Christopher Williams had been waiting 90 minutes inside the office of a helicopter tour company on the Hawaiian island of Kauai, keeping a careful eye on the airport parking lot below.

In his hands he held court papers, ready to be served on a Russian billionaire locked in a high-stakes divorce. He wore a small video camera to record the moment.

Suddenly Williams saw his chance. He uncrossed his legs and exhaled. He opened the door and sprinted down a short flight of stairs and across the asphalt to a convoy of white SUVs. Inside one of the vehicles was Dmitri Rybolovlev, a mining magnate. His wife Elena claimed he was hiding money she sought in their divorce.

“For Dmitri,” Williams said as he flung the court papers through an open driver’s side window into the lap of one of the billionaire’s chauffeurs. He locked eyes with Rybolovlev as the driver hit the gas pedal to speed away.

“Served!” Williams shouted, breathlessly.

Williams’ pursuit was one episode in a global asset hunt in one of the world’s bitterest divorces. It illustrates the lengths that spouses, their lawyers and professional trackers must go in search of wealth stashed offshore in complex networks of companies and trusts.

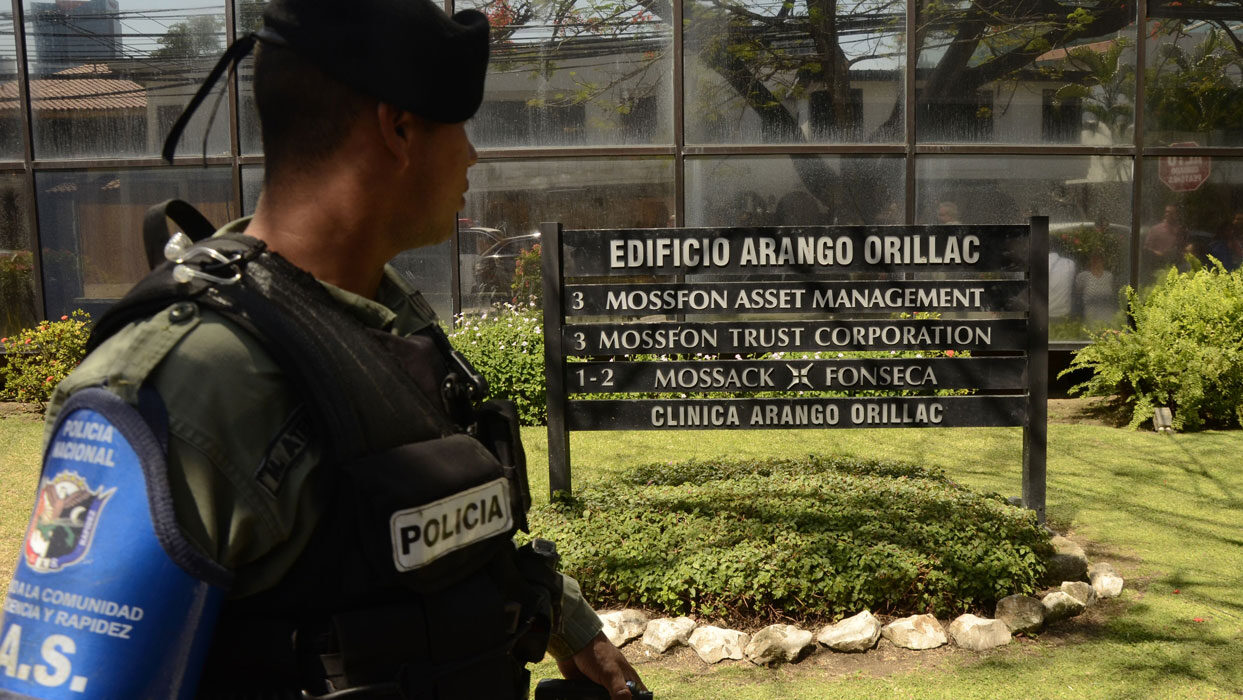

The details of the Rybolovlev divorce struggle and many others are contained in secret files obtained by the International Consortium of Investigative Journalists and the German newspaper Süddeutsche Zeitung and other media partners. The more than 11 million documents, dating from 1977 to December 2015, offer an inside view of Mossack Fonseca, a global law firm based in Panama that helps customers create offshore shelters. They provide facts and figures — cash transfers, incorporation dates, links between companies and individuals — that illuminate a dark alternate universe where some people go to play by different rules.

Family fraud?

“A dishonest husband is as much a fraudster as Bernard Madoff,” Martin Kenney, an asset recovery specialist in the British Virgin Islands who has worked on behalf of wives from Russia, the United Kingdom, Switzerland and the United States, told ICIJ. “These offshore companies and foundations . . . are instruments in a game of hide and concealment.”

At the heart of Elena Rybolovleva’s legal battle was the allegation that her estranged husband — now ranked by Forbes as Russia’s 14th richest man — had used tax havens to help obscure real estate and other wealth.

