In August 2023, an executive at Israel Bonds — an organization that sells bonds to fund that nation’s government and buttress its military — emailed the Ohio state treasurer’s office a sales pitch: Could the state of Ohio buy a batch of Israeli bonds for $5 million?

In less than 40 minutes, the treasurer’s office approved the purchase, bringing the state’s Israeli bond purchases to a total of $35 million for that year.

The fast deal was made between parties that were on exceptionally friendly terms, according to a trove of emails and other records obtained by the International Consortium of Investigative Journalists. And it was not the only matter being discussed with Israel Bonds. As Ohio Treasurer Robert Sprague, a Republican, allocated millions in state funds to the bond purchases, he was also making arrangements with Israel Bonds’ business development team to join its exclusive guided trip to Israel, scheduled for later that year.

Six weeks after the Ohio treasurer’s $5 million purchase, Hamas launched its deadly Oct. 7 attack, which killed an estimated 1,200 Israelis. Another 250 were taken hostage. In the following days, there was an outpouring of public support from lawmakers at all levels of government in the United States for the country’s closest ally in the Middle East. While Israel launched its retaliatory bombardment of the Gaza Strip — and President Joe Biden shepherded billions in funding and military aid through Congress — many state and local governments showed their support through a lesser-known financial mechanism: investing in sovereign bonds issued by Israel. Since the start of the war, U.S. states and municipalities have bought more than $1.7 billion in Israeli bonds, with Democratic and Republican officials around the country boasting of their investments as a show of support for an Israel at war.

Israel Bonds, which is based in New York, has meanwhile found itself caught up in a global political maelstrom since Oct. 7. Activists have singled out Israel Bonds in demanding that corporations and institutions divest from financial instruments supporting Israel’s government.

The more than 2,000 pages of emails and other records obtained by ICIJ offer an unprecedented glimpse inside Israel Bonds’ extensive efforts to court public officials in the U.S. with highly personalized sales pitches and pro-Israel messaging. The documents show how some officials who buy these bonds have gained access to an often-glitzy world of gala dinners, cocktail celebrations, and private meetings with top Israeli leaders and senior military officials — and how these dealings with Israel Bonds sometimes blurred the lines between private life and official business.

These types of practices, the mixing up of the personal and official, seem to go well beyond what’s seen as acceptable.

— law professor and ethics expert Richard W. Painter

In a statement to ICIJ, a spokesperson for Israel Bonds said that the bonds are a safe investment and that the group places importance on building relationships with its customers, partially to keep continuity if key decision-makers leave offices. “Investors usually choose to invest for a simple reason: Israel bonds offer strong credit as well as strong and steady returns,” the spokesperson, Nathan Miller, said in the statement. “The State of Israel has never missed an interest or principal payment in almost 75 years of issuing bonds.”

When an elected official tasked with investing taxpayers’ money buys government bonds, it’s usually a dry and straightforward process with little interaction between the seller and buyer. Government officials are generally discouraged from actions that could be construed as creating a conflict of interest — that could cause them, for instance, to favor certain assets for any reason other than selecting the best investments available. Ethics experts say some state officials may have crossed an ethical line in their dealings with Israel Bonds.

“This is an area of ethics where there are many potential conflicts of interest,” said Richard W. Painter, a law professor at the University of Minnesota who was a chief White House ethics lawyer during the George W. Bush administration. “These types of practices, the mixing up of the personal and official, seem to go well beyond what’s seen as acceptable,” Painter said, referring to actions of public officials described in this article.

But Miller said that “Israel Bonds marketing practices and events are legitimate, appropriate, and common practice” in the industry.

In an era of war and rising concerns over antisemitism in the U.S. and abroad, Israel Bonds sees itself at the vanguard of securing the future of the Jewish state. And given the historic scale of its operations, which have raised $52 billion over more than seven decades, Israel Bonds’ performance could have real consequences for Israel’s future.

‘The buck stops with me’

For decades after its launch in 1951, Israel Bonds, formally known as the Development Corporation for Israel, primarily focused on customers from the Jewish diaspora in the U.S. to bolster the fledgling Middle Eastern state. Israeli bonds have long been pitched as gifts for birthdays and bar and bat mitzvahs. But the bond seller — and its marketing strategy — has evolved, becoming an important source of government financing as it courted banks and other institutional investors, more recently including U.S. states and municipalities.

