The United States House of Representatives moved on Tuesday to crack down on anonymous shell companies in a push to thwart money laundering, financial crime and terrorism.

The Corporate Transparency Act, which requires companies to disclose their true owners, was approved by a vote of 249-173, with 25 Republicans joining 224 Democrats in support.

“The US has been repeatedly reviewed and the biggest anti-money laundering loophole is the ease with which one can incorporate an anonymous shell company,” said Clark Gascoigne, the deputy director of the Financial Accountability and Corporate Transparency Coalition, a nonprofit group that has advocated for the legislation.

“This bill closes that loophole.”

Currently, no US states require companies to provide details of their ultimate owner, according to a press release from Rep. Carolyn Maloney, the legislation’s lead sponsor.

The new measure would require corporations and limited liability companies to:

- Disclose their beneficial owners, including names and identification numbers from a passport, drivers’ license or other government identity card, at the time of their incorporation

- File annual updates listing their current beneficial owners and any ownership changes that occurred during the previous year

- Define a beneficial owner as anyone who exercises substantial control, receives significant economic benefits or owns 25% or more of the company

Ownership data would be disclosed to the Treasury Department’s Financial Crimes Enforcement Network (FINCEN), which would keep the information in an internal database that other law enforcement agencies could review upon request.

A series of global investigations led by the International Consortium of Investigative Journalists, including the Panama Papers and Paradise Papers, have shown how offshore shell companies were used in dubious financial dealings including sanctions busting, tax avoidance and public corruption.

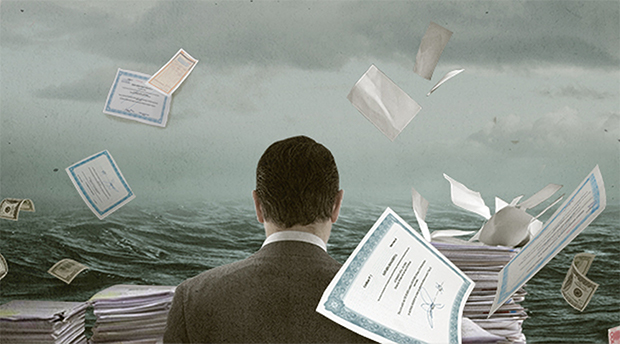

These abuses of offshore financial secrecy are dramatized in The Laundromat, the Netflix feature film based on the Panama Papers, which shows a series of vignettes illustrating practices from insurance fraud to embezzlement by public officials.

But while the popular image of shell companies centers on locales like Panama, U.S. states such as Delaware and Nevada are among the world’s most prolific destinations for secretive companies. More than two million corporations and LLCs are formed in the U.S. each year, and states do not currently require disclosure of beneficial ownership, according to findings by Congress cited in the text of the legislation.

Numerous law enforcement and national security officials have endorsed the legislation, and some contend that the U.S.’s lack of transparency poses a serious threat to global efforts to fight corruption and the political instability that it generates.

“Our lax regulatory policies mean that the U.S. is unwittingly complicit in the spread of the corruption that is an important factor in the global decline of democracy,” wrote Michael Chertoff, who led the Department of Homeland Security for four years under President George W. Bush, in an op-ed column on Tuesday.

In order to be enacted into law, the Corporate Transparency Act must also be approved by the Republican-controlled Senate and signed by President Donald Trump.

A similar bill called the ILLICIT CASH Act has drawn bipartisan support in the Senate, and in a statement this afternoon, the White House expressed support for the measure, although it urged Congress to revise the bill’s language to make it easier for small businesses to comply.

“The Administration believes this legislation represents important progress in strengthening national security, supporting law enforcement, and clarifying regulatory requirements,” the White House said.