The documents Williams served that day targeted Rybolovlev’s $88 million New York City penthouse, a purchase that Elena claims violated an order by a Swiss court freezing his assets.

But her attorney claimed there were greater treasures at stake elsewhere. Rybolovlev controlled an offshore company that was used to buy and store artwork worth $650 million, her attorney alleged in court documents filed in the British Virgin Islands.

For decades, spouses — nearly always male and part of the global One Percent — have solicited Mossack Fonseca to help shield assets from soon-to-be exes, according to the files. And Mossack Fonseca has agreed with little hesitation.

In Thailand, the firm offered help when a husband asked in an email for a “silver bullet” in case his wife ever tried to strip him of his assets. In Ecuador, Mossack Fonseca employees proposed shell companies to “a customer who needs to acquire a Panamanian corporation to transfer assets before the divorce.” From Luxembourg, employees joked and sent emoticon winks when they agreed to help another husband, a Dutch man who wanted to “protect” assets “against the unpleasant results of a divorce (on the horizon!)”

Offshore service providers that knowingly place a husband’s assets beyond a wife’s reach can be sued, experts say.

“The closer in proximity to a divorce when these people take these kinds of steps, the more likely these assets will eventually be set aside for marital fraud,” said Sanford K. Ain, a Washington D.C.-based divorce attorney.

Ain worked on one case so complex he kept an intricate diagram of the husband’s bank accounts, companies and trusts on a notebook in his desk. “It looked like someone had thrown spaghetti on a page,” he recall. He said it cost $2 to $3 million to track all the assets down.

Michelle Young, who fought a well-publicized divorce battle, founded an organization in 2014 to help defrauded ex-wives navigate the costly British court system.

“It’s a blood sport,” Young said. “Unless you’ve got the funds, you’re dead and buried.”

Young has spent seven years and millions of dollars tracing assets linked to her ex-husband, property developer Scot Young, who used Mossack Fonseca and other offshore service providers to manage a tangled financial empire that included companies and bank accounts in Russia, the British Virgin Islands and Monaco.

“It’s like a baby Enron there are so many assets,” she said in an interview from London.

In 2013, Young won $32 million in a divorce settlement. Shortly after his appeal against the settlement failed, Scot Young was found impaled on spiked railings after plummeting from the fourth floor of his London apartment. His girlfriend said he’d told her he was going to jump, but authorities said they could not say for sure if he committed suicide or simply fell.

“We are not involved in managing our clients’ companies,” said Mossack Fonseca in a statement. “Excluding the professional fees we earn, we do not take possession or custody of clients’ money, or have anything to do with any of the direct financial aspects related to operating their businesses.”

The firm added: “We regret any misuse of companies that we incorporate or the services we provide and take steps wherever possible to uncover and stop such use.”

Love lost

Dmitri Rybolovlev married Elena, a fellow student with whom he had fallen in love at a university in the Urals, in 1987. Over the next 20 years, the couple had two children, moved to Switzerland and made a fortune. Dmitri became known as Russia’s “Fertilizer King.” They were, lawyers later stated, “fabulously rich.”

In December 2008, Elena Rybolovleva filed for divorce, citing “a prolonged period of strained marital relations.” Under Swiss law, each spouse was entitled to an equal split of the couple’s wealth.

Deciding what assets should be part of the split wasn’t so simple. As the Rybolovlevs’ wealth had increased, so had a complex network of offshore companies.

For instance, in 2002 Mossack Fonseca had incorporated Xitrans Finance Ltd in the British Virgin Islands. The offshore company, no more than a post office box in sunny Tortola, was a mini-Louvre museum when it came to its assets; Xitrans Finance Ltd owned paintings by Picasso, Modigliani, Van Gogh, Monet, Degas and Rothko. It also bought Louis XVI style desks, tables and drawers made by some of Paris’s grandest furniture makers.

As the marriage broke down, according to notes from a court hearing sent via email to Mossack Fonseca in January 2009, Dmitri used Xitrans Finance Ltd to move these luxury items out of Switzerland to Singapore and London, beyond her reach. While Xitrans Finance Ltd was held by the Rybolovlev family trust, according to Mossack Fonseca’s records, only Dmitri Rybolovlev held shares in the company, despite Elena’s claim that Xitrans bought assets “on behalf of herself and her husband.”

In 2014, after years of legal wrangling, a Swiss court awarded Elena $4.5 billion. An appeals court later reportedly slashed this figure to $600 million when it re-calculated the undisclosed settlement based on money held in Ryboloblev’s Cypriot trusts.

Dmitry Rybolovlev and Elena Rybolovleva declined to comment.

Equal wrongs

Wives aren’t immune to the temptation to use offshore hideaways.

In 2004, Mossack Fonseca staff met with Marcela Dworzak, wife of retired Gen. Antonio Ibárcena Amico, Peru’s former naval chief and a friend to ex-President Alberto Fujimori.