“In some ways, the Israel Bonds program is one of the — if not the — most successful sovereign debt issuance programs in the history of the world,” said Mitu Gulati, a law professor specializing in international debt finance at the University of Virginia Law School. “They’ve never defaulted. And they have managed to tap retail investors,” Gulati said, referring to individual investors, who generally deal in smaller quantities.

In the early weeks of the war in Gaza, though, the Financial Times reported that Israel quickly borrowed billions of dollars by issuing bonds through privately negotiated deals, despite growing concerns about the bonds’ risks. Over the past year, credit rating agencies have downgraded Israeli government bonds due to growing political instability, although the bonds are still considered well within “investment grade territory,” according to Bloomberg.

But many U.S. state and local governments were undeterred by the country’s turbulence. On Oct. 11, Sprague announced Ohio’s plan to invest an additional $20 million in Israeli bonds. “Now is the time to stand with Israel,” he said in a statement. Around the same time, Stacy Garrity, Pennsylvania’s treasurer, announced a major investment, bringing the total for her state to $56 million.

“Israel Bonds have a proven history of providing great value to investors,” a spokesperson for Garrity told ICIJ in a statement. “They are reliable, secure investments that benefit Pennsylvania taxpayers and encourage economic growth in Israel, one of our nation’s greatest allies.”

Joseph Abruzzo, the chief financial officer of Palm Beach County, one of Florida’s wealthiest counties, announced an additional $160 million investment in Israeli bonds in October alone. Abruzzo, a Democrat, made one announcement in a press conference alongside Mark Ruben, the Palm Beach executive director of Israel Bonds.

Standing behind a lectern adorned with the Israel Bonds logo, Abruzzo said: “First and foremost I have a fiduciary duty to the taxpayers of Palm Beach County. … And, quite frankly, when it comes to managing our money, the buck stops with me.”

On March 12, 2024, the Palm Beach County Board of Commissioners approved Abruzzo’s request to lift the cap on the investments from 10% to 15% of the portfolio. Two weeks later, Abruzzo held another press conference to claim the county’s new title of “world’s largest investor in Israel Bonds,” which accounted for roughly $700 million of its $4.67 billion portfolio. In May, three Palm Beach County residents — all U.S. citizens with Palestinian heritage — sued Abruzzo for allegedly breaching his fiduciary duty to taxpayers and for investing for “social, ideological, and political reasons,” according to court documents. One of the plaintiffs said in the complaint that the Israel Defense Forces had killed 37 of his family members since Oct. 7.

“We expect the frivolous case brought against me in my capacity as Clerk will be quickly dismissed with prejudice,” Abruzzo, who is also clerk of the circuit court, said in a statement emailed to ICIJ. He added that the response to the county’s investment in Israel Bonds had been “overwhelmingly positive.”

The Palm Beach County lawsuit followed a spate of protests that brought increased scrutiny to Israel Bonds due to the war in Gaza, which has now killed more than 38,000 Palestinians, according to Gaza’s Ministry of Health. More than 600 Israeli soldiers have been killed since the Oct. 7 attack, according to the Associated Press. “This is different than, say, someone managing a hedge fund or a private person’s money — it’s public money,” Lydia Ghuman, a legal researcher who worked on the lawsuit, told ICIJ. “So it’s held to higher standards.”

In December 2023, both Sprague and Abruzzo joined Israel Bonds’ newly formed Government, Industry and Financial Services Leadership group, alongside Illinois’ treasurer, a Democrat, and treasurers from Pennsylvania and Oklahoma, both Republicans. The purpose of the group was to help Israel Bonds strengthen ties with government and other institutional investors in the U.S., according to media reports. Sprague was named chair.

In interviews, a half dozen experts on state treasuries explained that a treasurer normally chooses bonds based on expected performance alone, and that extensive interaction with sellers is rare.

Bill Lockyer, a former treasurer of California, said his office bought bonds only in arms-length transactions. Early in his tenure, he said, a major bank hosted a swanky event in Napa Valley. Although he attended the daytime activities, he recalled declining a hotel room and skipping the bank’s dinner due to ethics concerns. “I got my own motel and ate at the local Mexican restaurant,” he said. “I didn’t want to violate anything.”

High-level visits and access to Israeli officials

The itinerary for Sprague’s planned October 2023 trip to Israel reads like a luxury vacation mixed with an official state visit, offering a level of access and prestige available to few people. In a statement to ICIJ, Sprague’s office said he had planned to pay for the Israel trip with personal funds, some of which he had already spent before the trip was canceled following Hamas’ Oct. 7 attack on Israel.

