Political leaders and tax-justice advocates are raising new calls for legislative reforms and official inquiries in the wake of of the Paradise Papers investigation’s revelations about the offshore dealings of hundreds of powerbrokers and international corporations.

The year-long probe led by ICIJ is based on a cache of 13.4 million leaked files from 19 secrecy jurisdictions and two offshore providers, Appleby and Asiaciti. The documents were obtained by German newspaper Suddeutsche Zeitung and shared with more than 380 journalists in more than 65 countries.

Since ICIJ and its partners began releasing their stories Sunday, reactions have been reverberating from Washington, D.C., to Bermuda to London to India and all around the world:

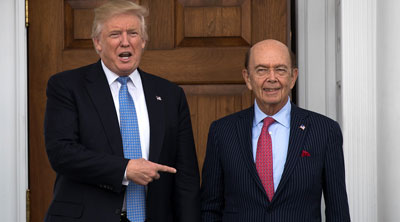

- United States: ICIJ’s revelations of Commerce Secretary Wilbur Ross’ interests in a company doing business with a firm close to the Kremlin have led Senate Democrats to call for an investigation on Ross’ business links. In a televised interview with Bloomberg News aired soon after the Paradise Papers made the headlines, Ross denied misleading Congress and said he will “probably” sell his stake in the company, which has been doing business with an energy company co-owned by Vladimir Putin’s son in law.

- United Kingdom: Politicians have been pointing fingers of blame in reaction to the media partners’ disclosure that the Queen of England had offshore ties to a fund that invested in a rent-to-own loan company accused of exploiting low-income Britons.

- Canada: The country’s revenue agency, CRA, announced that it won’t hesitate to investigate new evidence of offshore tax evasion. The leaked documents in the Paradise Papers included the names of at least 3,000 Canadian companies and individuals, including three former prime ministers and the chief fundraiser for current Prime Minister Justin Trudeau.

- Europe: Pierre Moscovici, the European commissioner for economic and financial affairs, sent out a tweet to his 189,000 followers saying that it’s “time to complete the EU’s anti-tax evasion toolbox with swift decisions” on tax havens. Eva Joly – a member of the European Parliament and the deputy president of a European parliamentary inquiry on the Panama Papers – said in a statement: “If all this is ‘legal’ then it is necessary to change the laws.”

- Spain: Finance Minister Cristóbal Montoro said the country’s tax agency will investigate the names appearing in the Paradise Papers, according to news agency EFE.

- India: Following revelations that more than 700 Indians are linked to offshore companies or trusts, the Indian income-tax department and the country’s securities regulator have announced investigations. The probes will check for any disclosure lapses, fund diversion or untaxed incomes, according to Mint, a daily newspaper.

- Australia: A few hours after ICIJ and its partners published the first stories, the Australian Taxation Office released a statement saying it will continue to collaborate with tax agencies in other countries “to share intelligence on [tax] advisers operating globally.”

- Bermuda: Prime Minister David Burt defended Bermuda’s tax laws in a radio interview with BBC. “You cannot hide money in Bermuda because any international tax authority can make requests and find out that information,” Burt said, according to the Guardian. He added that Bermuda would review revelations detailed in the global media investigation. Almost 7 million of the leaked files in the Paradise Papers come from Appleby, a law firm that was founded in Bermuda.

- Cayman Islands: Jude Scott, the chief executive of industry body Cayman Finance, issued a statement in support of the British financial services sector and Queen Elizabeth II. Cayman has a “globally responsible tax regime that enables the free flow of trade, services, capital and financing around the world,” he wrote.

- Appleby issued a second statement saying that the firm “has thoroughly and vigorously investigated the allegations and we are satisfied that there is no evidence of any wrongdoing.”

- Organizations promoting tax justice, such as Oxfam and Global Witness, renewed their concerns over the poor regulation of international financial centres and called for authorities to crack down on corporate secrecy and strengthen fiscal reform efforts described so far as “feeble.”