BANKING

Whistleblower accuses JPMorgan Chase of violating cash reserve rules meant to protect the financial system

Senate Banking Committee member Elizabeth Warren is concerned the Federal Reserve may be “turning a blind eye” to alleged misconduct by America’s largest bank.

JPMorgan Chase for years understated the risk it posed to the financial system, according to a whistleblower who claimed that America’s largest bank made billions of dollars by violating rules established to protect the global economy from crisis.

In a 35-page letter sent to JPMorgan Chase’s board audit committee, the whistleblower, a former JPMorgan Chase banker, alleged the firm “misrepresented” several indicators used to assess its complexity by the Federal Reserve by engaging in a process called “netting,” which is prohibited under Fed rules and international standards. This practice made the bank appear less complex, allowing the firm to hold less capital in reserve — in effect eroding the financial buffer meant to protect against future shocks.

Though the practice violates international standards, the Federal Reserve allowed JPMorgan Chase and other large U.S. banks to continue it, according to another banker familiar with the matter.

Sen. Elizabeth Warren, the top Democrat on the Senate Banking Committee, said she was deeply concerned that the Federal Reserve “may be turning a blind eye as JPMorgan and other Wall Street banks cook their books and skim off of funds meant to prevent a global economic collapse.”

“Inconsistent and lax bank supervision has crashed our economy before,” she told the International Consortium of Investigative Journalists and The Bureau of Investigative Journalism.

“[Federal Reserve Chair Jerome] Powell owes the American people an explanation for allowing CEOs to manipulate their financial reports so they can pay themselves and their wealthy investors more in executive compensation and buybacks.”

The whistleblower claimed that JPMorgan Chase was able to issue an additional $75 billion to $100 billion in loans by understating its complexity. They calculated that this could have allowed JPMorgan Chase to generate an additional $2 billion in net income in one year alone.

Former policymakers warned that the lack of proper enforcement of the rules established in the wake of the 2008 financial crisis — after which taxpayers footed the bill for colossal government bailouts to stabilize the global economy — could leave large U.S. banks without the necessary capital on hand in the event of another crisis.

“If [U.S. banks] don’t have enough capital for times when they experience financial stress, that is putting their domestic economies at greater risk because it’s eroding their ability to absorb losses,” said Graham Steele, a former assistant secretary for financial institutions at the U.S. Treasury Department. “It also imposes risks to the global financial system. They will spread risk and contagion because these are global financial institutions and global markets.”

In August 2023, the whistleblower wrote in the letter to JPMorgan Chase’s board audit committee, which oversees the firm’s financial reporting, that the bank had been misreporting complexity indicators since 2016. The whistleblower claimed they had raised the issue internally in 2018 and that they were ultimately retaliated against and laid off in 2022. According to the letter, they filed whistleblower complaints with the Federal Reserve and the Securities and Exchange Commission in 2022 and briefed both agencies on the matter that year.

The indicators are part of the Federal Reserve’s quarterly systemic risk report, which the U.S. regulator uses to calculate the risk posed by the eight largest American banks to the global financial system. The Federal Reserve uses the data in the report to calculate the additional capital each bank must hold above the minimum requirements set by U.S. law, which is known as the capital surcharge. The banks that pose a greater risk to the financial system are required to hold larger capital reserves.

A JPMorgan Chase spokesperson did not answer a question from ICIJ and TBIJ about whether the whistleblower’s description of how the firm reported these indicators was accurate. The spokesperson said in a statement that the bank fully complies with all capital regulations, and that the bank’s methodology “is fully transparent to our regulators.”

The Basel Accord, an international set of banking standards, also prohibits netting in reporting these complexity indicators. The framework is not legally binding, but the members of the international committee that sets these standards — which includes the Federal Reserve and other U.S. institutions — have agreed to fully implement them in their jurisdictions.