A spokesperson for Sprague, who has purchased $357.5 million of Israel Bonds on behalf of Ohio since 2019, said that there was nothing unusual or inappropriate about his relationship with Israel Bonds. The spokesperson added that every Ohio treasurer since 1993 had invested in the bonds, which have “consistently proven to be a strong and reliable investment for the state portfolio.”

The Israel trip was to begin with Sprague checking into a five-star Jerusalem hotel before being shuttled to a gala dinner at a subterranean venue with vaulted stone ceilings. The following days included a trip to the City of David, the controversial archaeological site, for “an exclusive tour of places not yet open to the public, including groundbreaking archeological artifacts.”

Also on the itinerary: a visit to the country’s Ministry of Foreign Affairs to meet with Foreign Minister Eli Cohen and a trip to Israel’s legislature, the Knesset, to meet with the country’s top lawmaker, Amir Ohana, speaker of the Knesset. It included a wine tasting at a vineyard, exclusive tours of two military bases, and a private, after-hours tour of Tel Aviv’s Museum of the Jewish People to see the earliest copy of the Hebrew Bible. On the final day of the trip, the itinerary listed a visit to Israel’s presidential residence for a meeting with President Isaac Herzog.

In a statement, Nathan Miller, the Israel Bonds spokesperson, said that only one public official — presumably Sprague — had registered for the ultimately canceled 2023 trip, and that the official planned to pay for the trip himself at the same rate as other attendees. No U.S. public officials have attended an Israel Bonds trip since 2019, Miller said. He added that Israel Bonds “has frequently facilitated missions to Israel for our leadership and investors” and called the trips “substantive educational opportunities for our investors to learn more about the financial health and economy of the country that they have invested in.”

Sprague listed a personal email address on the registration form for the trip, but his Ohio treasurer’s office email account was used for at least some communications around the planned trip. A spokesperson for Sprague said that “if a correspondence pertaining to office business was sent to a personal email address, it was appropriately forwarded to office channels for any further action.”

This wasn’t the first time Israel Bonds had helped plan Sprague’s travel. In March 2023, the organization hosted a conference in Washington, D.C., to commemorate Israel’s 75th anniversary. In an email message to Sprague’s office, a sales executive for Israel Bonds said he had reserved a hotel room for Sprague at the four-star Grand Hyatt.

The Washington event featured a cocktail reception, dinner and a Q&A with Sprague and Illinois Treasurer Michael Frerichs, for which Israel Bonds provided Sprague questions in advance. The organization also offered Sprague and Frerichs a private meeting with Israel’s finance minister at the event, according to Israel Bonds emails to Sprague. Frerichs did not respond to ICIJ’s questions about the potential meeting, and a spokesperson for Sprague said that the meeting did not take place.

Three months later, Sprague’s office reimbursed Israel Bonds $727 for his hotel and meal expenses at the event.

Late last year, Sprague traveled to Florida, where he attended an Israel Bonds gala dinner in Palm Beach to present an award honoring that state’s chief financial officer, Jimmy Patronis, for his support of Israel Bonds, including the state’s major bond purchases. A spokesperson for Treasurer Sprague said the trip “included work not for state business and that no public funds were used in paying for the trip.” Instead, Sprague used campaign funds to pay for “travel expenses and meals related to the trip,” the spokesperson said. In late 2023, Sprague had already assumed his second term in office and, due to Ohio’s two-term limit on treasurers, was ineligible to run for a third. The spokesperson said that term limits of the current office do not “preclude him from running for a different state legislative or executive office in the future.” The spokesperson did not answer questions about what campaign activity took place in Florida, referring questions to Sprague’s campaign, which told ICIJ he attended political meetings in Florida without providing further detail.

Ohio’s ethics law forbids public officials from taking substantial gifts from an “improper source,” including from any person or organization “seeking to do business with the agency.” Things of substantial value, according to the website, include lavish meals and entertainment activities. Sprague’s 2023 financial disclosure form lists nothing related to Israel Bonds.

The office of Illinois Treasurer Frerichs did not respond to ICIJ’s repeated requests for comment, which included questions about who paid for his hotel and dining costs at the March 2023 Israel Bonds conference in Washington. (Illinois ethics laws forbid a public official from accepting gifts of more than $100 total in a calendar year from anyone who does business with the state.) Frerichs’ office also did not respond to questions about whether he used a private email account to correspond with Israel Bonds, as the emails from his public account that ICIJ obtained appear to include no mention of the Washington event.

