TAX HAVENS

Former BVI premier sentenced to 11 years in prison for cocaine-trafficking conspiracy

Two years before his arrest in Miami, Andrew Alturo Fahie pledged to pull back the curtain on the islands’ notoriously secretive financial services industry.

A U.S. court has sentenced a British Virgin Islands leader, who pledged to clean up the Caribbean archipelago’s reputation as a tax haven, to more than a decade in prison for cocaine trafficking and money laundering conspiracies.

Earlier this year, the former BVI premier and finance minister, Andrew Alturo Fahie, was convicted at trial of agreeing to facilitate the safe passage of thousands of kilograms of Colombian cocaine through BVI ports en route to Miami. He was sentenced in Florida last week to 135 months in prison.

Fahie was arrested in April 2022 by the U.S. Drug Enforcement Administration after its agents pretended to be members of the Sinaloa cartel — once run by the notorious Mexican drug lord El Chapo — to lure Fahie to the United States, where he agreed to the fake smuggling scheme.

In September 2020, Fahie pledged BVI would introduce a public register of company owners in the secrecy jurisdiction.

“In advancing this commitment, we will be informed at all times by global best practice at the time within a timeframe that we consider deliverable,” Fahie said.

Reform plans for the proposed register have stalled.

The BVI, an overseas territory of the United Kingdom consisting of four main islands and more than 50 smaller ones east of Puerto Rico, has a well-documented history of being misused by drug traffickers, tax evaders and money launderers.

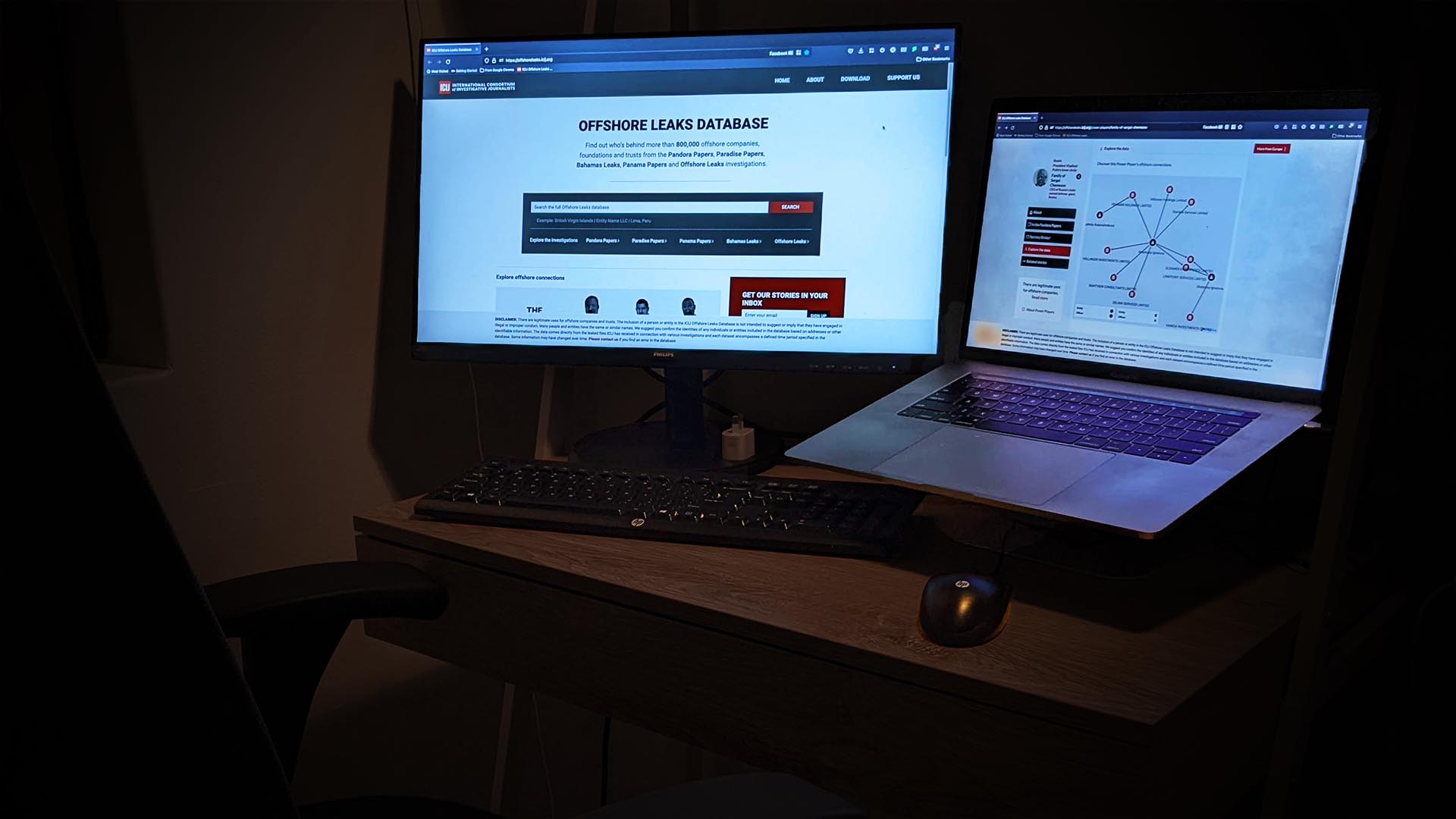

The islands, and secretive entities created there by financial services providers, have played an outsized role in major ICIJ investigations since 2013.

As part of the 2013 Offshore Leaks investigation, reporters identified the oldest daughter of the late Philippine dictator Ferdinand Marcos as a beneficiary of a BVI trust. ICIJ also identified BVI companies owned by the son of a former South Korean president embroiled in a tax evasion scandal and of China’s former ruler, Wen Jiabao.

The 2015 Swiss Leaks investigation revealed that HSBC Private Bank in Switzerland helped customers set up shell companies in BVI to skirt a new tax law.

BVI was the secrecy jurisdiction of choice for customers of the Panama-based law firm Mossack Fonseca, according to an ICIJ analysis of leaked files that formed the basis of the 2016 Panama Papers investigation. Mossack Fonseca created more than 113,000 BVI companies, which outstripped Panama as the world’s most popular tax haven.

According to evidence introduced at Fahie’s trial, during March and April 2022, Fahie, a BVI ports official and the official’s son participated in a series of meetings with the purported Sinaloa Cartel drug trafficker to broker the arrangement.

Fahie and the two others “agreed to secure licenses, shield the cocaine-filled boats while in BVI’s ports, and grease the palms of BVI government officials and employees,” according to the U.S. Attorney’s Office, Southern District of Florida. The group discussed bringing 3,000 kilograms of cocaine through a BVI port as a test run, U.S. authorities said, followed by 3,000 kilograms once or twice a month for four months. In exchange, Fahie and the port director would get a percentage of the millions of dollars in cocaine sales.

A 2022 Transparency International report found “endemic problems” with the BVI as the “destination of choice for the corrupt and other criminals to hide and launder their ill-gotten gains.”