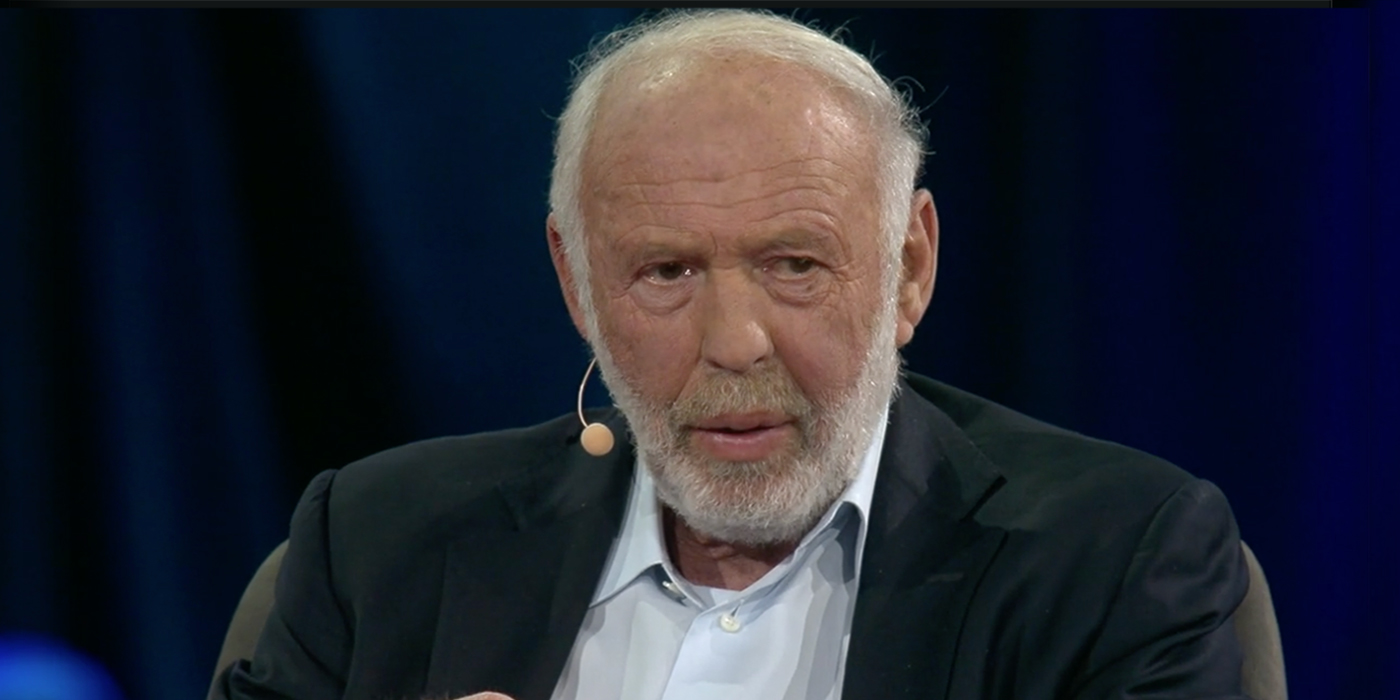

In December 2010, an attorney associated with James H. Simons, the billionaire founder of the hedge fund Renaissance Technologies, submitted a secret application to Bermuda’s highest court. He was seeking approval for a set of changes to a trust fund Simons had quietly maintained on the island since 1974.

Getting approval for the changes – which included adding his charitable foundation as a beneficiary of the trust’s fortune – required Simons to give the court, under seal, data relating to his overall wealth. But Simons’ legal team insisted that such filings must be limited. The “exact quantum” of Simons’ wealth was a strictly private matter, trust lawyer John Robert Balfour Richmond argued. The billionaire had no taste for discussion of his fortune.

“A Google search against Mr. Simons’ name will throw up any number of estimations of his or his family’s wealth,” Richmond wrote in a secret affidavit filed with the 2010 request. “Wikipedia, citing Forbes, for example, states his wealth as being US$ 8.5 billion.”

If Richmond sounded dismissive of Forbes’ estimate, one reason may have been simple: The magazine hadn’t captured the full extent of Simons’ wealth.

