Facing the threat of being blacklisted by the European Union, three British islands synonymous with aiding tax avoidance say they plan to embrace greater transparency.

Guernsey, Jersey and the Isle of Man have pledged to adopt public registers of the true owners of offshore companies incorporated in their jurisdictions.

The three islands off the coast of Great Britain, who have faced fierce criticism over harboring offshore companies, are crown dependencies, meaning they are self-governing possessions of the U.K. Crown.

In a joint statement issued on June 19, the islands defended their “long track record of high standards” but said by the end of 2023 they would introduce measures in line with the forthcoming European Union Money Laundering Directive.

The directive is expected to endorse publicly accessible registers of beneficial ownership of companies in 2022.

Jersey’s External Relations Minister, Senator Ian Gorst, said: “Jersey is proud to be among global leaders in matters of tax cooperation, transparency and in combatting money laundering and countering the financing of terrorism. The commitments we are announcing today, alongside Guernsey and the Isle of Man, will help to ensure that this leadership role is maintained.”

The available evidence suggests otherwise.

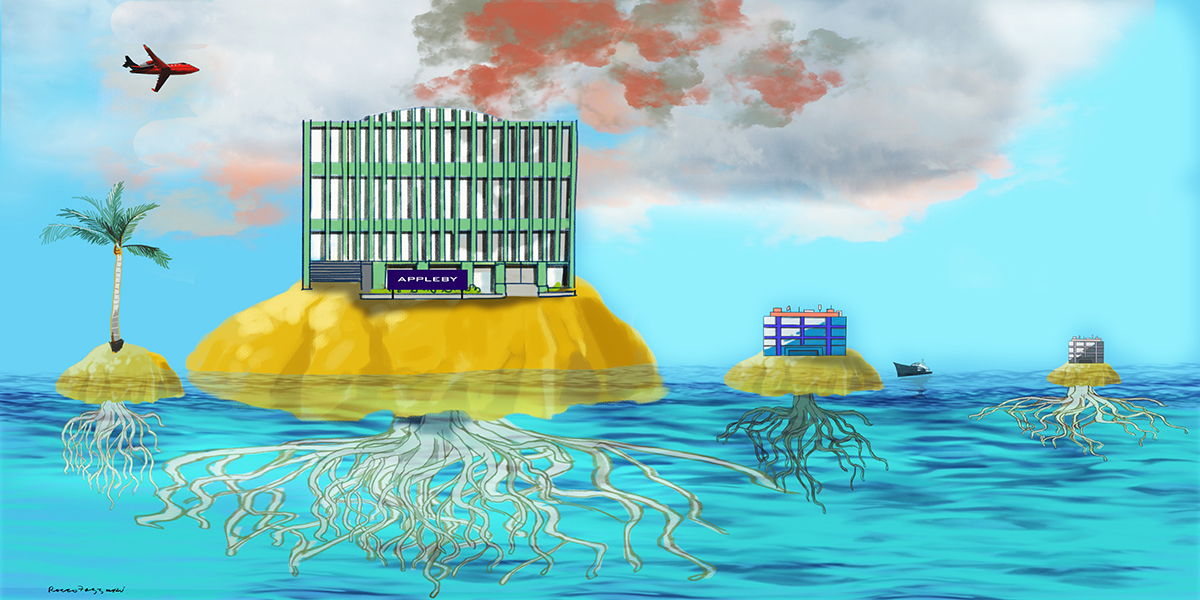

Jersey and the Isle of Man featured prominently in The Paradise Papers, a leak of 13.6 million confidential documents from Bermuda-based “offshore legal services provider” Appleby and its Estera Services associate that formed the basis of the landmark probe into seismic tax avoidance by The International Consortium of Investigative Journalists and a global network of more than 100 media partners.

Among other revelations, the 2017 reportage detailed how Apple had moved most of its $252bn overseas cash pile from Ireland to Jersey after 2015. This followed European pressure on Ireland to end its favorable tax treatment of transnationals, or at the very least to enforce its putative 12.5% corporate tax rate.

Apple saved billions of dollars courtesy of the island’s 0% tax rate on profits generated there.

Some of the world’s wealthiest companies and individuals were also listed among those who had taken full advantage of the benign regimes operating in the Crown Dependencies and British Overseas Territories, including heads of state, political leaders, celebrities and sports stars.

