Down-and-out in developed nations, Big Tobacco is refocusing its lobbying on emerging markets.

Multinational tobacco companies for years have been battered by politicians and lawyers in the United States and other developed nations like Australia and France. The global reputation of tobacco executives ranks near the bottom in public standing surveys. Market growth in the developed world has flattened out or declined. In the United States, the number of men who smoke dropped from 52 percent in 1965 to half that today. It appears to be so bad for the industry that one consulting group said selling tobacco represents “the worst operating environment in the world.”

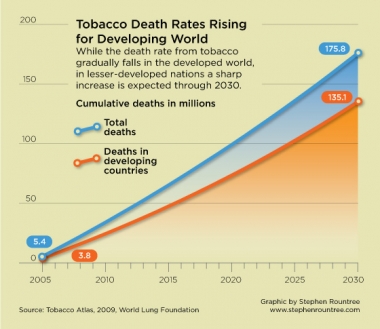

No wonder. The industry’s product is the world’s single-largest preventable cause of death. Between 2005 and 2030, tobacco-related illnesses will claim as many as 176 million lives worldwide, according to the World Health Organization.

And, since 2003, at least 171 countries, with some 90 percent of the world’s population, have signed onto the WHO’s Framework Convention on Tobacco Control – a legally binding international standard that governments can use to limit tobacco marketing and tamp down consumption with stern health warnings and higher cigarette taxes.

With all this pressure, it’s easy to believe that Big Tobacco is down and out.

But in five decades of fighting public health advocates over the dangers of smoking, the industry has proven time and again to be an effective brawler when its revenues are threatened. In fact, Big Tobacco may well have an answer to its woes: emerging markets and developing countries.

This week in Punta del Este, Uruguay, the WHO hosts the latest round of talks on global tobacco controls, meetings expected to draw hundreds of anti-tobacco activists, public health specialists, and industry executives from around the world. Held in Geneva the past two years, it is fitting that the current summit takes place in a developing country – one now in the middle of a contentious fight with the tobacco industry over proposed smoking controls.

Over the past decade, multinational tobacco firms have increasingly aimed their formidable lobbying prowess at weak governments in fast-growing nations. Their goals seem clear enough to public health experts: derail no-smoking laws and advertising prohibitions in countries rich with potential new smokers, especially among women and youths. For the industry, this is a chance to sustain and even add to its revenues, which, despite growing tobacco controls, reached an extraordinary $300 billion for the top five companies in 2008 – larger than the gross domestic product of all but 40 countries.

An upward curve

While smart business for Big Tobacco, it may well be a public health disaster for nations targeted by the industry. Of the 176 million tobacco deaths predicted to occur between 2005 and 2030, 77 percent will be in developing countries. The annual cost to the global economy – in direct and indirect health care and related costs – were estimated at $500 billion last year by the World Lung Foundation, a cost that will be borne increasingly in emerging markets. Much of the industry growth is in China, by far the world’s largest tobacco market, as well as places like Russia, Indonesia, and India – nations where cigarettes are at least $3 cheaper per pack than in the United States or Western Europe.

“This was our experience,” said Gro Harlem Brundtland, former WHO director general who led the international body in the years before its tobacco controls were established. “The industry is just too strong and there is too much money at stake for them not to try to subvert the control process.”

The growth in emerging markets is helping keep global rates of smoking on an upward curve. Despite Big Tobacco’s reputation and challenges by governments and public health advocates, an estimated 70 million people around the world started smoking between 1998 and 2008. This year the industry expects to sell more than six trillion cigarettes and cigars worldwide, up from 5.7 trillion in 2007.

Even in the United States, where statistics show 21 percent of adults are regular smokers, there is now a stall in the generation-long decline in tobacco consumers. Officials at the U.S. Centers for Disease Control and Prevention say this leveling out is due, at least in part, to tobacco industry marketing tactics.