Richmond knew what Forbes apparently didn’t: In addition to his billions of dollars in U.S. assets, Simons had amassed $7.25 billion in a low-profile Bermudan trust that is one of the largest private trust funds ever discovered. A confidential accounting document attached to the 2010 filing projects the offshore fortune growing to $15 billion by the end of this year and reaching $35 billion by 2030.

The revelation of the massive offshore holding changes the public understanding of Simons’ wealth, offering a case study of how little we know about the fortunes of the planet’s richest people. A report released last year by Oxfam International, relying on the Forbes billionaire list, estimates that just 62 people control as much wealth as the more than three billion people who make up the poorest half of the global population.

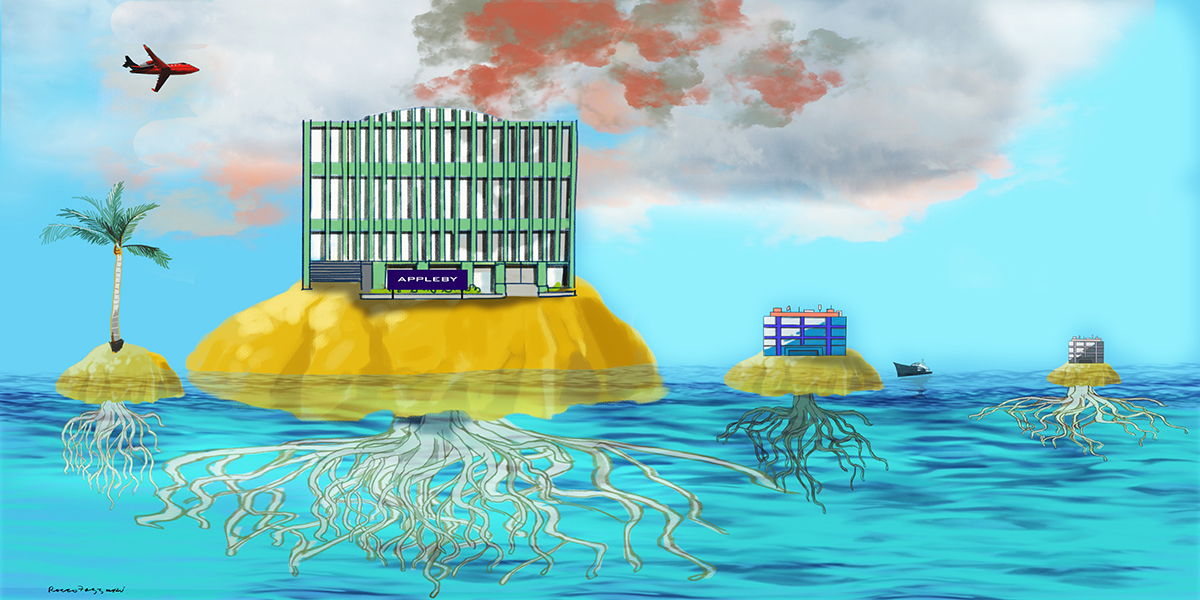

Details of Simons’ Bermuda-based fund, called the Lord Jim Trust, were uncovered during a joint reporting effort by the International Consortium of Investigative Journalists and 95 media partners around the world. The records come from a cache of 6.8 million leaked files from the offshore law firm Appleby and corporate services provider Estera, two businesses that operated together under the Appleby name until Estera became independent last year.

Over the years, Appleby has been an offshore industry leader in helping the world’s wealthiest people, including Simons, maintain holdings in global tax havens.

Simons is one of the Democratic Party’s foremost donors and is known as a prominent philanthropist. His New York-based Simons Foundation extensively funds math and science education.

Forbes lists Simons as having contributed $2.1 billion to charity. Yet the amount could be far higher: In 2011, representatives of Simons’ trust quietly set up a separate foundation in Bermuda, the Simons Foundation International, which recently received more than half of the Lord Jim Trust’s assets. The offshore foundation now holds approximately $8 billion in assets, according to a person familiar with the charity.