A Federal Reserve spokesperson did not answer a question by ICIJ and TBIJ about whether the regulator allowed banks to report the complexity indicators in the way described by the whistleblower. Instead, the spokesperson pointed to the overall higher amounts of additional capital that large U.S. banks must hold in comparison to European counterparts, and the advisory nature of the international banking standards.

“Comparing how U.S. and European banks calculate their capital surcharge exposures is not a proper comparison,” the spokesperson said. “The largest and most complex U.S. banks are required under Fed rules to have substantially higher capital surcharges than their international counterparts and substantially higher capital surcharges than specified under the non-binding Basel Accord.”

‘Our smartest people’

In the aftermath of the 2008 financial crisis, banking regulators across the globe agreed to a set of rules designed to strengthen oversight and regulation of banks. These new rules attempted to ensure that banks kept enough capital on hand to survive another crisis on their own without relying on a large taxpayer bailout, as occurred in the United States in 2008.

The executives of the largest U.S. banks, meanwhile, have made no secret that they consider how the U.S. has implemented these rules a roadblock to greater profits.

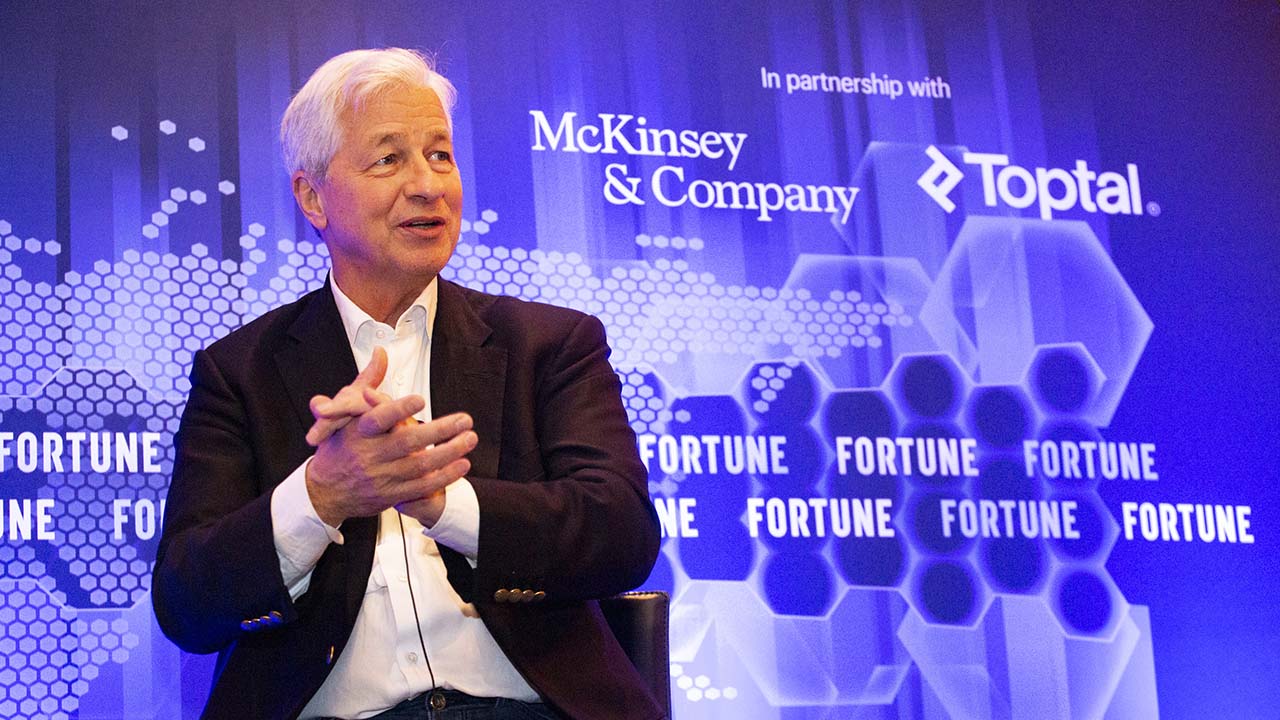

JPMorgan Chase CEO Jamie Dimon said previously the bank was working hard to minimize the capital it was forced to hold — assets that could otherwise be loaned out, disbursed to shareholders as a dividend, or awarded to executives in the form of annual bonuses. “We’ve got our smartest people figuring out every angle to reduce capital requirements for JPMorgan,” Dimon said in 2023.