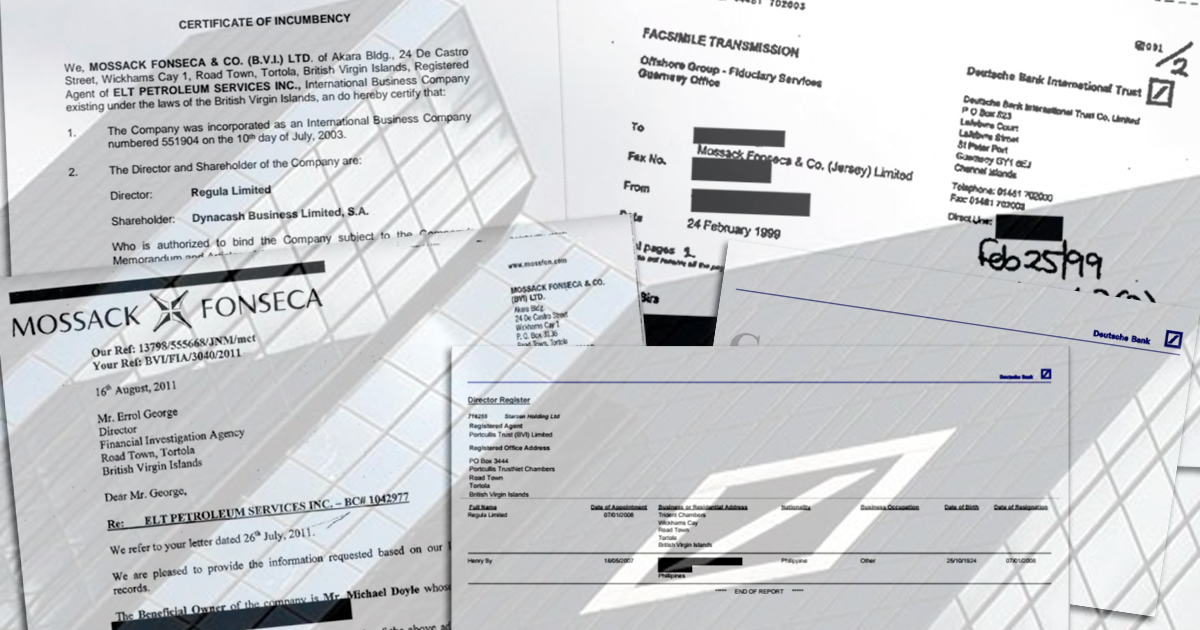

Following the revelations contained in both the ICIJ-led Panama Papers and The Paradise Papers, pressure has been mounting on these jurisdictions to become more transparent, especially regarding the identity of the true owners of companies registered in these UK satellites.

The European Union has threatened to include the Crown Dependencies on its tax haven blacklist of regimes, which facilitate offshore structures that “attract profits without real economic activity” and UK lawmakers have advanced several pieces of legislation to make disclosure of beneficial ownership mandatory, in line with the law in the UK itself.

The announcement by the islands may have generated positive headlines but the chief executive of the Tax Justice Network Alex Cobham was skeptical, describing it as “a triumph of spin.”

“This is a commitment not to do anything until 2024 and even then there is no guarantee that what will be brought forward in 2023 will even meet European Union standards,” he said.

The organization also pointed out that the statement failed to mention how other financial structures such as trusts and foundations would be treated. Such vehicles are popular tax-avoidance mechanisms. The Paradise Papers, for example, showed that Queen Noor of Jordan was the beneficiary of two Jersey-registered trusts with a combined value of around $58.7m.

The Crown Dependencies have their own governments, administrations, fiscal and legal systems but their citizens are entitled to British passports. The 14 British Overseas Territories, most of which are former colonies, remain under UK sovereignty and each has its own constitution and government.

Estera’s Bermuda fine

The fallout from the Paradise Papers continues to reverberate throughout these jurisdictions. Earlier this month the Bermuda Monetary Authority said it had fined Estera Services $500,000 for failing to comply with anti-money laundering legislation by a given deadline.

The regulator said it was particularly concerned with the failure to comply with the regulations “relating to the application of customer due diligence and enhanced due diligence, internal controls, and risk assessment.”

The Paradise Papers detailed repeated examples of a failure by Appleby to conduct due diligence on its clients, including the source of their funds.

In a statement, Estera Services, which separated from Appleby in 2016 following a management buyout, said the penalties related to historical client files inherited in the takeover and it was now fully compliant.