Although it is likely counted as one of the largest foundations created from a U.S. fortune, the new offshore charity has no website and few public disclosures, and its formation was never announced.

The big impact of trusts

The leaked records reviewed by ICIJ provide a window into the largely unexamined world of offshore trusts, a powerful tool for the wealthy to store, protect and grow their money under a veil of financial privacy. In general, trusts allow people to hand over technical ownership of assets to trustees, often a trust company, to use in accordance with the client’s wishes.

There’s a reason why this might feel like a hall of mirrors — it’s designed that way.

Offshore trusts can be used to add an additional layer of complexity to this chain of ownership. An offshore trust based in Bermuda can, for instance, own assets in Taiwan on behalf of a beneficiary in California. Some foreign trusts, like Simons’, hold the assets of a U.S. citizen but are regarded as foreign taxpayers, meaning that they conform to different rules of taxation and disclosure without breaking any U.S. laws.

Further complicating the blurry ownership of trusts is the lack of transparency with which they often operate. Such secrecy has been increased by tax havens like the Cayman Islands and even U.S. states like South Dakota, which have passed laws that make trusts an appealing vehicle for the ultra-wealthy seeking deep financial privacy. Bermuda is one of numerous jurisdictions that do not require trusts to declare their existence by registering with local government authorities.

“Trusts are now the most important, complex, non-transparent issue of the entire financial world,” said Jeffrey Winters, a political scientist at Northwestern University who studies economic elites. “There’s a reason why this might feel like a hall of mirrors — it’s designed that way.”

Offshore trusts accounted for the third-largest single area of Appleby’s business, according to an ICIJ analysis of the leaked data. By 2014, the leaked files contained information about more than 2,600 offshore trusts linked to individuals and companies from more than 100 countries. According to the analysis, roughly two thirds of these trusts are based in the Cayman Islands and Bermuda.

Big wealth and big corporations benefit

Appleby’s internal documents show that Bermuda, a remote sliver of land in the Atlantic, has become quietly populated by the world’s largest known private trusts, which enjoy favorable local tax laws. “The Bermuda trust,” according to an article on Appleby’s website, “is a popular estate planning vehicle for private clients wishing to structure their affairs in a tax efficient manner.”

The leaked documents from Appleby’s Bermuda office show that, between 2012 and 2015, the firm provided legal services to at least five secretive trust structures that each contained a billion dollars or more. In each case, the Appleby file lists the clients as “CONFIDENTIAL.” One of these anonymized clients held three related trusts — two in Bermuda, one in the Bahamas — that together contained $8 billion in 2015, according to a memo describing the matter. It remains unclear who is behind this particular fortune.

Offshore trusts can also be used by corporations to reduce tax bills. Appleby’s files reveal that Blackstone, a private equity firm founded by Stephen Schwarzman, an associate of President Donald Trump, minimized tax payments on large rental properties in the United Kingdom partly by using trusts based in Jersey, a tiny island that is home to more than 4,000 trust professionals. These U.K. properties were held by Jersey trusts, which were themselves owned by Blackstone subsidiaries in the tax haven of Luxembourg, according to a confidential tax memo.

This structure appeared to use loans between these subsidiaries to shift Blackstone’s profits from the U.K. to Luxembourg with no tax paid anywhere, according to Reuven Avi-Yonah, professor and tax expert at University of Michigan Law School, who reviewed the records.

In response to questions about these tax structures, a law firm for Blackstone sent ICIJ a statement saying, “Blackstone’s investments are wholly compliant with UK and international tax laws and regulations.” Blackstone said that it had acquired these structures “from institutional investors” and that the arrangements were commonplace for such real estate investments and had been used for decades in the U.K. The configurations, according to the statement, “were adopted after appropriate advice was taken from leading tax and legal advisors.”

The mathematician

Before James Simons became a hedge fund manager, he was an obsessive mathematician and teacher. He is a man with a no-nonsense demeanor that is quickly animated when explaining the basics of a complex equation or the quest for the origins of human life.

While working as head of the math department at Stony Brook University, on Long Island, Simons was investing on the side, parlaying the proceeds from a small yet lucrative investment in a Colombian tile factory into larger and more profitable bets.

