Mar 28, 2025

The IRS unit that audits billionaires has lost 38% of its employees since January, new data shows

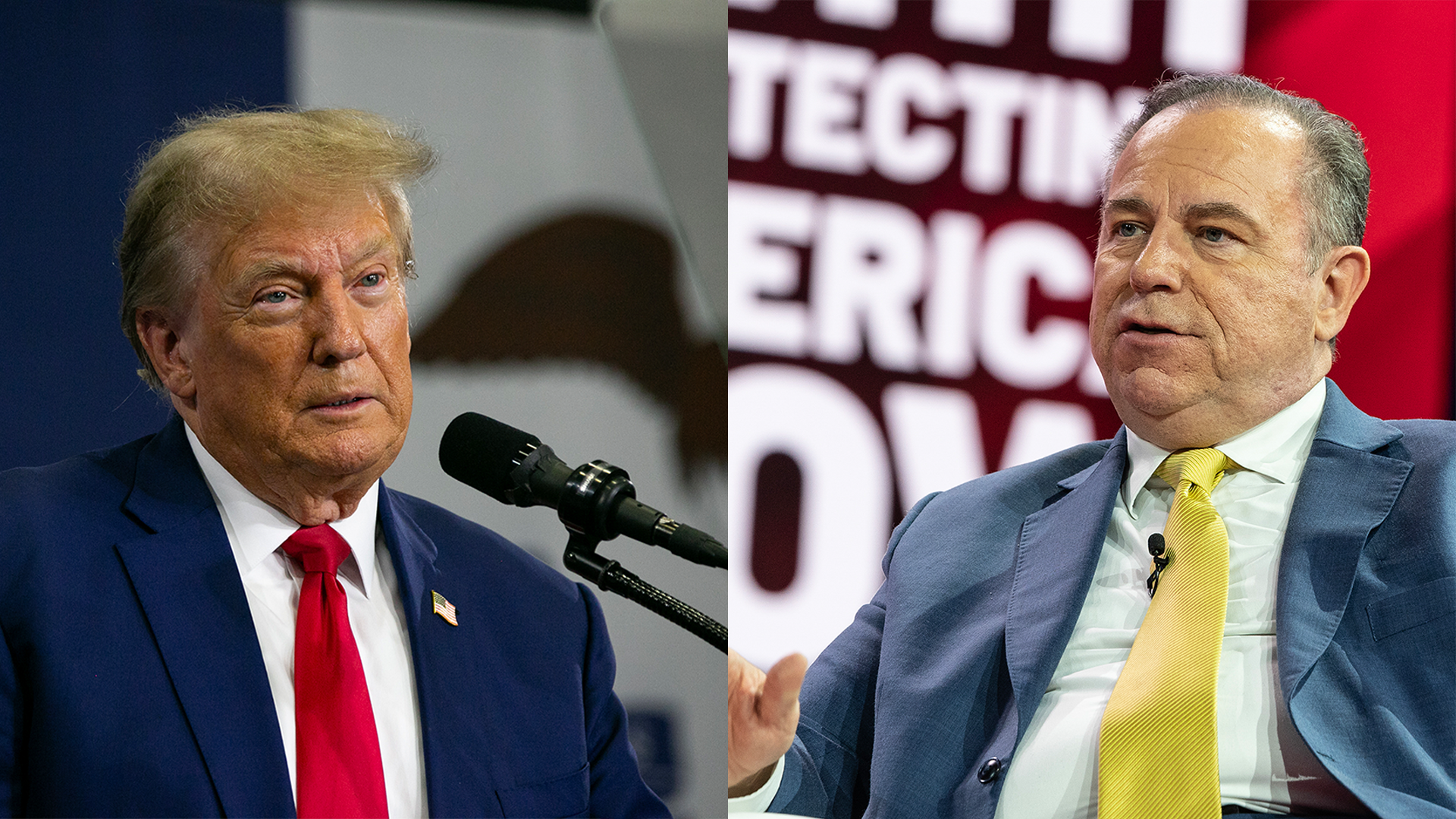

As Donald Trump and Elon Musk take a chainsaw to the federal bureaucracy, the cuts at the IRS may be especially good news for America’s wealthiest taxpayers.