“The industry has gotten even better at sidestepping laws designed to get people to stop smoking,” CDC director Thomas R. Frieden told reporters this year.

In a written statement, BAT defended its lobbying as above board and aimed at educating governments. “We believe the tobacco industry should be permitted to engage with regulators and participate in the development of policy that affects its business environment,” the statement says. “We always say who we are and where we’re from and we openly and transparently engage with governments to warn them of the negative impact some of these ill-thought out guidelines could have.”

Tobacco’s global rebound did not happen overnight.

For most of this year, journalists in six countries have documented the industry’s moves into emerging markets around the world. This inquiry, sponsored by the Washington, D.C.-based International Consortium of Investigative Journalists, has uncovered a long list of aggressive industry lobbying tactics from Moscow to Mexico City. Among the items in the industry’s tool kit: political campaign contributions; gifts and donations; helping regulators write new tobacco rules; threatening legal action against reforms; and in at least two cases, paying bribes to secure favorable trade deals and legislation.

It is difficult to gauge how much the industry has spent lobbying capitals in emerging markets, as the industry makes little of its political work public. ICIJ has traced millions of dollars to lobbyist firms, foundations, social clubs, and even government health ministries. Companies have donated computers to schools on behalf of politicians and made grants to favorite causes of politicians’ wives. The payoff for all this is delaying anti-smoking efforts in some countries, and derailing them entirely elsewhere.

Russian revolving doors

Consider the case of Russia, one of the most important emerging markets for the tobacco industry. Last year some 400 billion cigarettes were consumed in a country where about 60 percent of adult men and 22 percent of women smoke. Russia is also an important exporter of cigarettes to Eastern Europe. By 2012 – four years after signing the WHO’s tobacco control pact – Moscow promises it will have new limits on the industry. Getting there, however, has meant Russian leaders sloughing off decades of industry interference with government tobacco policy.

A Philip Morris spokesman in Russia, Sergey Chernenko, acknowledged that company officials took part in the working group. “It is a natural democratic approach to legislation,” Chernenko explained.

Industry influence is not hard to find in the State Duma, Russia’s national legislature. Ivan Savvidi is one of the Duma’s most influential legislators on tobacco control and tax policy, even though he once controlled Donskoy Tabak, the nation’s leading domestic cigarette brand. Savvidi’s wife now runs the company, which since 2007 has sold billions of cigarettes to the Russian military for soldiers’ ration kits, according to Russian government records.

Savvidi declined to comment for this story.

Mexican computers

Also critical to the tobacco industry is Mexico, where, despite a declining population of adult smokers, some 57 percent of teenagers between ages 13 to 15 have smoked at least once. In Mexico this year, an estimated 60,000 people will die because of tobacco-related illnesses, making tobacco one of the nation’s top killers.

Mexico also is home to Carlos Slim, the world’s richest man. Slim, who built his early wealth on sales of popular Mexican cigarette brands, first partnered with Philip Morris in 1997 and a decade later sold most of his tobacco holdings to the multinational company. He still owns 20 percent of the firm’s Mexico operation. He also has a seat on the parent company’s board of directors. In 2004, Slim also participated in a private meeting with then President Vicente Fox, according to a former government official who attended the meeting. After the meeting, the government announced a compromise in which the industry would help pay some costs of treating tobacco-related illness in Mexico – as long as the country put off new excise taxes on cigarettes.

Slim, of course, is not the only tobacco investor with interests at stake in the Mexican capital. Industry lobbyists spread largess to politicians, inviting them on trips abroad, feting them at auto-racing events, even supplying computers to their public school districts. After a donation in 2008 of 15 computers to a school in Guadalajara, the local legislator later inserted a rule in federal tobacco restrictions requiring universities to make space available for smokers.

To further hold back progress against smoking, the industry and its allies have launched a legal assault on Mexico’s tobacco control statutes. Lawsuits by a pharmacy chain, a group of casinos, and Slim’s Sanborn’s restaurants, among others, have easily blocked measures to limit public smoking. The net effect in Mexico, health experts say, are weak, incremental rules on smoking and tobacco sales that promise the industry a vibrant market for years to come.