In 1974, Simons and prominent mathematician Shiing-Shen Chern published the Chern-Simons theory, a geometric model that would later be incorporated into the study of string theory and identify Simons as a pioneer in his field. In August of the same year, Victor Shaio, a Colombian industrialist and a friend of Simons, established the Lord Jim Trust for Simons in Bermuda. In a statement, Simons said the trust was a surprise gift of $100,000 from Shaio, adding that “Victor could have established a U.S. trust, but he chose Bermuda.”

Because it was established by a noncitizen, U.S. tax authorities would consider the trust a foreign entity, limiting the Internal Revenue Service’s ability to tax its funds until it made distributions to its beneficiaries.

Responding to questions from ICIJ and its partners, Simons said he did not use the trust to steer money away from tax authorities. “When distributions were made from the Lord Jim Trust to my parents, children and myself, those distributions were reported to the IRS and taxes were paid,” Simons said.

In 1982, Simons founded Renaissance Technologies, a New York-based hedge fund that developed secret trading algorithms that would soon make the fund’s rates of return legendary on Wall Street. Over the next three decades, Renaissance developed into one of the most lucrative hedge funds on the planet, making Simons a billionaire many times over.

As Renaissance Technologies’ investments grew, so did Simons’ footprint on American life. Simons has become one of the country’s top political donors, leaning heavily toward Democratic candidates. During the last election cycle, Simons was the sixth-largest benefactor of U.S. political causes, giving more than $26 million, nearly all to Democrats, including $11 million to Priorities USA Action, a political action committee supporting Hillary Clinton.

Meanwhile, Simons’ business partner at Renaissance, Robert Mercer, has risen to the highest ranks of Republican Party donors, becoming one of the most influential backers of Donald Trump’s presidential campaign. (Mercer has also been an Appleby client).

Renaissance-linked campaign donations are not the only way the hedge fund has caused a stir in Washington. In 2014, the U.S. Senate’s Permanent Subcommittee on Investigations issued a searing report that accused Renaissance and another hedge fund of using a complex accounting maneuver to misclassify stock trades and improperly avoid an estimated $6.8 billion in taxes. The IRS is still attempting to collect related back taxes from Renaissance, according to Bloomberg News. Renaissance said the trades were legal and were not meant to avoid taxes.

Measuring wealth – and inequality

This Senate report came as Simons continued his steady rise on the Forbes list of richest Americans. He is now 25th on the list, with a net worth estimated at $18.5 billion. The Bloomberg Billionaires Index puts Simons’ net worth at $15.7 billion.

These rankings do more than cater to public curiosity about the ultra-wealthy; they also offer two of the few consistent measures of the growing share of wealth held by the world’s richest people – an important yardstick in the study of global development and inequality.

Such lists must often rely on incomplete public data. The Lord Jim Trust offers one example. Its fortune appears to have not been wholly accounted for by these lists. To include the trust in calculating Simons’ 2010 net worth would have vaulted him up the ranks of the super-rich. One trust document from 2010 states that, in addition to the trust’s $7.25 billion, Simons held more than $4 billion outside the trust. At that time, Forbes estimated Simons’ fortune totaled $8.5 billion.

End game is complicated

Yet factoring the trust into Simons’ wealth wouldn’t have been so straightforward, because its structure defied common categories used to calculate individual net worth. The trust’s assets can be seen as having existed in a quasi-charitable status that falls somewhere between a philanthropic mission and a potential engine of personal income.

You can accumulate a great deal more in a foreign trust that avoids paying taxes.

One feature of Simons’ trust, which appears to have operated in a legal manner, was its delaying the payment, perhaps forever, of billions in tax dollars it would owe to the IRS if it ever paid out its fortune to the Simons family. A large portion of the trust would go to a tax-exempt charity, thus helping both to fulfill Simons’ commitment to philanthropy and to erase the massive tax liability the trust has built up over the decades, the documents state.

Delaying taxes allowed the trust to reinvest more of its income, helping it to grow to a stunning size.

“You can accumulate a great deal more in a foreign trust that avoids paying taxes,” said Ellen Harrison, a partner at McDermott Will & Emery in Washington, D.C. who works in estate planning and trust law. “Over time, it will become much larger than its comparable U.S. trust. That’s simple. We know that.”