Archon Fung, a professor focusing on democratic governance at Harvard University’s Kennedy School of Government, said that transparency is key for officials, who naturally face a variety of potential ethical pitfalls. “Conflicts of interest are ubiquitous in public life,” Fung said. “For somebody in a public role, they have to explain how they are managing these issues. If there is a conflict suspected, then the public is owed an account.”

Israel Bonds said it paid the expenses for speakers at the Washington event, and that “expenses were modest and we did not ask our speakers for reimbursement.”

“Just like any other business, it is common practice for broker dealers to host seminars, meetings and conferences, during which clients and potential clients attend to discuss issues of interest to them,” Miller said in a statement. “We invite a variety of speakers to present, including elected officials, and often pay for housing and transportation for those speakers who are coming in from far away. These expenses are modest.”

Miller said that public officials speak at numerous conferences and events each year, including for financial professionals, as part of their public responsibilities.

Few states, if any, have formed the kind of partnership with Israel Bonds that Florida has. The Sunshine State has a treasury holding more than a quarter billion dollars’ worth of the bonds. As chief financial officer, Patronis, who has led a major drive to invest the state’s money in Israeli bonds, has been recognized by Israel Bonds several times in recent years.

“CFO Patronis is committed to providing the best return on investment for taxpayers’ dollars,” Devin Galetta, a spokesperson for Patronis, told ICIJ in an email, adding that four Florida state treasurers have bought Israeli bonds. “Since 2001, Florida has earned approximately $29 million in interest from State of Israel bonds.”

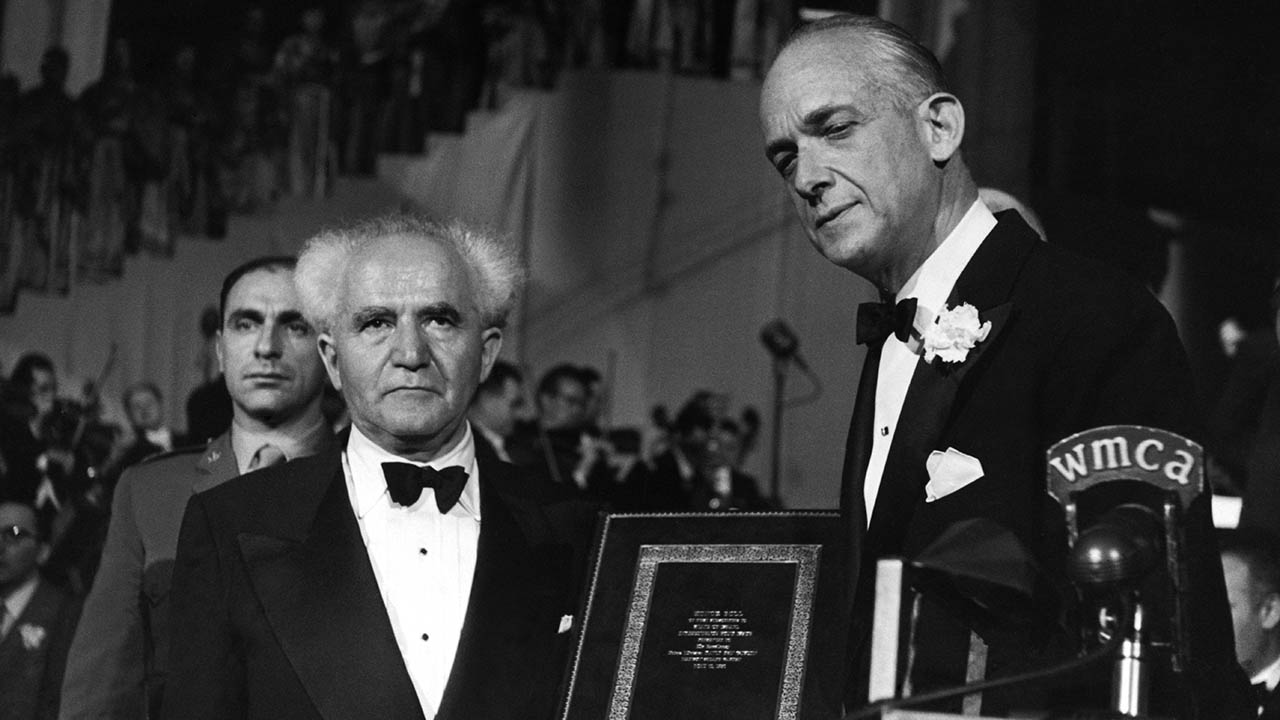

In 2018, after Patronis began dramatically increasing the state’s holdings of Israeli bonds, the bond seller honored him at a celebration during which he was presented a plaque by Israeli army Maj. Gen. Mickey Edelstein, then the nation’s military attache to the United States.