Following the money

As the industry spends less in the United States to lobby legislators – the amount plunged from $65 million in 1998 to $24.6 million in 2009, according to the Center for Responsive Politics – WHO officials say they are seeing more government-relations work in emerging markets. But it is difficult to quantify exactly how much is spent in developing nations. Philip Morris International and British American Tobacco do not report lobbying expenditures abroad as they do in the United States. Japan Tobacco International said it does not discuss international lobbying expenses.

With its fast-growing economy and population, India is one of the world’s biggest tobacco markets; more than half the men, from 15 to 49 years old, smoke. Ironically, Japan Tobacco rolled into homegrown opposition from India’s powerful makers of bidis, small cigarettes, hand-rolled in tendu tree leaves, which are the choice of 100 million smokers.

About 300 bidi barons control a business that produces at least 550 billion smokes per year and operate with little government oversight. Bidi tycoons are closely tied to federal politicians. More recently, Talwar has become an ally of Praful Patel, the country’s aviation minister and a leading bidi merchant.

Japan Tobacco in India did not respond to ICIJ’s request for an interview.

Another industry target is Indonesia, the largest country that has yet to adopt the WHO tobacco standards. Standard cigarettes sell for about $1 a pack in Indonesia, and the domestic favorites – clove-flavored kreteks – are widely marketed to teens and children. It’s also a nation rife with official corruption – federal police are investigating several cases of alleged bribery among legislators, including some who have played roles in setting tobacco rules.

Still another tactic surfaced in Colombia. Last year, Philip Morris promised a $200 million investment in Colombia – just as politicians were discussing new rules designed to crack down on the industry. The agreement states that Philip Morris will contribute to tobacco seed improvement programs in the country, open a tobacco research lab, and fund forums on job creation and investment. The agreement also says it will provide “matching funds for crop substitution programs, including those that foster the growing of tobacco.”

“The timing of this agreement shows it was no mere business decision,” said Gigi Kellett, who directs tobacco research for Corporate Accountability International, a Boston-based nonprofit. The deal also conflicted with Colombia’s April 2008 adoption of the WHO agreement, which calls for producing countries to explore crop alternatives to tobacco.

As they did in Mexico, tobacco companies and their allies have raised threats of legal action against governments to blunt the impact of tough new controls.

Uruguay, for example, may end up in international court after Philip Morris warned the country to back away from plans for one of the world’s toughest anti-tobacco laws that would require dire health warnings covering 80 percent of cigarette packaging, and limit tobacco companies to selling just one variation of each brand.

Philip Morris said the country’s proposed tobacco controls violated international trade rules and would hinder its right to sell a legal product. It filed a claim with the trade-dispute settlement branch of the World Bank. Uruguay’s new president José Mujica, unwilling to take on the corporate giant, initially backed down. On July 23, the country’s health minister delivered a routine message on state television, outlining changes that would shrink the size of the health warnings and allow tobacco companies to once again sell more than one variety of each brand.

ICIJ’s examination of the Uruguay episode found that it was more than a simple claim of over-regulation by Philip Morris that led Mujica to retreat. Government sources in Uruguay say that while Philip Morris was applying legal pressure from abroad, the country’s domestic tobacco executives were privately pushing Mujica to strike a deal. The reason: Uruguayan manufacturers had complained that foreign tobacco was being sold at cut-rate prices that undermined domestic sales, and pushed for a compromise on tobacco controls as leverage to get foreign cigarette makers to raise their prices.

Since then, though, Mujica has had a change of heart. Backed by pledges of legal support from international anti-tobacco groups, the Uruguayan president now says his government may go ahead with some reforms.