Getting the money out of such an offshore trust, however, can be a complex matter, according to Harrison. Unlike domestic trusts that must pay income taxes annually, foreign trusts like the Lord Jim Trust often pay much of their taxes only when funds are withdrawn – and those tax bills can be huge if the trust sits untouched for decades, according to experts and court documents regarding Simons’ trust. Because Simons’ trust had accumulated so much money for so long, it was incurring a multibillion-dollar U.S. tax liability approaching 80 percent, according to an accounting document in Appleby’s data. This would include more than $200 million in interest charges for the delayed payment of its taxes.

This tax liability, which would be triggered only if the Simons family received any of the fund’s aging billions, was growing by the day. One projection of the offshore trust’s growth indicates that, had it continued accumulating so much wealth, an attempt to withdraw the trust’s funds in 2030 could trigger a more-than-100 percent tax liability, including some $18 billion in interest charges.

Yet the billions in assets Simons held outside Bermuda gave him a key advantage: He didn’t need to withdraw funds for his personal use, so, for the most part, he wouldn’t.

According to tax documents, the trust would afford Simons the ability to continue delaying the huge tax paymentswhile having the option to receive substantial sums each year, without penalties or interest charges, from the annual returns on the trust’s massive investments. Although the interest charges would apply to the money the trust had accumulated in previous years, all timely distributions of the trust’s earnings within any current tax year would be taxed without any interest charge, so long as the funds were withdrawn in time, according to trust experts and the Lord Jim Trust documents.

‘Weak link’

For Simons and his family, such annual income could be immense, given how large the trust’s investments had grown, free of paying full income taxes. As of December 2010, however, the documents indicate that Simons received few withdrawals from the trust and had been more interested in simply watching the fund grow. In a statement to ICIJ, Simons said that, now that it has been given to a private charity, he has not received a distribution from the trust’s fortune for several years.

Trust funds date back to the 12th century, when knights riding away to join the Crusades left their property in the hands of financial protectors. Through the centuries, trusts evolved into a favored means of wealthy families seeking certainty in how their assets would be passed to younger generations.

In some cases, the obscured ownership that trusts offer have served other purposes by providing the means to hide money from tax authorities or from litigants with rightful financial claims. In 2013, The Economist magazine identified trusts as “the weak link” in the fight against concealing untaxed money globally.

Unlike the trusts of the Middle Ages, many modern trusts, including Simons’, are known as “discretionary trusts,”— flexible funds that allow trustees to pick and choose who among potential beneficiaries receive distributions and how much they get.

In December of 2010, representatives of Simons’ trust made a set of changes that, given the sum of money involved, they described as “momentous.” The trust would be divided into four “sub-trusts,” with Simons retaining a 54 percent share for himself, his foundation and other charities. The rest was split into three new offshore sub-trusts for his three children. (This was in addition, accounting documents show, to separate trust funds for each child, each containing more than $120 million.)

Like the Lord Jim Trust, the sub-trusts it spun off would make their investments through a shell company in Bermuda called Shining Sea Ltd., which held “a stable of funds by Renaissance and other investments including investment funds managed by other parties,” according to an affidavit from Richmond, the trust lawyer.

Each of the children’s new offshore sub-trusts would receive more than a billion dollars, as well as massive potential tax liabilities.

Yet the new trusts still had the potential to enrich the family, according to Richmond.

“Mr. Simons’ children and their descendants are neither excluded actually nor practically (fiscally)” from distributions of current income, Richmond wrote, adding, “which itself is liable to be substantial.”

In 2009 alone, the Lord Jim Trust grew by $1.3 billion. Out of that sum, the children’s separate trusts each received more than $15 million, according to an accounting document.

According to an accounting projection, the children’s new Bermudan sub-trusts, if left untouched, could each contain slightly more than $2 billion today.

Simons has lost two of his five children. In 2003, Nicholas Simons, 24, drowned while visiting Indonesia. Paul Simons, 34, died in 1996 after he was struck by a car while bicycling.

