supplies,” according to EU rules.

Stealth (IOM) Ltd. has no employees. Knock on the door at 33-37 Athol St. in Douglas, the capital, and you’ll find an Appleby office that also serves as headquarters for more than 1,100 companies and trusts. Stealth (IOM) has no staff and no building of its own. It has a “brass-plate” address and a single director, General Controllers Ltd. – another Appleby shell company used as a “nominee director,” a stand-in for the controlling parties.

Although the importing firm clearly exists only on paper, Isle of Man officials pre-approved Hamilton’s arrangement. After that, all that was required was a layover on the Isle of Man for customs to sign the jet’s paperwork allowing the VAT refund. Neither Hamilton nor his plane ever had to visit the island again, even though the firm that imported it is incorporated there.

Appleby sold its Isle of Man jet operation and the rest of its fiduciary business to the unit’s managers in early 2016; the new company took the name Estera.

In their statement, Hamilton’s lawyers said Stealth (IOM) Ltd. is not a shell company and was formed to run a leasing business and hire the aircraft on a long-term basis at a commercial rate. They said the company made all necessary disclosures to Isle of Man officials, who approved the approach.

The lawyers said that reducing taxes was not the motive for the arrangements, but even if it had been, it is lawful to lease, rather than buy, to reduce the VAT.

They added that it was not correct that Hamilton had paid no VAT on any of the arrangements.

In a separate statement, Ernst & Young said commercial leasing arrangements such as those used by Hamilton constitute entirely legitimate commercial practice. The accounting firm said that as a commercial business, the import company is entitled to reclaim the VAT incurred on its business asset against the VAT which it is due to pay on the import of the aircraft into the European Union if the aircraft is being used wholly or predominantly for business purposes by the end user.

It said the relevant consideration for such arrangements is where the aircraft flies (not where the aircraft is bought, leased to or leased from). Ernst & Young said it advises clients they should consider whether VAT needs to be charged for all flights within EU airspace and added that it is not able or required to monitor a client’s use of an aircraft on a day to day basis following registration.

“All our advice, whether in planning or compliance, is based on our knowledge of tax law and providing transparency to tax authorities,” Ernst & Young said in the statement.

It could not be learned whether any Hamilton entities paid VAT on trips within the EU.

EU rules forbid VAT refunds for personal jet purchases and imports. Hamilton, however, received a refund even though he had planned to use the plane for non-business purposes one-third of the time, according to draft leases in the Appleby files. And his social media feeds and website often flaunt his private use of the plane. One video, uploaded to Hamilton’s YouTube account, shows him, his dog Coco, and some friends aboard the plane, followed by scenes of him cavorting on four-wheeled dirt bikes in Colorado and dancing and drinking at a 2015 festival in Barbados.

The jet was used primarily for business purposes, Hamilton’s lawyers said, adding that on the few occasions that it was used for private purposes, a proper hire charge was invoiced and paid.

An unsigned statement to the Guardian on behalf of the Isle of Man government, said the government is committed to enforcing tax rules. “Whilst it is clear that no jurisdiction in the world could ever guarantee that instances of evasion, abusive tax avoidance and error do not occur on an individual basis, the Isle of Man is committed to ensuring that it is not used by those seeking to evade taxes or to abusively avoid taxes,” the statement said.

The statement added that in October 2016 the government began “to review the accuracy and efficacy of the declarations being made to it” by the roughly 270 aircraft ownership arrangements there.

Such arrangements aren’t so unusual among the very rich.

The United Arab Emirates – one of the world’s wealthiest countries – sought to avoid the VAT with help from Appleby. In 2012, the authoritarian Persian Gulf monarchy bought two Bombardier Global 6000s for $120 million and committed to paying $98 million more to convert them into high-tech spy planes.

Because it’s a state, the UAE wasn’t eligible to register an aircraft in the Isle of Man. Appleby and Washington-based Akin Gump lent a hand. Appleby created a shell company called Advanced Integrated Systems (IOM) Ltd. that could register the aircraft on behalf of the UAE.

Appleby also received assurance from the island’s customs officials that the planes wouldn’t be taxed. Akin Gump helped arrange Appleby’s registration of the plane, according to emails sent from its lawyers to Appleby. Neither Akin Gump nor the UAE returned requests for comment.

Not all such maneuvers, in the Isle of Man or elsewhere, are particularly complicated.