Some tobacco companies simply didn’t have time for such niceties as hard-boiled lobbying and legal threats. In at least two instances, industry representatives have descended into blatant payoffs to foreign officials, earning scrutiny from federal corruption prosecutors in the United States.

Alliance One International and Universal Corp. are two U.S. suppliers of raw tobacco. In Thailand, Bobby Elkin was an executive with a company that later became Alliance. Prosecutors say Elkin orchestrated more than $500,000 in payoffs to officials from the government’s Thailand Tobacco Monopoly, which controls the nation’s cigarette industry. And in Greece, China, Kyrgyzstan, Malawi, and Mozambique, Alliance and Universal executives also doled out cash and gifts to government officials and friendly politicians.

The companies settled the cases with federal prosecutors, paying almost $30 million in combined fines. In late October, a judge in Virginia sentenced Elkin to probation, saying the former tobacco executive had faced a tough choice: conduct business how it’s done in those countries or lose a market. The judge also characterized Elkin’s actions as similar to how the CIA gathers intelligence.

Project Cerberus

From legal threats in Uruguay to insider deals in Russia, what appears to connect these global dots is an old political playbook the industry once considered but said it never used. In a series of secret industry meetings from 1999 to 2001, industry executives plotted how to fight back against smoking law reforms spreading around the globe. In attendance were executives from the three world leaders in cross-border cigarette sales – Philip Morris, British American Tobacco, and Japan Tobacco International – as well as leading international marketing and political consultants.

The meetings were held under the moniker “Project Cerberus,” named after the three-headed creature of Greek mythology that protected the gates of Hades. According to industry documents from litigation against the tobacco industry, the meetings focused on an informal unified industry strategy to fend off an international wave of controls that started in the United States and was about to crest with the forging of the WHO convention on tobacco. The idea was to instead push for an international body that would oversee voluntary industry steps to reduce the harm caused by tobacco, and to “maximize public acceptability” of that body.

Researchers who have dedicated years to plumbing industry documents made public by lawsuits say Project Cerberus set the stage for global push-back by the industry. In its first meeting, called “Regaining the Initiative,” the Cerberus group put forth ideas such as industry offers to write tobacco-control regulations; promises to voluntarily comply with new standards and avoid the need for government rules; and offers of research on why negotiated regulations work best. These measures were later employed in places like Russia and Mexico.

Project Cerberus and related initiatives have prompted tobacco control advocates to publish a watch-list of measures the industry most commonly uses to subvert proposed smoking and advertising controls. The “Seven Deadly Ds”: deny the harm tobacco poses; deceive the public via paid-for science on tobacco; divert governments by promising cooperation; distract attention by pointing to other public health threats; establish decoys of pro-tobacco coalitions of retailers and farmers; make dire economic predictions of economic harm because of tobacco controls; and delay controls via legal challenges.

In its statement, BAT described Project Cerberus as an industry move to create international marketing standards that recognize a need for self-regulation. “When we acquire new companies, they are expected to bring their marketing practices in line with our standards within a reasonable timeframe,” the company said.

To combat industry influence, the WHO tobacco convention included rules barring company participation in writing standards in individual countries, and urged governments to more closely monitor industry lobbying. But in the rough-and-tumble world of politics in developing nation capitals, such controls can be tough to enact, and even tougher to enforce.

“In the new history of Russia there were adopted just two halfway serious restrictions for the industry…the ban on advertising on TV and on billboards,” complains Dmitry Yanin, head of the Russian Confederation of Consumers Associations. “All other anti-tobacco initiatives remained just as intentions… or were adopted in very soft variations without any harm to the industry.”

The effect of the interference has been to slow and dilute reforms, said Derek Yach, former top assistant to the WHO director general and now head of PepsiCo’s Global Health Initiative. “Incremental legislation is favored by the industry,” Yach said. “And every tactic used by the industry in the past will be used again. They’ll do so as long as they can get away with it.”

Ricardo Sandoval Palos is a project manager for the International Consortium of Investigative Journalists.