A spokesperson for the Financial Services Forum, which represents the largest U.S. banks, said that the amount of capital these banks hold has tripled to nearly $1 trillion over the past 15 years, and that the organization has urged the Fed to review U.S. capital requirements “which are higher than international standards and have increased due to economic growth and inflation unrelated to systemic risk.”

The complexity indicators described by the whistleblower constitute a substantial part of a bank’s total global systemic risk score. A reduction to the bank’s score on those indicators could therefore have a tangible effect on its capital requirements.

The complexity indicators also require banks to report their overall trading volumes. Large banks often hold both long positions, which increase in value when the assets appreciate, and short positions that decline in value if the assets appreciate. If the banks net, or offset, their long and short positions, their trading volume will look smaller.

A bank that holds long and short positions in a single security, for example, might have zero net exposure — but it would be more complex than a bank with no positions in that security. For that reason, Federal Reserve rules and international standards require banks to report the long position and specifically prohibit netting short and long positions.

The whistleblower included in their letter what they alleged was a description of JPMorgan Chase’s methodology for reporting these indicators. It described a practice dubbed “internal operational elimination,” which the firm asserted did not constitute netting. The whistleblower contended that this policy was functionally the same as netting and derided the interpretation as “nonsensical.”

Another former JPMorgan Chase banker, who has since moved to another large U.S. bank, said other banks subject to the capital surcharge have adopted similar policies to JPMorgan Chase in reporting these indicators.

It’s deeply unfortunate that [the Federal Reserve] would allow the banks to get away with violating very clear domestic and international standards, but even more shocking to do it in a way that’s so opaque — former U.S. Treasury official Graham Steele

Asked if the banks had sought approval for that interpretation from the Federal Reserve, the banker said: “U.S. firms are kind of discouraged from making the regulators their interpretive offices. Supervisors expect the banks to have expertise, to do their work and then it’s subject to review. It’s less asking for permission up front and more of doing the interpretations and being subject to being told that they’re wrong.”

Steele, the former Treasury official, said the Fed’s failure to enforce its own rules was concerning, and could potentially advantage some U.S. banks over others if all banks were not made aware of its position at the same time. “It’s deeply unfortunate that [the Federal Reserve] would allow the banks to get away with violating very clear domestic and international standards, but even more shocking to do it in a way that’s so opaque,” he said.

Gaming the rules

Former policymakers and economists critical of the Federal Reserve told ICIJ and TBIJ that the U.S. regulator’s approach on this issue fits within a larger pattern of caving to banks’ desire for less regulation, and could undermine international coordination on banking standards.

The banking industry waged a lobbying blitz in 2023 and 2024 against proposed rules, dubbed the “Basel Endgame,” that would increase capital requirements for the largest U.S. banks. Lobbyists for the banks paid to put up billboards opposing the new rules alongside major highways and Washington’s Reagan National Airport, and even aired ads during Sunday Night Football warning that the rules would increase costs for working-class Americans.

In September, the banking industry scored a major victory when the Fed dramatically revised its plan, proposing a 9% increase for large U.S. banks instead of the 19% increase it had proposed in summer 2023. The Fed’s vice chairman for banking supervision, Michael Barr, also announced in January that he would step down from his position after advisers to President Donald Trump mulled an effort to demote him. Barr had come under attack by Republicans in the Senate in part for his role in pushing for higher capital requirements.

By deviating from international standards, critics also said the Fed had made it more difficult to ensure a level playing field among banks across the globe.

“No individual country will want to penalize its own large banks,” said David Aikman, a professor of finance at King’s College London. “They’ll only sign up to those rules if they think everybody else is applying the rules faithfully.”