The following year, Patronis went on a trip to Israel that was reported by the Tampa Bay Times to be partly sponsored by Israel Bonds, which said it hosted a meal for the delegation. Patronis and a delegation of Florida politicians and business people were joined on the trip by two Israel Bonds executives, according to an official itinerary of the trip posted online.

In 2020, Israel Bonds held a celebration in which Patronis was honored for originating state legislation that enshrined a commitment to continue buying Israeli bonds. In 2022, the group hosted Patronis as a special guest at its annual Prime Minister’s Circle Gala in Boca Raton. And last year, the bond seller made Patronis the main attraction at the same gala event, presenting him with a top honor called the Israel Bonds Leadership Award. This was the same December event that Sprague attended.

In response to ICIJ’s questions about who paid for Patronis’ costs around Israel Bonds events, Galetta responded only that “all appropriate statutory requirements have been met.”

‘What can I do for Israel?’

Last year, Democracy for the Arab World Now, or DAWN, a nonprofit organization that has accused Israel of human rights violations, submitted a complaint to the U.S. Department of Justice alleging that Israel Bonds appeared to be violating a federal law designed to keep tabs on foreign influence operations in the U.S. The complaint urged the Justice Department to investigate whether Israel Bonds broke the law by not registering as a foreign agent.

Miller called the letter “false and defamatory” and said Israel Bonds “is not a foreign agent, and never has been.”

As the Securities and Exchange Commission-registered underwriter for bonds issued by Israel, Israel Bonds acts as a private seller for the Israeli Finance Ministry, including in times of crisis and conflict, when sales have historically spiked. The recent funding campaign has raised a staggering $3 billion worldwide.

At the same time, the group has attracted new attention from activists seeking divestments from Israel. In May, the advocacy group Jewish Voice for Peace protested outside Israel Bonds’ Philadelphia offices, shutting down city streets and demanding government offices withdraw investments in Israel.

In a marketing video titled “Israel at War,” released in December, footage of soldiers is overlaid with the words: “When you ask yourself ‘What can I do for Israel?’ Go today to israelbonds.com and make an investment in Israel bonds.” As previously reported by The Guardian, many of the U.S. states that answered the call are the same ones that have railed loudly against investment strategies based on social and environmental issues, such as climate change. The Guardian found that the majority of state financial officials who invested millions in Israeli bonds in the first month of the war belonged to a conservative group that is now lobbying to keep “the Left” out of state treasuries.

In mid-2021, Thomas Clancy, Pennsylvania Treasurer Stacy Garrity’s then-chief investment officer, cautioned that Israeli bonds could be a risky investment for the state, according to emails obtained by ICIJ. Clancy emphasized Israel’s political instability and the country being “frequently involved in military violence.” He also noted that the bonds are not traded on the open market — meaning, regardless of headwinds the nation may face, buyers are stuck with the bonds until they pay out. He proposed “investing in more liquid securities, with fewer risks to the investment capital.”

His advice was not followed. Erik Arneson, a spokesperson for the Pennsylvania Treasury Department, pointed out in an email to ICIJ that the chief investment officer “is one member of the Pennsylvania Treasury Department’s Investment Committee” and that “In this case, the other members of the Investment Committee did not agree with the former CIO’s view on Israel Bonds.” Arneson also emphasized that Israel Bonds has never defaulted on its payments. “Treasurer Garrity decided to continue the Pennsylvania Treasury Department’s longstanding practice of investing in Israel Bonds,” Arneson added, after listening to a range of views and considering such factors as the bonds’ rate of return.

On Oct. 10, 2023, Pennsylvania’s new chief investment officer conveyed an opportunity from Israel Bonds for the state to make an additional investment “given everything taking place.” It took Garrity just an hour to confirm that she would “love” to temporarily increase the state’s investment by $10 million. By Oct. 12, she publicly pledged to double that amount to $20 million worth of bonds.