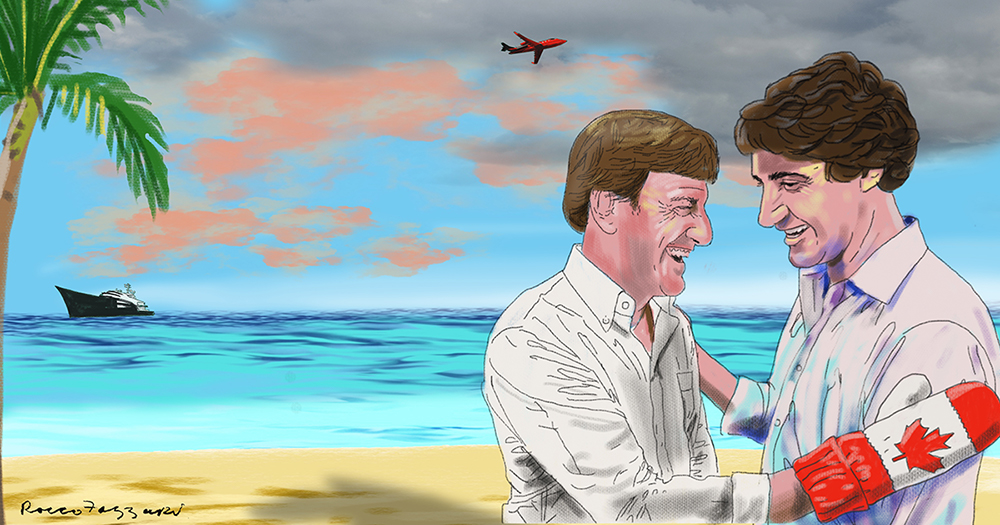

When Mohammed bin Salman, now crown prince of Saudi Arabia, bought the mega-yacht Serene from Russian vodka billionaire Yuri Shefler for $456 million, it was docked in the Port of La Ciotat, in the south of France. (The hefty price bought 30,000 square feet of living space, including an underwater viewing room, a climbing wall, a cinema and an indoor seawater pool, as well as space for 52 crew members. The yacht also has a helicopter hangar, at least five onboard boats and a submarine garage.)

Advisers proposed motoring the 439-foot yacht to international waters in the western Mediterranean and closing the sale there, according to documents sent from the American law firm Baker McKenzie to Appleby in 2015.

It couldn’t be learned if the plan was ever carried out. It’s unclear if any VAT was paid. A spokeswoman for the Saudi government declined to comment, as did Baker McKenzie.

Martinez, of Oxfam, said moving yachts is a common tax-avoidance strategy. “If you’re in international waters, no country can claim it,” she said. “It’s stateless income.” Whether the sale closed in international waters and whether the location was part of a tax-avoidance strategy could not be learned.

American flyers

The lucrative business of working around ownership problems for aircraft and yachts has also attracted U.S. financial institutions. Appleby worked at least nine times total with Wells Fargo and Bank of Utah to create trust structures enabling noncitizens to register jets in the United States.

The Bank of Utah served as a trustee on one such deal involving natural-gas oligarch Leonid Mikhelson, deemed by Forbes the richest man in Russia, with a fortune estimated at $17 billion. Appleby made arrangements that included creating an Isle of Man branch of Mikhelson’s Panama company, Golden Star Aviation Ltd., which leased a Gulfstream G650 from a Cayman Islands company to also avoid VAT in Europe on the $60 million plane. (Golden Star Aviation’s president is listed as James Ackroyd-Cooper, a personal trainer in Suffolk, England.) The arrangement saved Mikhelson up to $12 million, according to Isle of Man documents approving the exemption from the 20 percent tax. Using the Bank of Utah as trustee also gave Mikhelson access to the U.S. jet registry, which would likely increase the plane’s resale value.

“Mr. Mikhelson acts strictly within the boundaries of the law and in compliance with applicable legislation at all times,” a spokesperson said. “He does not deem it necessary to provide any comments on his personal property activities.”

Gabriel Zucman, an assistant professor of economics at the University of California, Berkeley, and the author of “The Hidden Wealth of Nations,” said tougher information-sharing requirements for the offshore industry are required to stop the wealthy from avoiding taxes. “This confirms that the offshore system benefits a tiny elite who uses it to avoid and sometimes evade billions of dollars in taxes,” he said. “Unless we are willing to accept ever rising inequality, this situation is unsustainable.”

Appleby cut its ties to Mikhelson after U.S. authorities retaliated against Russia’s 2014 invasion of Crimea by blacklisting his natural-gas company, Novatek, along with other businesses and people tied to Putin.

This confirms that the offshore system benefits a tiny elite who uses it to avoid and sometimes evade billions of dollars in taxes.

An Appleby official wrote that, “with regret,” he had to advise Mikhelson’s representatives of the law firm’s decision to end relationships that were directly or indirectly connected to entities or people on the U.S. sanctions list. Appleby helped transfer Mikhelson’s arrangements to another Isle of Man firm.

The Bank of Utah applied to renew Mikhelson’s plane’s registration with the Federal Aviation Administration in 2016, two years after his company was sanctioned, according to FAA records.

In an interview with an ICIJ partner, The New York Times, Bank of Utah trust officer Joe Croasmun said the bank took seriously its obligations to know its customers and to be on guard against suspicious activities. When asked about the bank’s relationship with Mikhelson, Croasmun went to look in the bank’s files. When he returned, he said that the bank was indeed trustee for Golden Star Aviation but that he couldn’t find any mention of the Russian businessman.

“His name is not in there,” he said.

In a later statement, Croasmun said, “We view our risk management processes to be a living and breathing methodology, always growing to implement best practices and enhancing our country risk assessment as the world changes. We are currently doing a review of all countries we have designated as ‘higher risk’ – including transactions involving Russia.”

Contributors to this story also included: Tim Robinson and Mike McIntire.