REAL ESTATE

Russians bought up $6.3B in Dubai property after 2022 Ukraine invasion, report finds

A trove of leaked records reveals Russian property holdings soared “more than tenfold,” economists say.

Since the 2022 invasion of Ukraine, Russian nationals have bought up $6.3 billion in existing and in-development properties in Dubai, a group of economists with the EU Tax Observatory and Norway’s Centre for Tax Research estimated in a recent report.

The influx of Russian investment into Dubai real estate in the past few years has been previously documented but newly leaked property records from 2022 now provide a snapshot of its scope. The records were obtained as part of Dubai Unlocked, a recent collaboration by ICIJ and 70-plus media partners led by Norwegian financial outlet E24 and the Organized Crime and Corruption Reporting Project.

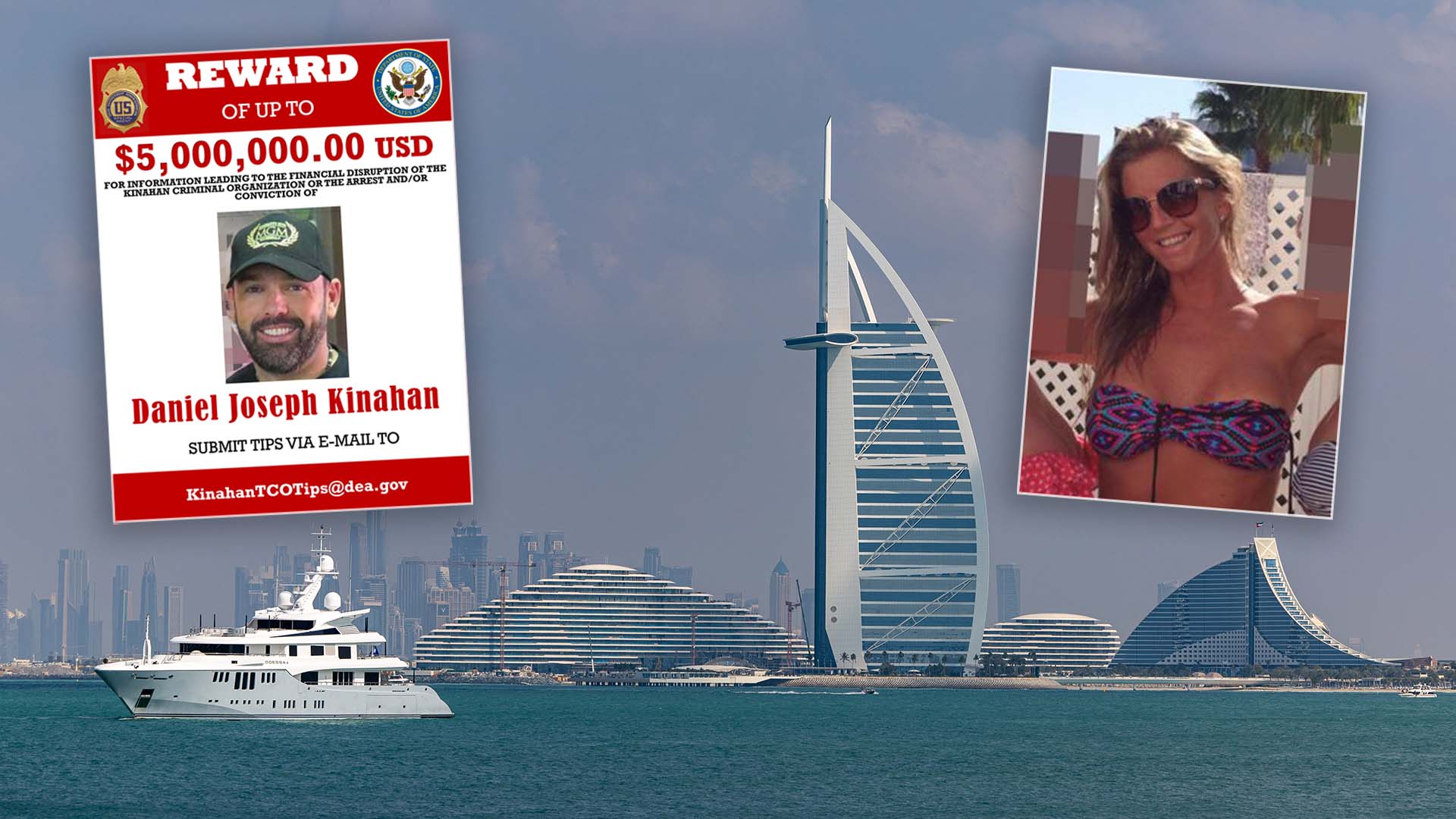

The six-month investigation into the UAE’s booming and secretive property market shows how politicians, alleged criminals and suspected sanctions evaders — from “cryptoqueen” Ruja Ignatova to accused drug kingpin Daniel Kinahan — bought real estate in some of the most exclusive neighborhoods in the Middle East.