Simons family philanthropy

It’s not completely clear how the sub-trusts of Simons’ three surviving children have been managed, and they did not respond to questions regarding the trusts. In his written statement, Simons said that “the trusts for my children’s benefit have made donations primarily to Bermuda charitable foundations.” He did not name any in particular.

Yet the family’s past philanthropic giving may offer clues as to how the sub-trusts’ holdings may be spent.

Simons’ oldest child, Elizabeth Simons, 57, supports the Heising-Simons Foundation, which has a broad mandate to fund climate change research and promote clean energy. The foundation has supported press freedom and recently teamed up with the Simons Foundation to fund a $40 million observatory to study the nature of dark energy, dark matter and “the formation of structure in the universe.”

Her younger brother Nathaniel Simons, 51, who runs a Renaissance affiliate called the Meritage Group, co-founded the Sea Change Foundation, which has supported efforts to mitigate climate change and promote clean energy.

There is every reason to leave it offshore if you want to avoid the U.S. foundation rules.

In 2009, James Simons’ younger daughter, Audrey Simons, 31, established the Foundation for a Just Society, which has provided more than $43 million in grants to further racial justice, gender equality and human rights for marginalized communities in the United States and around the world, according to its website.

Meanwhile, their father’s New York-based Simons Foundation has made large donations to the computer science department at Stony Brook University and to support math and science education in secondary schools around the country, including direct financial support to thousands of high-performing math teachers. He has also heavily funded autism research. Simons said his U.S. foundation now holds $3 billion.

A new foundation, born in obscurity

Despite the Simons Foundation’s steady growth in recent years, its assets now appear dwarfed by Simons’ new charity in Bermuda.

The decision to transfer Simons’ portion of the offshore trust to the new Bermudan foundation is likely a boon to philanthropy with few precedents. But the offshore charity also raises questions. The scale of the transfer is staggering. In a written statement to ICIJ and its partners, Simons said the new charity’s assets are “meaningfully larger” than the approximately $3 billion currently held by his New York-based Simons Foundation, whose mission of funding scientific research and education it mirrors.

The new foundation operates in obscurity. It is exempt from filing the detailed annual reports required by the Internal Revenue Service, and appears to have little footprint in Bermudan public filings.

“There is every reason to leave it offshore if you want to avoid the U.S. foundation rules,” said Michael G. Pfeifer, a Washington-based lawyer with Caplin & Drysdale who specializes in estate planning and trusts for high-net-worth individuals.

When asked why he had chosen Bermuda for the new charity, Simons pointed to his trustees, saying it was their decision. He said they chose Bermuda in part to avoid rules that require charities to spend a minimum amount each year. (In the United States, charities must spend just 5 percent of their assets each year.)

He also said that a Bermudan foundation would make it easier to donate to charities overseas. Simons said his offshore foundation makes annual donations to research institutions in Europe as well as annual donations to the Bermuda Institute of Ocean Sciences. He added that the offshore foundation is in the process of making “sizable grants to U.S. research institutions such as MIT and Rockefeller University.”

“So far it has not been very active, but as time goes on its activity will increase,” Simons said of the new foundation. “In future years as my income decreases and ultimately ceases, SFI will play an increasingly larger role in funding.”

How much still hidden?

The quiet residence of Simons’ billions in Bermuda begs the question of how many more massive holdings remain undiscovered offshore, perhaps waiting to someday distribute their billions.

A likely answer is many, according to Gabriel Zucman, an assistant professor of economics at the University of California at Berkeley, who has studied how much global wealth has disappeared into tax havens around the world. Zucman estimates that $8.7 trillion in financial assets of wealthy households has gone missing by being routed to countries, mainly tax havens, other than those where the owners reside.

With the growth of the offshore financial services industry, Zucman said, such arrangements have become increasingly popular over the past two decades.

In addition to causing headaches for tax authorities around the world, he added, this has complicated the job of those seeking to study and educate the public about the widening gulf between rich and poor.

“There’s a lot of wealth that’s becoming harder and harder to measure,” Zucman said. “The end result is that we know way too little about how wealth is distributed and how wealth is growing in today’s world.”

Contributors to this story: Rigoberto Carvajal.