Shortly after the end of the Fujimori regime in 2000, Dworzak’s husband had been convicted of corruption and embezzlement for his role in a military arms deal.

The files show Mossack Fonseca employees were concerned by a media report that claimed that a member of Dworzak’s family had used an offshore company to launder money through real estate and into her bank account. The name of the suspect offshore company reported in the media was similar to one of Dworzak’s two companies registered with Mossack Fonseca, Alverson Financial S.A. The journalists had misspelled the company’s name, Mossack Fonseca suspected, and the company in question was one of theirs.

To clear up this issue, Dworzak visited Mossack Fonseca’s headquarters in Panama. With lawyers at her side, she assured employees at the law firm that Alverson Financial S.A. was, in fact, her company and that everything had been done “in a transparent, legal and clean way.”

Her companies were only used to hide assets from her husband.

“She has been separated for years from her husband, an official of the Fujimori government, and the companies were to protect the property she inherited from her family against the possible divorce,” Mossack Fonseca employees reported in an intra-company note. Dworzak’s lawyers confirmed that she “does not want him to know about the goods she has,” according to notes from the meeting shared among Mossack Fonseca employees. After some discussion, Mossack Fonseca accepted Dworzak’s explanation and she remained a client of the firm.

Years later, Peruvian authorities did investigate Dworzak for money laundering. She now lives in Chile and has not returned to Peru to face allegations that she used a Panamanian bank account to hold money from the corrupt arms deal for which her husband was convicted. The Ibarcena-Dworzak family denies all wrongdoing and claims Peru’s allegations are politically motivated.

Dworzak declined to comment.

“Rotten edifice”

Like the Rybolovlevs, Nichola Joy and Clive Joy-Morancho’s divorce has been expensive and well publicized.

The couple separated in December 2011 after more than five years of marriage and three children. Since then Nichola Joy has been seeking $40 million in assets that she says should be hers. At issue are at least two London homes, a charter plane, a six-bedroom French chateau, a Caribbean villa and a plot of land in a Swiss ski village.

Joy-Morancho, a Zimbabwean-born aviation tycoon, insists the fortune is tied up offshore and not his to use. He says he will suffer financial ruin if he’s forced to meet his ex-wife’s demands.

In late 2014, an English judge decided the fate of some of the feuding ex-couple’s disputed wealth, which included vintage cars worth millions. Of the 35-car collection that included a Bentley, a Ferrari and two McLarens, Joy-Morancho found his Alfa-Romeo particularly “pretty,” he told the court.

The judge, Sir Peter Singer, refused Joy’s request for the cars and any value they might have. Even though Joy-Morancho had described the collection as “mine,” in the eyes of the law the cars were not owned by their driver but by a trust via an offshore company. Joy won $180,000 a year until the final decision is made on how to split the remainder of Joy-Morancho’s wealth.

The judge criticized both sides but reserved his harshest words for Joy-Morancho, his friends and business associates.

“Their position is an elaborate charade, the stage management of which has been conducted ruthlessly and without regard to cost,” the judge wrote, calling the ex-husband’s case “a rotten edifice founded on concealment and misrepresentation and therefore a sham, a charade, bogus, spurious and contrived.”

The files show Mossack Fonseca has been part of Joy-Morancho’s offshore edifice for years.

The firm has hundreds of emails and files on Joy-Morancho and businessmen and dealings connected to him dating back to 1997. The firm has earned thousands of dollars for paper-pushing in the name of some of the same companies and directors used in England to contest his ex-wife’s claim.

In May 2013, Joy’s lawyers sent Mossack Fonseca a court order to freeze Joy-Morancho’s wealth until the courts divvied up the couple’s belongings. As the British Virgin Islands representative for Glengarriff Property Holdings Limited, a company that owned two disputed London homes, Mossack Fonseca was prohibited from doing anything that could harm Joy’s rights.

“The consequences for breach of a Freezing Injunction are serious, and we as Registered Agent, must act responsibly,” Daphne Durand, a legal supervisor in Mossack Fonseca’s compliance office in the British Virgin Islandswarned her colleagues.

In any case, it may not have mattered; Justice Singer ruled that Joy-Morancho passed official ownership of the London homes to an offshore trust before he married Joy, who could not therefore claim the properties as part of their marriage.

“I was naïve, innocent of what trust fund meant when I married him,” Nichola Joy told ICIJ in an email.

“The problem is that the cost to fight this injustice precludes me and my ex knows it,” Joy wrote. “The law has to change, these offshore trusts make a mockery of justice.”

Joy-Morancho did not respond to requests for comment.

A judge may eventually decide on what is left of Joy’s $40 million settlement demand. But with offshore companies and trusts obstructing her path, Joy faces a challenge familiar to many ex-spouses who chase assets across the globe.

Behind it all, Justice Singer noted, is an ex-husband with “a desire to vanquish her financially.”

He has two “horrors,” the judge said: “paying anything that cannot be avoided” to tax collectors or to his ex-wife.