About the Dubai Unlocked data

The property records at the heart of Dubai Unlocked come from multiple leaks totaling more than 100 datasets, mostly from the Dubai Land Department, plus publicly owned utility companies.

The economists’ report, co-written by Annette Alstadsæter, Matthew Collin, Bluebery Planterose, Gabriel Zucman and Andreas Økland, presents updated estimates of foreign-owned real estate for the years 2020 to 2024, drawing on both the leak and additional transaction data.

“We estimate that the amount of Russian money flowing into Dubai real estate has increased more than tenfold following the invasion of Ukraine,” said Matthew Collin, senior researcher at the EU Tax Observatory. “This illustrates how the city became a prime destination for elite Russians evading sanctions or escaping the war itself.”

Of the $6.3 billion worth of residential properties purchased — a “conservative estimate,” according to the report — $2.4 billion worth were existing properties and $3.9 billion were still under development.

Russians in Dubai

Among the investors were key players in Russian politics, state companies, and business — as well as colorful characters, like the spy Anna Chapman.

Chapman was arrested in New York in 2010 for espionage and then subject to a prisoner exchange between the U.S. and Russia. Property records suggest she purchased an apartment in Dubai early in 2022 for $566,000, shortly after promoting property investments in the city to her Russian followers on Instagram, according to E24.

In March 2022, less than a month after the launch of Russia’s full-scale invasion of Ukraine, one of the richest deputies of the Russian State Duma, Grigory Anikeev, bought a $13 million penthouse apartment in the exclusive Serenia Residences on the Palm, according to IStories reporting on the leak and available transaction records.

In April 2022, Irina Kupareva — Anikeev’s once-partner and the mother of one of his sons — also became the owner of a 140-square-meter apartment in the same Serenia Residences complex, IStories and The Times of Malta reported. Earlier this year the apartment was rented out for $84,000 a year. Olga Poliakova, the mother of another of Anikeev’s sons, is also the listed owner of two properties in Dubai worth $3 million total, the two outlets reported.

The property records from 2022 obtained by the Dubai Unlocked investigation include 5,000 Russian citizens and companies as listed owners of 6,600 residential Dubai properties worth an estimated $3.3 billion. In addition, reporters found that several Russian citizens appear in the data with other nationalities and passport numbers; the use of multiple citizenships can help sanctioned individuals evade scrutiny.

The team of economists estimated the total Russian investment in Dubai residential real estate was $4.8 billion in 2022 — even higher than the leak revealed, making Russians seventh among foreign owners of residential property.

Money laundering and tax evasion risks

The researchers found that, in 2020, foreign nationals owned approximately $98 billion worth of Dubai residential real estate — a number that jumped to $121 billion in 2022. That’s 43% of the total value of all residential real estate and higher than any other city in the world with available estimates. By 2022, they also owned $39 billion in properties under development.

The sheer size and scale of foreign investment in the Dubai real estate market represents a “money laundering vulnerability,” the report warned.

“It is well known that real estate is one of the sectors that is prone to money laundering and that requires most attention and due diligence,” EU parliamentarian Markus Ferber, a deputy chairman of the parliament’s subcommittee for tax matters, told E24. “It seems Dubai has made it a business case to look the other way.”

The scale of foreign investment in Dubai has implications not only for the emirate but also for other governments as it creates “a major blind spot for foreign tax authorities,” the researchers noted. For example, about 70% of Dubai properties owned by Norwegian taxpayers were not reported for tax purposes in 2019, according to a previous report.

In an emailed statement to ICIJ’s U.K. media partner, The Times, an official with the UAE’s British embassy said that the “UAE takes its role in protecting the integrity of the global financial system extremely seriously,” and that the country “works closely with international partners to disrupt and deter all forms of illicit finance.”

The report presents three policy recommendations to combat the potential flow of suspicious funds through Dubai real estate.

Increasing international collaboration and exchange of information makes it harder to hide money in foreign banks … But real estate remains a blind spot.

— Annette Alstadsæter, EU Tax Observatory

The first entails including real estate in automatic-exchange-of-information reporting agreements, like the OECD’s Common Reporting Standard — which requires jurisdictions to collect and share information from their financial institutions with each other.

The economists also recommended the creation of a global assets registry to help track wealth, property and other assets and identify their true owners, and the renewal of international pressure on the UAE to clean up its real estate sector.

“Increasing international collaboration and exchange of information makes it harder to hide money in foreign banks,” Annette Alstadsæter, a professor of economics and program director at the EU Tax Observatory said. “But real estate remains a blind spot and a means to hide assets from the authorities.”